The yen had been in a constant and progressive rally against the US dollar, as geopolitical risk and global economic uncertainty were taking their toll. The yen is often seen as a global safe haven currency in times of financial crisis. The threat of which had sent USDJPY to a most recent low of 98.975 two weeks ago.

The downward momentum changed radically on Monday after Mr. Abe won the political general elections for a second consecutive term. The Prime Minister has been known for his unorthodox view of economic policies, often referred to as Abenomics. One of the first things Mr. Abe has mentioned is that he still believes in monetary stimulus to get the economy back into fast track.

There are another ¥10 trillion in a stimulus package ready for another round of securities buying.

The Japanese government has already heavily bought shares in Nikkei 250 index companies and more stimulus is on the way. This kind of monetary intervention adds currency to the system and inevitably depreciatesits value. Not surprising then that yen has lost 4.25% since its open on Monday at 100.596 to its close yesterday.

There has even been mention of the use of helicopter money to spur the economy. The government would simply make payments to individuals with the idea that the money received will have to be spent on goods within a given period. A kind of quantitative easing but aimed at consumers directly rather than financial institutions.

If you think that USDJPY will rise over the next week then you may buy a Call option, which allows you to buy USDJPY at a set price (strike), on a set day (expiry) and for a specific amount.

The screenshot below shows a USDJPY Call option with a 104.922 strike, 7 day expiry and for $10,000 would cost $81.97, which would also be the total risk.

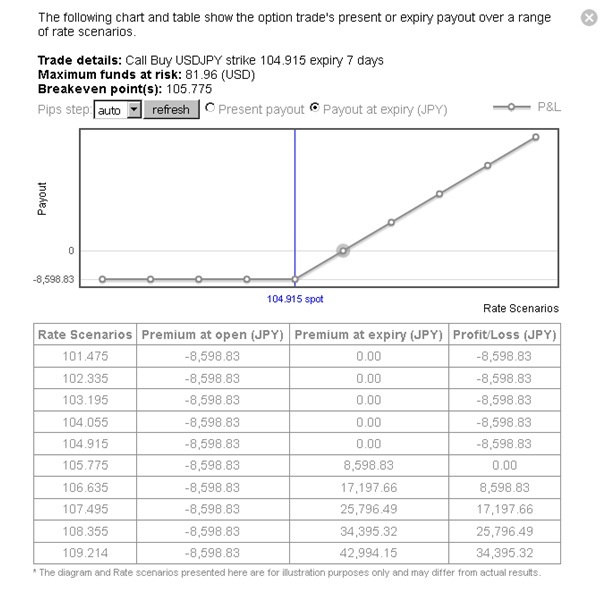

This screenshot shows the profit and loss profile of the above Call option, just click on the Scenarios button.

On the other hand if you think that the price of USDJPY will go back down over the next week then you may buy a Put option, which gives you the right to sell USDJPY at a set strike, expiry and amount.

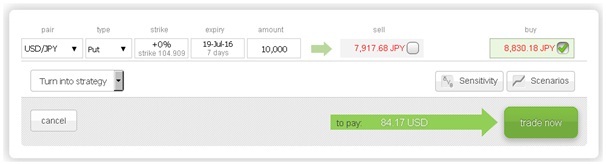

The screenshot below shows that a USDJPY Put option with a 104.909 strike, 7 day expiry and for $10,000 would cost $84.17, which would also be the maximum risk.

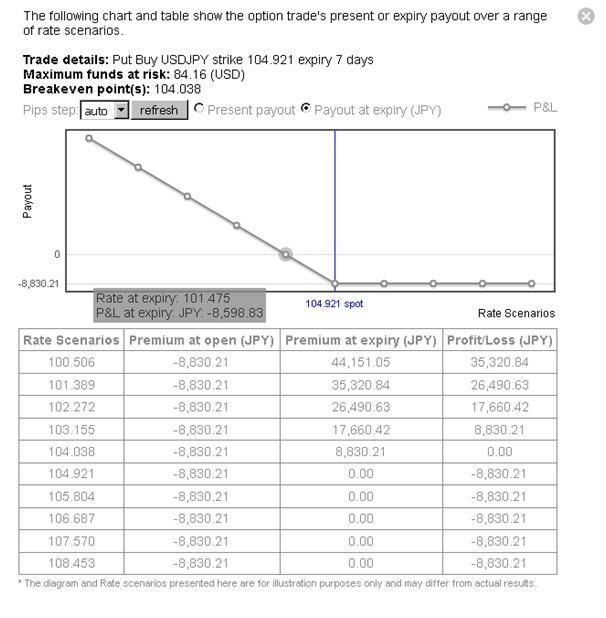

This screenshot shows the profit and loss profile of the above Put option.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.