Fundamental Forecast for Pound: Bearish

GBP/USD Continuation, EUR/GBP ST Triangle in Play after BoE Inflation Report

Cable at New Lows for 2014, but Key Support Awaits

For Real-Time SSI Updates and Potential Trade Setups on the British Pound.

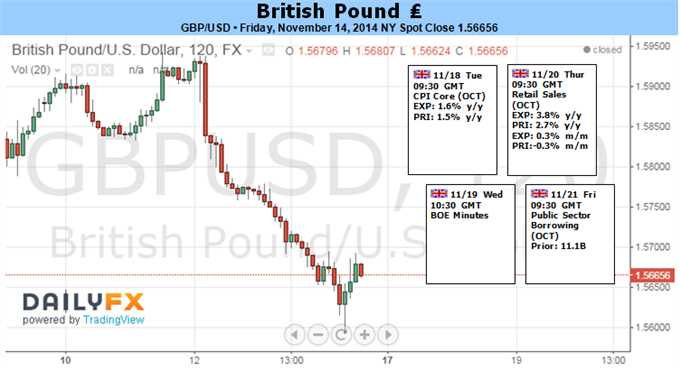

The Bank of England (BoE) Minutes are widely expected to show another 7-2 split within the Monetary Policy Committee (MPC) as the majority retains a wait-and-see approach, and the policy meeting minutes may do little to increase the appeal of the British Pound as the central bank curbs its growth and inflation forecast.

Even though the BoE remains on course to raise the benchmark interest rate in 2015, the downward revisions delivered in the quarterly inflation report favors a bearish outlook for GBP/USD as Governor Mark Carney adopts a more dovish tone for monetary policy and warns of the ‘large disinflation pressures’ coming from abroad. With that said, easing interest rate expectations is likely produce further headwinds for the sterling, but positive data prints coming out of the U.K. may generate a near-term correction in GBP/USD as the central bank sees the economy returning to normal.

As a result, a rebound in the U.K’s core Consumer Price Index (CPI) along with a marked pickup in Retail Sales may spur a bullish reaction in GBP/USD, but we will for an extension of the series of lower highs & lows in the exchange rate as it retains the bearish trend dating back to July.

In turn, we will retain the approach to sell-bounces in GBP/USD and watch former support around the 1.5890-1.5900 for new resistance, with the next downside region of interest coming in around 1.5540-50, the 78.6% Fibonacci retracement from the August 2013 low.

FXCM, L.L.C.® assumes no responsibility for errors, inaccuracies or omissions in these materials. FXCM, L.L.C.® does not warrant the accuracy or completeness of the information, text, graphics, links or other items contained within these materials. FXCM, L.L.C.® shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation losses, lost revenues, or lost profits that may result from these materials. Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.