- Block.One fined by SEC for the breach of federal legislation.

- The company will have to pay a fine in the amount of $24 million.

- EOS/USD is gaining ground, trading above critical $3.00.

Block.one, the company behind EOS ecosystem reached an agreement with the Securities and Exchange Commission (SEC) in connection with a year-long ERC-20 tokens sale . The company agreed to pay a fine in the amount of $24 million, though it neither admitted or denied the SEC’s charges.

The financial regulator pointed out that EOS token sale lasted nearly one year after the publication of The DAO collapse report. Meanwhile, the company did neither register its initial price offering (ICO) as a security offering as required by Federal law nor applied for a waiver.

“We are excited to resolve these discussions with the SEC and are committed to ongoing collaboration with regulators and policy makers as the world continues to develop more clarity around compliance frameworks for digital assets,” the company said in the press-release.

Meanwhile, Block.one explains that the charges relate specifically to the ERC-20 token, which is no longer in circulation.

EOS/USD is on the rise

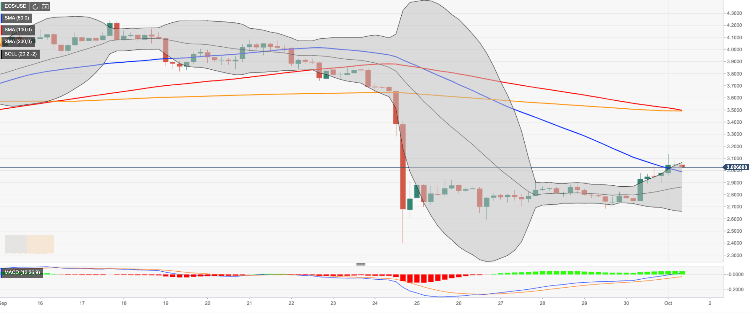

EOS/USD is changing hands at $3.00, off the intraday high reached at $3.13. The coin has gained about 10% of its value on a day-on-day basis amid the global recovery on the cryptocurrency markets. If the price stays above $3.00, the recovery may be extended towards the next bull’s target at $3.50 protected by SMA100 (Simple Moving Average) and SMA200 four-hour.

On the downside, the initial support is created by $2.66 ( the lower line of four-hour Bollinger Band).

EOS/USD, four-hour

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AAVE proposes a slew of upgrades and expansions in plan for 2030

Aave has proposed a Unified Liquidity Layer, V4, and solutions to enhance and compete with zero-knowledge networks in its plan for 2030 and beyond. The proposal states that Aave aims to implement its plan together with the community within the next three years.

Top 3 meme coins Dogecoin, Shiba Inu and Bonk: Recovery likely if Bitcoin freefall ends

Meme coins Dogecoin (DOGE), Shiba Inu (SHIB) and Bonk (BONK) look primed for recovery, according to technical indicators, despite the broader crypto market correction prompted by the sharp drop in Bitcoin (BTC) price.

XRP tests $0.52 resistance while XRP Ledger developers propose lending protocol on the blockchain

Ripple has failed to close above $0.52 for five consecutive days, struggling with the sticky resistance. XRP holders digested the news of US Securities and Exchange Commission’s response to Ripple in its filing that addressed the issue of “expert testimony.”

Pepe whales buying spree could trigger 55% rally Premium

Pepe price shows signs of a potential comeback as it retest the a declining resistance level. A successful breakout could kick-start a 56% move to the upside as whales continue to accumulate on dips.

Bitcoin: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s (BTC) recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.