Fundamental Forecast for Japanese Yen: Neutral

The Weekly Volume Report: Next Volume Surge Key For USD Direction

Post-FOMC Levels Holding USD for Now; JPY-crosses Begin Breakdown

For Real-Time SSI Updates and Potential Trade Setups on the Japanese Yen, sign up for DailyFX on Demand

The fundamental developments coming out of the U.S. economy may continue to undermine the long-term bullish outlook for USD/JPY as recent headlines point to a growing dissent within the Federal Open Market Committee (FOMC).

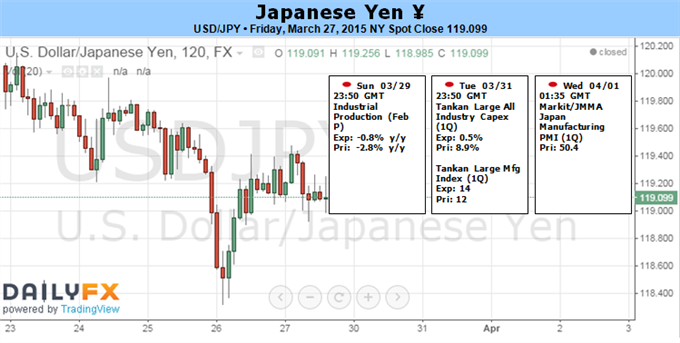

At the same time, capital flows will also be closely monitored as Japan kicks off its 2015 fiscal-year, but the fresh batch of Fed rhetoric may largely dictate dollar-yen price action going into April especially as the Bank of Japan (BoJ) endorses a wait-and-see approach for monetary policy.

With a slew of Fed officials (Stanley Fischer, Jeffrey Lacker, Dennis Lockhart, Loretta Mester, Esther George, John Williams Janet Yellen, Lael Brainard and Narayana Kocherlakota) scheduled to speak next week, the new commentary may highlight a further delay in the normalization cycle as an increasing number of central bank officials see scope to retain the zero-interest rate policy beyond mid-2015. As a result, a further deterioration in interest rate expectations may trigger another test of near-term support around 118.20 (61.8% retracement), and USD/JPY may continue to congest ahead of the second-half of the year as the central bank remains in no rush to normalize monetary policy.

Nevertheless, the U.S. Non-Farm Payrolls (NFP) report may generate a bullish reaction in dollar-yen as market participants anticipate another 250K expansion in employment, while the jobless rate is projected to hold at an annualized 5.5% - the lowest reading since May 2008. However, another unexpected downtick in Average Hourly Earnings may drag on the greenback as Fed Chair Yellen highlights a cautious stance on the economy, especially as the central bank struggles to achieve the 2% target for inflation.

With that said, the 118.20 (61.8% retracement) support zone will be closely watched going into the week ahead, and the pair remains vulnerable for a further decline as it continues to carve a series of lower-highs. In turn, a failure to preserve the March low (118.32) may open the door for a move back towards the 117.15 region (78.6% expansion) should the key event risks dampen bets for a mid-2015 Fed rate hike.

FXCM, L.L.C.® assumes no responsibility for errors, inaccuracies or omissions in these materials. FXCM, L.L.C.® does not warrant the accuracy or completeness of the information, text, graphics, links or other items contained within these materials. FXCM, L.L.C.® shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation losses, lost revenues, or lost profits that may result from these materials. Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.