In last week’s article, I described four separate methods for using options to protect a position. Today we’ll go into more detail on two of them.

This may be even more timely now. On the day when my last article was written, April 2, the S&P 500 had just made a fresh all-time high. Three trading days later, on April 7, the index had dropped almost three percent, giving back all of the 2014 gains.

The two alternatives we’ll look at today for protection are stock with protective puts on one hand; and converting to a position of cash and call options on the other.

Stock with protective puts is just what it sounds like. We keep our stock position, and buy puts to protect it. In the event of a drop in the stock price, the puts increase in value, cushioning our loss. If there is no drop in the stock price, then the cost of the puts will just have to be subtracted from our gains on the stock. We’ll then have to overcome the cost of the puts before we again have a net profit.

The alternative, converting a stock position to cash and call options is also simple. Instead of keeping our stock, we sell it, receiving cash. We then use part of that cash to buy call options, so that we can still make money if the market does go higher.

As I mentioned last week, these two positions are equivalent to each other. I have written before about why this is. It is a consequence of the idea of put-call parity, which defines the relationship between put and call prices.

By the way, if you’re interested in the history and theory behind this idea, there is a fascinating paper available called “The Ancient Roots of Modern Financial Innovation: The Early History of Regulatory Arbitrage.” It is from the law school at the University of Pennsylvania. This paper describes business arrangements throughout history, beginning thousands of years ago, that were based on concepts almost identical to put-call parity. The Chicago Board Options Exchange wasn’t around then, of course. But the financial engineering used in these past eras was every bit as ingenious as it is today. The author’s point of view concerns what he calls “regulatory arbitrage.” This is using transactions with different forms, but the same substance, as a prohibited transaction to accomplish the same result. His focus is on past practices used to enable deals that were desired by both parties, but that were prohibited by legal or social rules. It’s an idea that has no doubt existed as long as there have been both deals and rules. If there’s economic advantage to be gained, humans are endlessly inventive about getting around any pesky rules. The same dodge used two thousand years ago to skirt usury laws, lives again today as a way for mortgage lenders to circumvent borrower protection laws. Fascinating reading, both for the history and for the insight into options.

In the present case, here’s how this equivalency works.

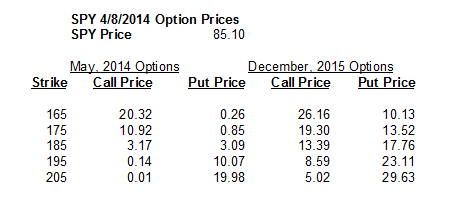

For use in this discussion, here are some actual put and call prices (all prices are the mid-point between the bid and ask prices) as of the close on April 8, 2014:

Let’s focus first on the far-out December, 2015 options. These would provide long-term protection. They are also high enough in price and far enough out in the future that they show us some things about put-call parity that otherwise can be obscure.

One way to protect ourselves from a crash would be to buy the December 2015 185 puts. At $17.76, they would cost 9.6% of the SPY’s value of $185.10, for 619 days of protection. This works out to about 5.7% per year. There is no way we could lose more than this. Our upside is unlimited. However, our effective cost of the SPY is higher than without the insurance. If we held these puts for the full term of 623 days, SPY would have to return that $17.76 cost to make the whole position profitable. That is a pretty strong headwind, although not out of line with recent years’ performance.

If we are willing to self-insure for the first 10+% of a drop, and wish only to insure against an even larger drop, than the December 2015 165 puts, at $10.13 provide catastrophic coverage at an annual cost of about 3.2%.

Note that if we have a reasonably diversified portfolio of stocks and stock-based ETFs, we could use SPY to represent our entire equity holdings when buying puts. This will simplify things. If there truly is a crash, all equities will be dragged down and SPY will be representative.

Now let’s compare the protective put strategy to the alternative of selling our stock positions now and using calls for our upside exposure.

First, we could sell our stock position at the then-current price of $185.10. To replace our upside exposure, we could buy December 2015 calls at the $185 strike, at 13.39. Our maximum loss now is $13.39 (compared to $17.76 with the long stock/short put combo); our upside is unlimited, but we have an “overhead” of $13.39 (again, compared to $17.76) to overcome, in order to make any profit.

At first glance, the calls appear preferable to the long stock with puts. Both provide limited risk and unlimited profit; but the puts cost more than the calls to do the same job ($17.76 for the puts vs $13.39 for the calls). Does that make the calls the clear winner?

Actually, no. Here is why: The SPY would be expected to pay about $5.25 in dividends in the next 619 days, based on recent history. The protected stock owner would receive those dividends; the call holder would not. On the other hand, the call holder could collect interest on $185.10 – $13.39 for 619 days. At the current risk-free rate of 1/4%, that would amount to about $.78. So the comparison becomes:

Long put insurance cost: $17.76

Dividend Income: 5.22

Net cost: $12.54

Long Call Cost: $13.39

Interest Income: .78

Net cost: $12.61

These Net Cost numbers are almost identical, well within the bounds of rounding and bid-ask spreads. They have to be – that is the concept of put-call parity. This parity must exist for the option markets to function. So the cash-and-calls strategy, is, in fact, exactly the same as the married put strategy in terms of risk and reward, and has to be so.

Next time, we’ll look at some of the other protective measures.

This content is intended to provide educational information only. This information should not be construed as individual or customized legal, tax, financial or investment services. As each individual's situation is unique, a qualified professional should be consulted before making legal, tax, financial and investment decisions. The educational information provided in this article does not comprise any course or a part of any course that may be used as an educational credit for any certification purpose and will not prepare any User to be accredited for any licenses in any industry and will not prepare any User to get a job. Reproduced by permission from OTAcademy.com click here for Terms of Use: https://www.otacademy.com/about/terms

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays firm above 156.00 after BoJ Governor Ueda's comments

USD/JPY stays firm above 156.00 after surging above this level on the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

Discover how to make money in forex is easy if you know how the bankers trade!

5 Forex News Events You Need To Know

In the fast moving world of currency markets, it is extremely important for new traders to know the list of important forex news...

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and...

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.