EUR/USD

Anyone who has expected an increase of EUR/USD in the past week, was wrong. Last week, wave A was breached and the market weakened and dropped below 1.2700. This week we are expecting a consolidation and return to wave A, however the overall trend will be rather decreasing. If wave C is breached, we can expect a decrease up to the 1.2500 level.

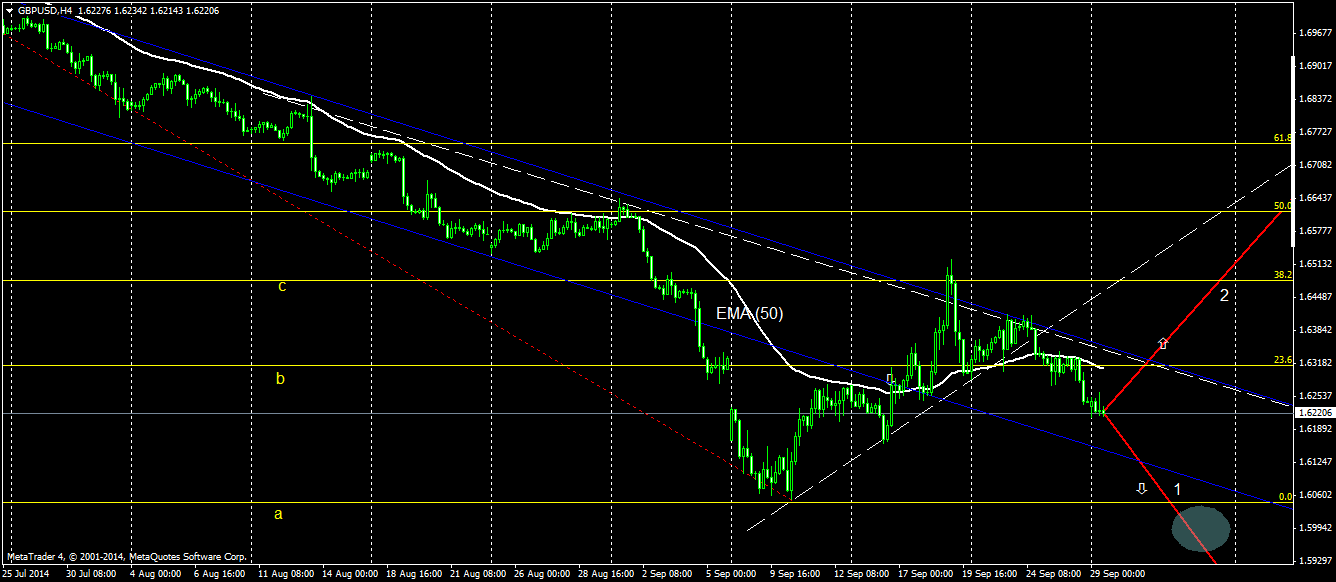

GBP/USD

Although GBP/USD seemed to start to grow in the past week, its breath run out and opposite happened. It tested the 1.6200 level. In a long run the GBP/USD has decreasing trend, therefore we expect a movement from wave B toward wave A during this week. The decrease trend will probably stop at this point and have attempt the support level of 1.6000.

USD/JPY

The USD/JPY is still following a growing trend. After several breakouts and a rapid movement of wave B towards wave A we expect a cooling of the growing trend followed by consolidation. If consolidation is accompanied by attempts to break the EMA (50), it can lead to a decline up to wave B, and if it is breached it can likewise breach wave C.

GOLD

As wave C was not breached last week (did not drop below 1200USD), a strong support has surfaced. If there is no breach of wave C during this week, we can expect a stagnation below the EMA(50) level and slight growth, which should not exceed 1250 USD.

By utilizing this website, you agree to be bound by these terms and conditions. This is a legal agreement (“Agreement”) between you and Leconte, sro.. (“Gurulines”) for use of the website, data, Gurulines electronic trading platform, and products and services which you selected or initiated, which may include the Gurulines trading platform and third party signal providers (“Products and Services”). If you do not agree with the terms of this Agreement, do not use this website or any of the Products and Services.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.