Where are the pips today

Here is one of the currency pairs that have chlearest market conditions today. By market conditions I mean:

- Clear support and resistance levels

- Clear market swings

When you get that information it simplifies our job as a trader because you know what the market is currently doing, and what the market is likely to do in the following hours/days.

That’s like gold for traders, because with that info its way easier to take advantage of market movements.

Ok, now to one of the clearest currency pairs to trade today.

GBPUSD Long term analysis

What I like about the GBPUSD long term chart is that it’s got clear S&R levels on the long term charts.

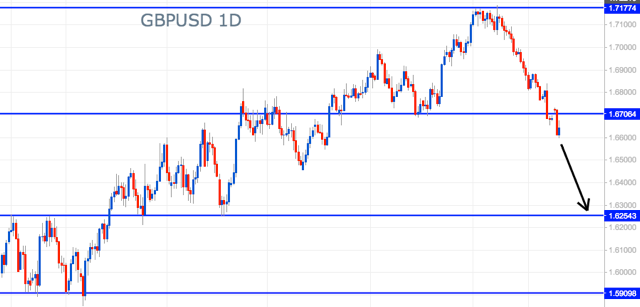

GBPUSD Daily Chart

Its clear that the GBPUSD already broke through a very important support level (1.6706).

One of the main principles of techncial analysis is that, most of the time, the market moves from one level to the other. This means that the GBPUSD is likely to continue its way down until it hits the next LT level at 1.6254, which means we’ve got plenty of room to look for our short opportunity.

GBPUSD Short term analysis

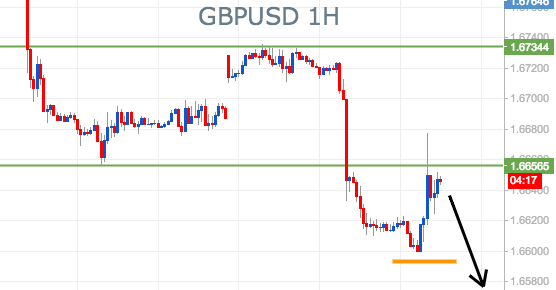

GBPUSD Hourly Chart

If the GBPUSD gets rejected from the ST resistance level (1.6656) I’ll try to go short once it breaks through the previous low (orange line).

What do you think about the GBPUSD? Are you going to trade? What other currency pairs are you trading/monitoring?

En dónde están los pips hoy…

Aquí está uno de los pares que tiene más clara su condición de mercado el día de hoy.

Y por condición de mercado me refiero a:

- Claros niveles de soporte y resistencia

- Claros swings de mercado

Cuando tienes esa información se simplifica nuestro trabajo como trader porque sabes lo que el mercado está haciendo, y lo que es más probable que haga en las siguientes horas/ días.

Eso es como oro para los trader, de esa manera es mucho más fácil tomar ventaja de los movimientos del mercado.

Bien, vamos a analizar uno de los pares más claros para operar el día de hoy.

Análisis de Largo Plazo de la GBPUSD

Lo que me gusta de la GBPUSD es que tiene claros sus niveles de S&R en el largo plazo:

GBPUSD Daily Chart

Está muy claro que rompió a través de un nivel importante de soporte de LP (1.6706).

Uno de los principios básicos del análisis técnico es que, la mayor parte del tiempo, el mercado se mueve de un nivel a otro. Esto significa que es probable que la GBPUSD continúe su movimiento bajista hasta que alcance su próximo nivel de soporte en 1.6254, lo que significa que tenemos suficiente espacio para buscar nuestra venta.

Análisis de Corto Plazo de la GBPUSD

GBPUSD Hourly Chart

Si la GBPUSD es rechazada del nivel de resistencia de CP (1.6656) voy a intentar ir a la venta cuando rompa el mínimo anterior (línea naranja).

¿Qué opinas de la GBPUSD? ¿La vas a operar? ¿Qué otros pares estás monitoreando/ operando?

At StraightForex, we value the relationship with our clients and respect each individual’s right of privacy. We consider client confidentiality to be the foundation of our relationship with our clients. StraightForex does not sell, rent or disclose any former, current and future client’s information to third parties except on specific circumstances, such as to fulfill law requirements. If you contact us, the information you share with us will be only used by StraightForex to contact you, we attach a link to unsubscribe from our newsletter, with a simple click you will never hear from us again.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.