US – Labor market for September disappoints

Eurozone – stable unemployment rate/energy prices burden inflation

Glencore increases uncertainty on markets

US labor market report for September clearly below expectations

Non-farm payrolls grew considerably below market expectations in September and gained only 142,000 vs. the market estimate of 201,000.

Additionally, the gains of the previous two months were revised downward, by 59,000 in total. After the revision, September employment gains were slightly higher than in August. In total, the last two months show a significant slowdown of employment growth, if compared with the previous months, and most sectors were affected. The unemployment rate, on the other hand, remained unchanged at a post-Lehman low of 5.1%, as markets had estimated. Average hourly earnings stagnated compared to the previous month and disappointed the market’s estimate of 0.2% growth. However, this was partially compensated for by an upward revision of the growth rate in the previous month from 0.3% to 0.4%.

With today’s data, a rate hike in October can basically be ruled out.

Markets will also assign an increasingly smaller likelihood to a rate hike in December. Due to the timely coincidence, we think that the weakness in hiring is due to the uncertainty created by the turbulent financial markets in August and September, and we expect the labor data numbers to improve again in the future. Just this week, a number of indicators have pointed to good domestic demand. Our core scenario remains a rate hike in December. However, the risks have obviously increased and interest rate expectation on markets will remain low for the time being.

Eurozone – stable unemployment rate (11.0%) in August; low energy prices burden inflation data (-0.1% y/y) in September

This week’s released indicators for the Eurozone indicate a stable economic development. The unemployment rate for August stabilized at 11.0% after a revision of the July data. The unemployment rate continued to decline in Spain, Germany and Italy. In France, however, the unemployment rate rose slightly. This mainly reflects the lack of reforms in France. The solid condition of the labor market allows an unchanged positive outlook for consumption, even though consumer sentiment slightly deteriorated in 3Q when compared to the high levels seen in 2Q.

Due mainly to low energy prices, the Eurozone’s inflation rate declined after first estimations to -0.1% y/y (previously +0.1% y/y) in September. Core inflation, however, remained stable (+0.9% y/y), thanks to further rising price levels for services and food. We expect the currently dampening impact of energy on price levels to gradually vanish throughout the coming months. This should result in a gradual increase of inflation data until year-end and beyond.

Generally, the economy of the Eurozone remains in good shape, despite the currently unstable situation on financial markets, and we continue to expect growth of around 0.3% q/q for 3Q. From an economic perspective, the Eurozone is a beneficiary of declining commodity prices, since they give real disposable incomes a boost, which in turn supports consumption. Declining growth in China has led to lower export growth from the Eurozone to China. This, however, has been compensated for by strong domestic trade as well as rising exports to the US. In a next step, the thus-far slow growth of investments will have to play a crucial role for the Eurozone economy. The Capital Markets Union (the EC released a concrete action plan on September 30) is going to play a crucial role in this context, especially in order to ease access to alternative sources of financing for SMEs and start-ups. Next week, retail sales for August (October 5), August industrial production data for Germany (October 7) as well as France and Italy (October 7) will be in focus.

Uncertainty likely to persist

Markets reacted extremely nervously to a research report that highlighted the risks for Glencore stemming from stagnant commodity prices for an extended period of time. Glencore’s total liabilities amount to USD 148bn, roughly a third of which is equity. The news increased fears on the market that the impact of low commodity prices might spill into the financial sector via the indebtedness of large commodity companies. Glencore has a net debt of USD 47.4bn and its total debt amounts to almost USD 100bn. Next year, Glencore needs to meet debt repayments of USD 13.8bn - compared to other large commodity companies (Anglo American, Rio Tinto, BHP Billiton), this is by far the largest amount.

Notwithstanding only small further declines of commodity prices during the last few weeks, the outlook for commodity prices seems to have deteriorated on markets. Estimates for profit increases for mining and energy companies for next year indicated expectations of a recovery of commodity prices. Due mostly to an expected slowdown in China, these expectations have been revised, which increases the risks for companies whose revenues depend on commodity prices. Fears about an insolvency of a major company could remain on markets for some time to come and limits the potential for yield increases, in our view.

Accordingly, we have adapted our yield forecasts.

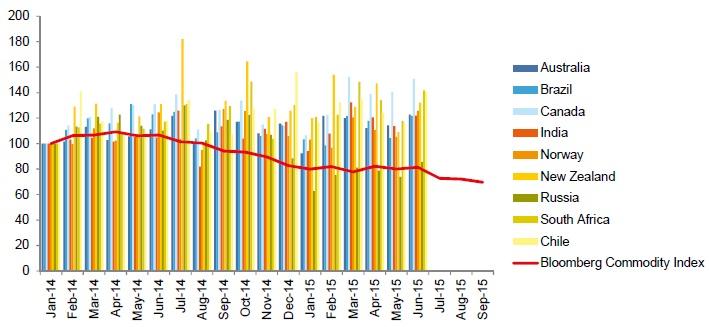

However, the reasons for our lower yield forecasts lie exclusively in the market sentiment, which is characterized through an extreme nervousness, to which concerns over commodity companies were added recently. The best indicator for the high degree of uncertainty is the strong divergence between markets and macro data. The data released this week delivered renewed confirmation of the ongoing - albeit moderate - recovery of the Eurozone. Markets are currently driven by fears of an economic slowdown ahead, coming mostly from lower exports. We currently do not see any noteworthy indications of a slowdown. We think that the market fears in this regard are strongly exaggerated, as Eurozone exports to China are relatively small, amounting to only 1.3% of GDP, and China’s economy has been slowing down for some time, without standing in the way of the Eurozone’s recovery. Lower commodity prices will very likely reduce growth in countries with a high share of commodity exports, albeit to a strongly differing extent. However, the decline of commodity prices up to now has not resulted in lower Eurozone exports to the respective countries. According to the Bloomberg Commodity Index, commodity prices fell almost 20% from January to 2014 to June 2015. During the same period, exports from the Eurozone to major commodity-producing countries rose, with the exception of Russia. During the last three months, the Bloomberg index dropped another 10%, and it is incomprehensible why this should have any noticeable impact on Eurozone exports, given past experience. This is especially the case since exports to these countries account for a relatively little share of overall exports and - more importantly - the Eurozone is a net importer of commodities. Lower commodity prices leave more money for spending on domestically produced goods and services, stimulating the economy. With our expectation of a continued recovery of the Eurozone, we maintain our mid-term expectations for yields and expect a continuous correction of the severe overvaluation of sovereign bonds.

Eurozone: Exports to selected commodity exporting countries and development of commodity prices

This document is intended as an additional information source, aimed towards our customers. It is based on the best resources available to the authors at press time. The information and data sources utilised are deemed reliable, however, Erste Bank Sparkassen (CR) and affiliates do not take any responsibility for accuracy nor completeness of the information contained herein. This document is neither an offer nor an invitation to buy or sell any securities.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.