In last week’s article, which you can read here, I discussed relatively conservative income generating strategies. One of my examples was the credit vertical spread. Today we’ll look at a way to simulate that strategy in cases where we are not permitted to do credit spreads.

First, credit vertical spreads are positions that involve selling an out-of-the-money option in hopes of its expiring worthless; together with the purchase of an even further out-of-the-money option as protection. The long option covers the short option, limiting its risk. If both options are behind the “firewall” of a strong demand or supply level, both options are expected to remain out of the money until expiration.

OK. Why might we not be permitted to use credit spreads? The answer is that brokers have a hierarchy of “approval levels” for option trading. The higher the risk, the more stringent the requirement. Brokers set their own rules for who will be allowed to use each type of strategy. Note that it is not really the risk to you, the customer that is the issue. It’s the risk to the broker. If a strategy could possibly result in any loss to the broker, a higher level is required.

Here are a typical set of approval levels. Each level up the chain requires more money in the account and/or more years of experience than the previous one:

Level 1

Sell covered calls against a stock position

Buy protective puts on a stock position

Level 2

Buy puts or calls “speculatively” (without owning the stock).

Sell cash-secured short puts (without owning the stock, but with 100% of the money in the account that would be needed to buy the stock)

Level 3

Debit spreads (buy a more expensive option that covers a less expensive short option)

Level 4

Credit spreads (buy a less expensive option that covers a more expensive short option)

Sell short puts “naked” (with less than 100% of the cash required to buy the stock)

Level 5

Sell short calls “naked” (without owning the stock)

Notice that credit spreads are at level 4, while debit spreads require only level 3. Since level 4 is significantly harder to get than level 3, many people are able to use debit spreads but not credit spreads.

If this is the case, we can substitute a debit vertical spread for any credit vertical spread.

Here’s an example:

On February 20, Incyte Corp (INCY), at $63.92, was in a long-standing uptrend. It had recently pulled back to a long-term trendline, which had so far held (see chart below). There was good support in the area around $58.00.

First, let’s look at the possibility of a credit spread – a Bull Put Spread. It looked like a good bet to sell the March $57.50 puts (at $1.65). As long as INCY remained above that $57.50 level for 29 days, they would expire worthless, allowing us to keep the premium. We could simultaneously buy the $52.50 March puts for protection at $.80. The net credit was $1.65-.80 = $.85 per share ($85 per contract). This amount was our maximum profit. Our breakeven price was the $57.50 strike less the $.85 credit, or $56.65.

Maximum loss on the credit spread would occur with INCY below $52.50 at expiration. In that case we would need to pay the $5.00 difference between the two strike prices to get out of the spread. Subtracting our $.85 credit, our net loss would be $4.15 per share ($415 per contract). This maximum loss would be our margin requirement. With strong technical support well above $57.50, this looked like a good trade.

Now let’s look at the debit spread alternative. If we had approval to buy debit spreads (level 3), but not to sell credit spreads (level 4), we could still get nearly the same deal. All that was required was to use the calls at the same strikes, in place of the puts.

We could have bought the $52.50 calls for about $12.05, and sold the $57.50 calls for about $7.95. The net debit was $ 4.10 per share ($410 per contract). Since this was a debit spread, the $410 we paid for was our maximum loss and our required cash outlay. This maximum loss would occur at any price of INCY of $52.50 or less at expiration. In that case our spread would be worthless. Note that this was almost identical to the $415 margin requirement for the credit spread. Like the credit spread, our maximum profit would occur at expiration at any price above $57.50. In that event, both options would be in the money, and we could sell the spread for the $5.00 difference between the strike prices. Subtracting our $4.10 cost would leave a net profit of $.90 per share, or $90 per contract – almost exactly the same as the credit spread’s $85 profit. Either spread would work out to a profit of about 20% in one month, as long as INCY held above that $57.50 level.

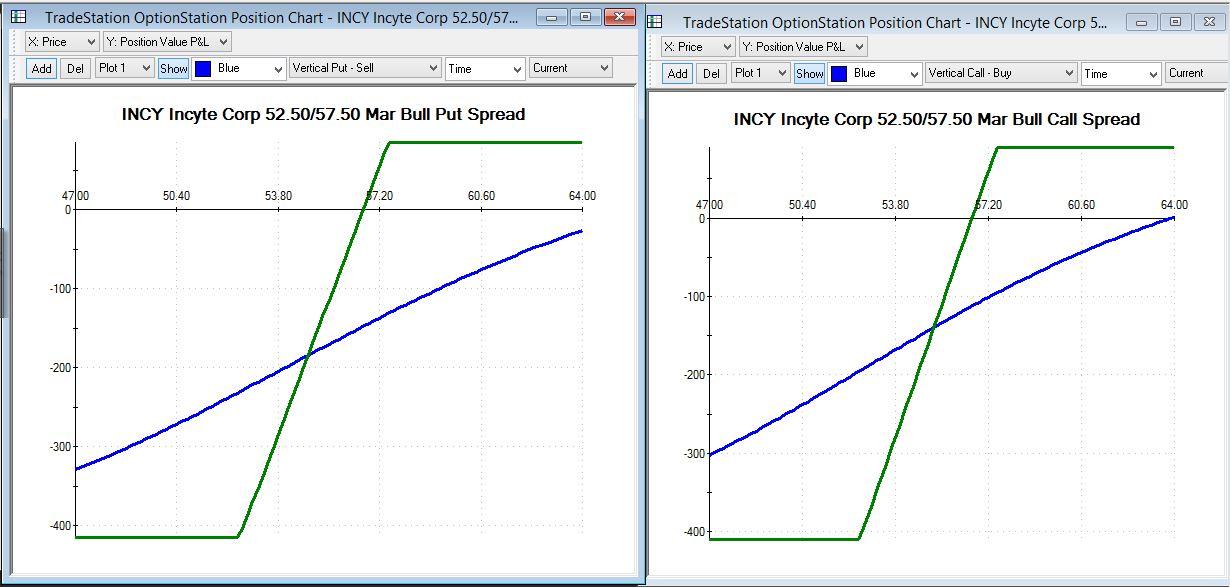

Below are the profit graphs of both spreads. Note that the charts look almost the same. Max profit, max loss, and break-even are within a few cents of each other.

This same idea can be used to convert any credit vertical spread into its debit equivalent, or vice versa. In this case, the profits were almost identical. In other cases, one version may offer slightly more profit than the other, depending on volatility differences between the puts and the calls.

This shows another example of the versatility of options. Not only do we have many choices of strategies, but there is always more than one way to use any one of those choices.

This content is intended to provide educational information only. This information should not be construed as individual or customized legal, tax, financial or investment services. As each individual's situation is unique, a qualified professional should be consulted before making legal, tax, financial and investment decisions. The educational information provided in this article does not comprise any course or a part of any course that may be used as an educational credit for any certification purpose and will not prepare any User to be accredited for any licenses in any industry and will not prepare any User to get a job. Reproduced by permission from OTAcademy.com click here for Terms of Use: https://www.otacademy.com/about/terms

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

Discover how to make money in forex is easy if you know how the bankers trade!

5 Forex News Events You Need To Know

In the fast moving world of currency markets, it is extremely important for new traders to know the list of important forex news...

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and...

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.