I used to be a night owl. As an undergraduate, I avoided 8 a.m. classes, and rarely took advantage of the daily breakfast that was a mandatory component of our meal plan. I did my best work between 10 p.m. and 3 a.m., whether in the library or at the dormitory poker table.

That all changed when I became a dad. My children tired me out; over the years, I find myself hitting the hay earlier and earlier. These days, I’ll typically nod off at 9, after checking the opening trends in the Asian markets. And when I rouse myself at 4:30, I’ll check the close.

Over the past few weeks, I have had a number of rude awakenings. The news from China has been volatile and disconcerting. There is a general sense that the carnage would be far worse if not for active intervention from Chinese authorities.

Market corrections are nothing unusual and not to be feared. Sound underlying fundamentals can limit the downside of these episodes. In China’s case, a lack of transparency and economic statistics that few find credible have created an environment where investors fear the worst.

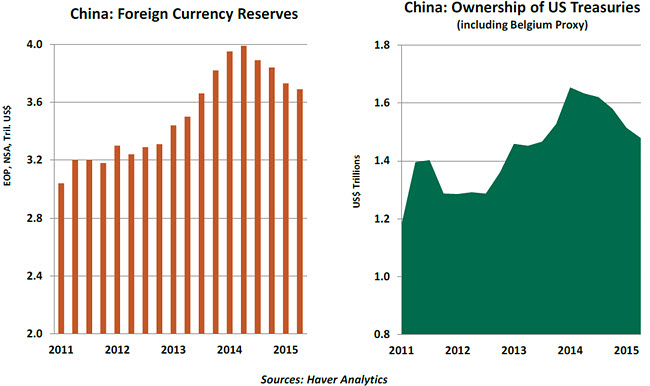

As Ieisha has noted, inconsistent movements from Chinese policymakers have compounded the problem. Will they support the stock markets, or won’t they? Do they aim to devalue their currency, or maintain a “dirty peg” with the U.S. dollar? Officials have certainly not been shy about using their vast reserves in the name of stability; conservative estimates place the cost of recent currency and stock market intervention at $400 billion.

China’s reserves serve multiple purposes. They are presently being utilized to place a floor under equity markets, prevent the yuan from declining, buffer capital outflows and fill cracks in the financial system. Going forward, it seems likely that they will be applied to stimulate economic growth. So while China’s reserves seem substantial on the surface, they are being relied upon to solve a series of substantial challenges.

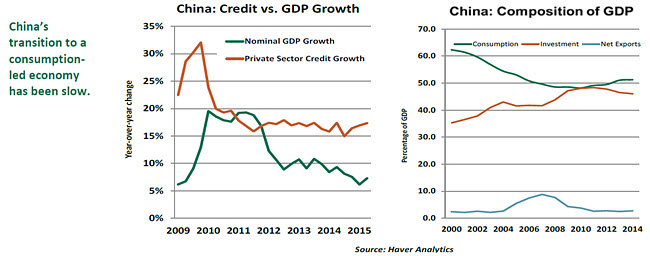

The People’s Bank of China (PBOC) continues its efforts to boost economic activity. This week, the PBOC reduced the reserve requirement to 18% from 18.5%. The central bank also lowered its key lending and deposit rates by 25 basis points each. It remains to be seen whether this somewhat-belated response has the intended impact of lowering borrowing rates for cash- strapped companies and signals enough of a policy response to assuage jumpy investors.

Adding more leverage to a system that some think is already overburdened by debt is a temporary solution, at best. For China, regaining economic balance is critically dependent on generating greater levels of domestic consumption to buffer against swings in exports. China’s wealth has grown, but its spending remains the same percentage of gross domestic product (GDP) as it was five years ago.

China’s recent equity market turbulence won’t help matters. Stocks aren’t nearly as widely owned in China as they are in the United States, but the correction will make a negative impression on the populace. It doesn’t help that the property markets are also in retreat.

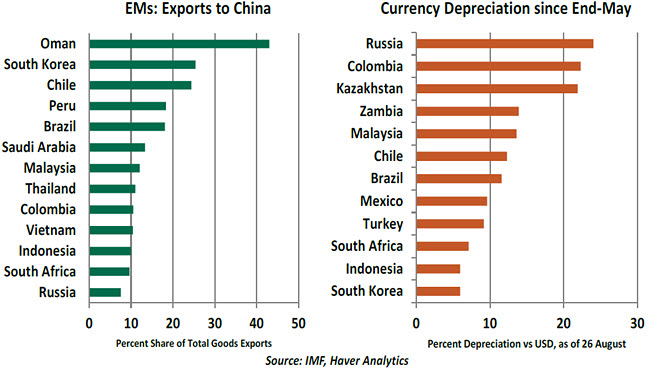

Many wonder how China’s struggles will reverberate through emerging markets. First-order effects are somewhat straightforward. Those with a high degree of reliance on exports to China or commodities are clear losers. In general, this leads to lower growth and exchange-rate depreciation.

Further knock-on effects are more difficult to predict. Nearby financial centers could be weakened, and investor risk-aversion could easily cause capital flight from higher-risk emerging markets. Which markets are most vulnerable?

India should be in a less precarious position, with limited dependence on China and commodities. (In fact, lower oil prices may be a benefit.) Gulf countries are under pressure due to low oil prices, but large sovereign savings remain a strong backstop.

On the other side of the equation, Brazil is already in the midst of a serious recession and political upheaval related to various corruption investigations. A China hard-landing scenario would likely cost Brazil its investment-grade ratings and trigger an exit of foreign investors.

Most vulnerable of all are the higher-risk frontier markets that China has helped prop up in recent years with bilateral financing. These include Venezuela, Argentina, Ecuador, Zimbabwe and Myanmar. For these nations, a reversal of Chinese support would be extremely costly.

While the problems of an individual emerging market may not threaten growth in the developed world, serial distress certainly can. Those looking for road maps for what might lie ahead have quickly seized on the Asian crisis of 1997-98, which leapt the Pacific and caused the failure of Long-Term Capital Management. Intervention from the Federal Reserve Bank of New York prevented further contagion in the West (the Fed facilitated a meeting of leading investment banks to resolve the issue), but it took a long time for the Asian “Tigers” to regain their roar.  Are we on the precipice of something similar? Compared to 1997, most major emerging markets have floating exchange rates, improved external debt profiles and higher levels of foreign reserves. So while we would not dismiss this possibility out of hand, we don’t find it likely. But should China opt for a more-aggressive competitive devaluation of its currency, it could create much more-extreme hardship for its neighbors.

Are we on the precipice of something similar? Compared to 1997, most major emerging markets have floating exchange rates, improved external debt profiles and higher levels of foreign reserves. So while we would not dismiss this possibility out of hand, we don’t find it likely. But should China opt for a more-aggressive competitive devaluation of its currency, it could create much more-extreme hardship for its neighbors.

Eulogies mourning the death of Chinese growth are probably overdone, which should be good news for everyone. Best known for its manufacturing, China does have a thriving service sector. Economic growth in developed countries seems to be steady, which should help demand for China’s exports. Monetary policy can do a lot more to support activity.

But recent events have called into question the inexorable rise of China and the seeming infallibility of its leadership. Unless Beijing comes up with satisfactory answers, the volatility may just be starting.

The ABCs of the Fed’s New Monetary Policy Implementation Framework

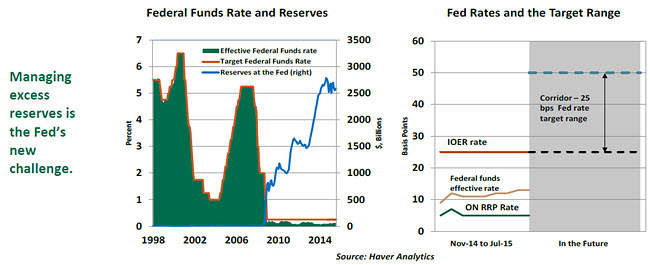

The Federal Reserve is widely expected to raise the policy rate soon. The procedures used to tighten monetary policy will differ from those that prevailed in 2006, when the Fed last increased the federal funds rate.

The old method of executing monetary policy is not appropriate anymore, as some aspects of the banking environment have undergone a radical transformation since the Great Financial Crisis (GFC). The following discussion consists of the old monetary policy implementation framework, why it has to be modified and an overview of the new procedure.

Prior to the GFC, the Fed set reserve requirements, and banks held reserve balances to meet this obligation. Reserves were held as vault cash or maintained at the Fed. Banks kept their reserve balances to a minimum because they did not earn a return.

The demand for reserves (to meet reserve requirements) and bankers’ aim to limit balances (as reserves earned zero interest) resulted in an active interbank market known as the federal funds market. Banks borrowed from and lent to each other on a daily basis at the “federal funds rate.”

A tightening of monetary policy by announcing a higher federal funds rate was followed by open market sales of Treasury securities to primary dealers in exchange for bank reserves. A reduction of reserves in the federal funds market pushed the market-determined federal funds rate upward.

Through these operations, the Fed could influence the interest rate determined in the federal funds market such that it would be close to the new target. The Fed could also drain reserves or add reserves temporarily through repurchase agreements.

This operating framework changed when the Fed reduced the federal funds rate to a range between 0 and 25 basis points in December 2008, where it stands today. Thereafter, the Fed put in place a series of large-scale asset purchase programs between November 2008 and October 2014 to support the economy. These purchases led to a ballooning of reserve balances to about $2.6 trillion.

With reserves no longer scarce, the Fed was unable to control the federal funds rate. In 2008, the Fed commenced paying 0.25% interest on excess reserves (IOER) that banks held at the Fed, to keep the Fed funds rate from falling too far. Other non-bank institutions (federal home loan banks, government sponsored enterprises and money-market mutual funds) cannot by law earn interest from the Fed. These entities lend to banks at a lower rate, which has led to the federal funds rate hovering between zero and 0.25%.

Under these circumstances, the Fed cannot follow the traditional method of tightening through sales of Treasury securities, as there are more-than-adequate reserves in the banking system. The Fed has no plans to shrink its holding of Treasury securities anytime soon.

The Fed has tools to overcome the limitations of its old procedures. It has indicated that it intends to move the federal funds rate into the target range by changing the IOER. There are three channels through which it can influence the federal funds market to achieve its goal.

First, all else equal, an increase in the IOER is expected to put upward pressure on the federal funds rate, as banks would have an incentive to borrow in the federal funds market at rates below the IOER and place those balances at the Fed to earn the IOER rate.  Second, by allowing non-bank institutions to participate through the overnight reverse repurchase program (ON RRP), they can help to keep the federal funds rate within the target range, as it discourages them from lending to lend to a bank at a lower rate. Third, the Fed can increase reserve scarcity by reducing the aggregate level of reserve balances through term reverse repurchase programs and the Term Deposit Facility (TDF). The Fed has tested each of these programs.

Second, by allowing non-bank institutions to participate through the overnight reverse repurchase program (ON RRP), they can help to keep the federal funds rate within the target range, as it discourages them from lending to lend to a bank at a lower rate. Third, the Fed can increase reserve scarcity by reducing the aggregate level of reserve balances through term reverse repurchase programs and the Term Deposit Facility (TDF). The Fed has tested each of these programs.

With these available options, the Fed will be operating in a “corridor system” with the IOER as the ceiling (the upper limit of the federal funds target rate) and the ON RRP rate as the floor. With a ceiling and floor established, the corridor defines the limits of the fluctuations of the federal funds rate. In theory, regardless of the supply of reserves, the Fed can control the federal funds rate within the corridor.

But the Fed is entering unchartered waters, and challenges are almost certain. The important issue is whether ON RRP will be sufficient or whether term RRPs and the TDF will be needed to manage the federal funds market. Initially, the Fed may err on the side of offering a combination of programs to ensure the federal funds rate is higher than the floor.

The federal funds market remains important for the implementation of monetary policy. This market has shrunk dramatically in the post-GFC period. Excess reserves have reduced the need to borrow, and IOER has resulted in a smaller need to lend. Banks account for less than one-fourth of total lending, while non-banks are the large lenders in this market. The Fed has to take into account this transformation of the federal funds market.

The monetary policy implementation process is not likely to be smooth. The Fed has given itself enough flexibility to minimize errors, but the communication channel to markets will bear a large burden in the months ahead.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.