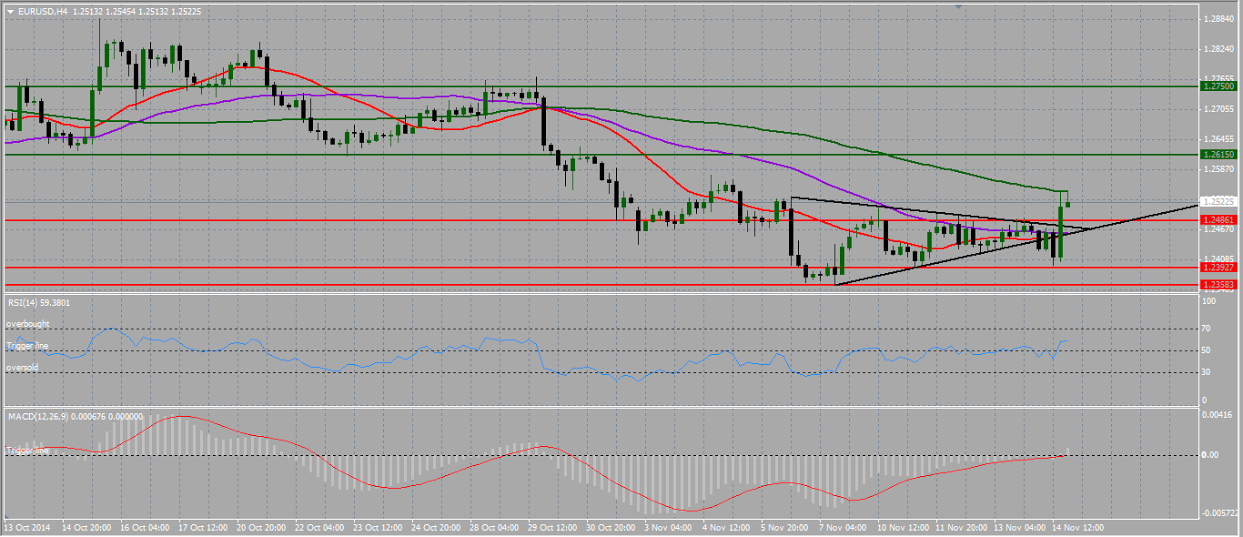

EUR/USD Technical analysis Nov 17th - Nov 21st

Despite the previous week’s bear rush, EUR/USD opened the week with a small positive Gap over the weekend giving bullish signals from the very beginning of the trading week. However the bulls were not powerful enough to clearly push above the previous week’s main support zone of 1.25 psychological level and traded most of the week on a narrow range until Friday. On Friday after a week-long of attempts the pair finally broke above its 1.25 resistance level and managed to close the week just above the 1.25 level, USD/EUR 0.80 level.

Fundamentally talking, the week had minor developments. Germany q/q prelim GDP figures came at marginal growth of 0.1%, whereas Europe’s troubling founding member France showed 0.3% growth, better than previous expectations. In the US although the Unemployment claims and the JOLTS job opening data came as disappointing, we had an important development; the US “quit rate” rose back to its pre-2008 levels, indicating people’s confidence in finding new jobs.

For the week the pair found its resistance at 1.2530, made lower high, but higher low. As said last week, clear break below 1.2430 support level on weekly timeframe could open the way towards 1.2300 monthly support zone and the anticipated 1.2000 psychological barrier.

On the daily chart, the price structure still remains majorly sideways, below 20, 50 and 100 day Simple Moving Averages and this keeps the overall down path intact. Overall the daily trend can be concluded as bearish however, at this given moment we would not advise entering short entries as we have bullish divergence on both of our indicators and on 4 hour timeframe the pair has broken above the upper boundary of the symmetrical triangle.

Expectations for the upcoming week (Nov 17th - Nov 21st):

From smaller time frame point of view, we can see the pair bouncing off the monthly 1.2300 psychological support zone. Especially given that the pair broke above its symmetrical triangle, we may expect to see price retracement this week towards our monthly pivot line at 1.2635.

Resistance levels: 1.2535 (R1), 1.2615 (R2), 1.2635 (PP) and 1.2750 (R3)

Support levels: 1.2480, (S1), 1.1.2392 (S2) and 1.2357 (S3)

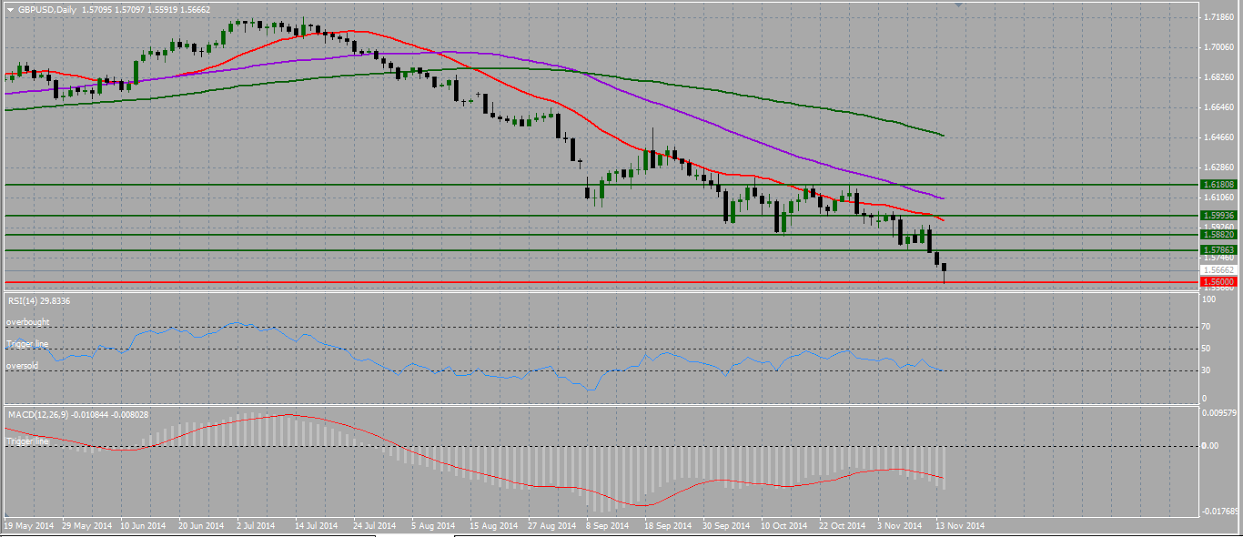

GBP/USD Technical analysis Nov 17th - Nov 21st

Although Cable started the week positively, the pair suffered on Wednesday’s UK inflations report. As the bears kept the British pound under pressure, GBP/USD continued to make lower lows on Wednesday as well as on Thursday and Friday. On Friday the pair touched its 15 months’ low at 1.5592 however the fading bearish momentum lead the pair to rapidly bounce again up towards 1.5660 level and closed the week at 1.5666 levels, lowest daily closing since 9 September 2013.

Although we may expect further bearish power, investors should be open for possible retracement waves as the pair has just bounced of its psychological support zone of 1.56.

Expectations for the upcoming week (Nov 17th - Nov 21st):

At the time of analysis the pair is trading just above its long-lasting support/resistance zone of 1.5666 and all three of our MAs are sloping downwards both on 4 hour and daily timeframes. Meanwhile RSI is breaking above its oversold zone both on 4H and daily timeframes.

As the [air has bounced off strongly from 1.5600 psychological support zone, we may expect the pair testing 1.57 level and if 1.57 level is strongly broken, the pair could open its doors towards 1.5880 and above.

Resistance levels: 1.5768 (R1), 1.5882 (R2), 1.5994 (R3) 1.6039 (PP)

Support levels: 1.5600 (S1), 1.5500 (S2) and 1.5397 (S3)

This market forecast is for general information only. It is not an investment advice or a solution to buy or sell securities.

Authors' opinions do not represent the ones of Orbex and its associates. Terms and Conditions and the Privacy Policy apply.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange, you should carefully consider your investment objectives, level of experience, and risk appetite. There is a possibility that you may sustain a loss of some or all of your investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.