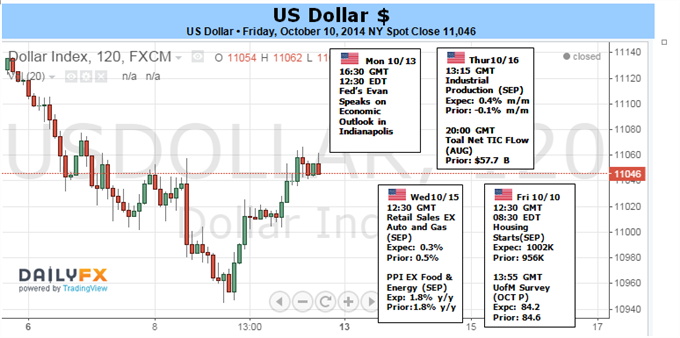

Fundamental Forecast for Dollar: Bullish

The Dollar Index finally called an end to its record-breaking 12-week consecutive rally

Traders have squeezed the premium from rate expectations, risk trends carries the dollar’s greatest potential

See the fundamental and technical forecast for the USDollar in our updated 4Q Forecast Trading Guide

The Dollar finally took a breather this past week. After 12 consecutive weeks of climb, the Dow Jones FXCM Dollar (ticker = USDollar) fell 0.7 percent. Yet, we shouldn’t be too hasty in calling for a full-scale reversal just because the record-breaking advance has been called to a close. Fundamentally, the greenback could be considered ‘stretched’ if we evaluated it on its more active drivers: the mass depreciation of its major counterparts and a build in interest rate expectations for the Fed. Yet, if this currency’s – and financial system’s – most omnipotent theme rears its head, we may have only seen its opening move. That theme: risk trends.

The FX market considers the US currency a ‘safe haven’. However, that does not necessarily mean that the Dollar will simply rise with every slip in equities or lurch from a volatility index. This particular player’s haven status reflects a more extreme sentiment. The USD is the most abundant reserve currency and the Treasury and money markets that it fronts are considered international standards for stability. Functionally, that means the Dollar’s appeal in the spectrum of sentiment really keeps in when investors demand liquidity – when the consideration for ‘return’ evaporates.

In the past five-and-a-half years, we haven’t seen many bouts of panic sweep over the global financial system and trigger the blind rush to liquidity. The market seizures in mid-2010 and mid-2011 are arguably the most prominent. Aside from these periods, ‘risk aversion’ has fallen comfortably within the constraints of complacency. The markets retreating just enough to draw short-term and opportunistic traders into the market to bid the dip and sell the risk premium. Hitting the level where the undercurrent changes and the ranks finally unwind in a meaningful way requires a scope and intensity. What we have seen last week may signal that long-awaited fraction in the serene backdrop.

We have watched as implied (expected) volatility measures have climbed over the past 2-3 months, while some of the financial systems more volatile risk assets (Emerging Markets, high-yield) and growth dependent assets (Euro, commodities) have been in retreat as well. This is evidence of scope – where sentiment is leading the way rather than just a localized or isolated situation in one area of the system. Scale, however, has remained ever elusive. Perhaps that is changing though. We ended this past week with the most stubborn of risk benchmarks – the S&P 500 – closing below its incredibly consistent trend channel floor going back to January 2013.

Is this simple technical cue the definitive shift in sentiment? No. A trend over half a decade in the making, will also take time to turn. Yet, we could very well be at the opening stage of the acceleration phase in that turn. Should we take that next step, an unwinding of risky positions and record leverage against a backdrop of thin open interest will heighten the demand for liquidity (stability). That is where the dollar would shine.

As we monitor the ‘risk’ theme closely, it is important to keep in mind the currency’s other primary fundamental avenues. If the spark doesn’t catch, the US rate speculation has stabilized after initially wavering on the dovish Fed meeting minutes. Officials’ remarks suggest they are still heading towards hikes and the calls for deferring a hike until end of 2015 or later are very few. Data in the week ahead poses limited volatility threat to this consideration. Alternatively, risk aversion would likely push back the lift off, but the Dollar would still gain through its safety appeal. As for the weakened position of its counterparts, the unflattering growth forecasts and warnings issued for the Eurozone, Japan and China keep this a bullish greenback lever whether sentiment collapses or not. – JK

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

GBP/USD consolidates above 1.2500, eyes on US PCE data

GBP/USD fluctuates at around 1.2500 in the European session on Friday following the three-day rebound. The PCE inflation data for March will be watched closely by market participants later in the day.

Gold clings to modest daily gains at around $2,350

Gold stays in positive territory at around $2,350 after closing in positive territory on Thursday. The benchmark 10-year US Treasury bond yield edges lower ahead of US PCE Price Index data, allowing XAU/USD to stretch higher.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.