EUR/USD

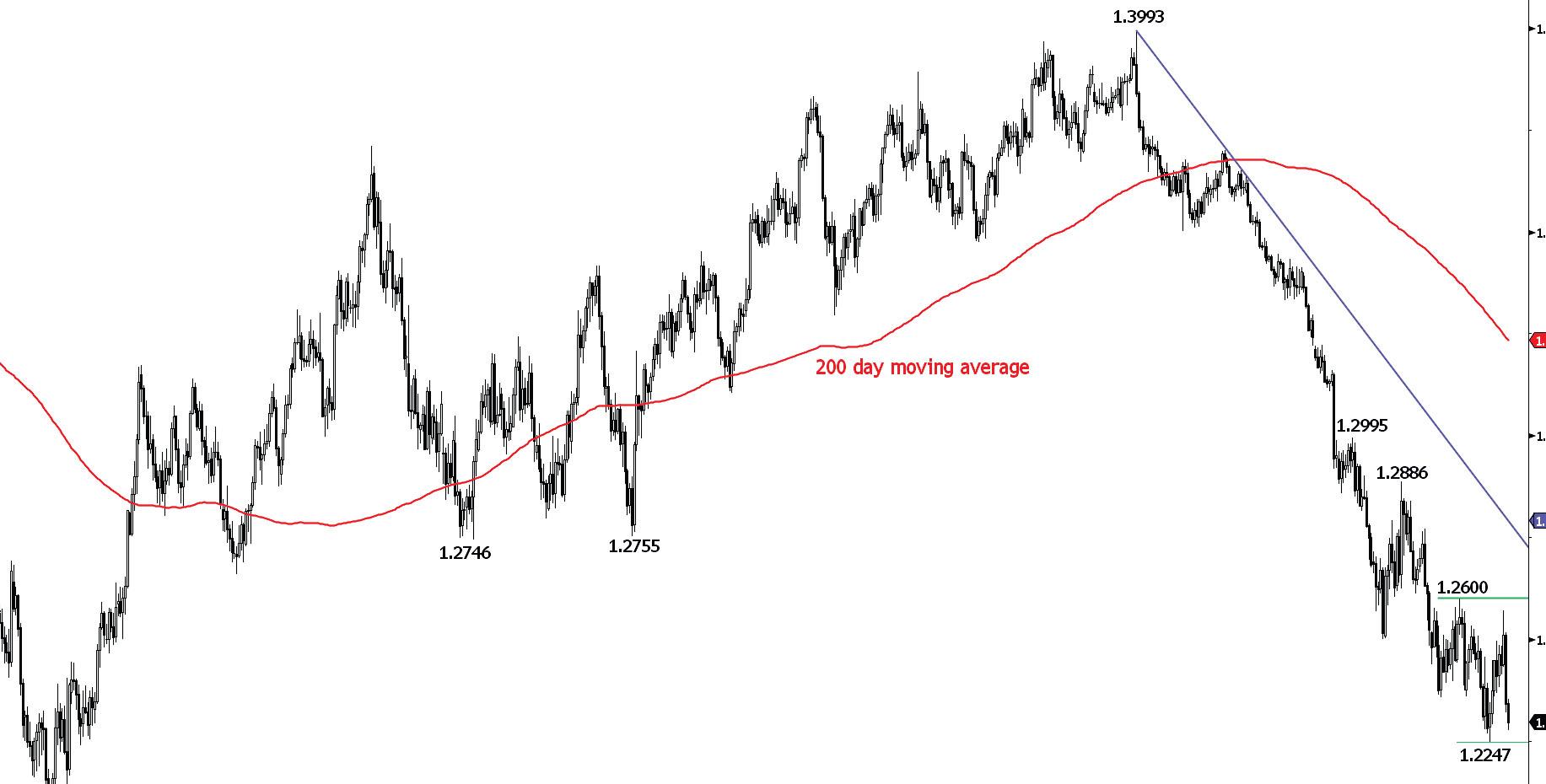

Declining towards its recent lows.

EUR/USD has declined sharply near the resistance area between 1.2577 (04/11/2014 high) and 1.2600, indicating renewed selling pressures. A support stands at 1.2247. Hourly resistances can now be found at 1.2373 (intraday high) and 1.2423 (intraday high).

In the longer term, EUR/USD is in a downtrend since May 2014. The break of the strong support area between 1.2755 (09/07/2013 low) and 1.2662 (13/11/2012 low) calls for a decline towards the strong support at 1.2043 (24/07/2012 low). A key resistance stands at 1.2600 (19/11/2014 high).

Short 2 units at 1.2522, Obj: Close remaining at 1.2070., Stop: 1.2610 (Entered: 2014-12-16).

GBP/USD

Testing its recent lows at 1.5542.

GBP/USD declined sharply yesterday, confirming persistent selling pressures. Monitor the test of the support at 1.5542. Hourly resistances for a short-term bounce can be found at 1.5634 (intraday low) and 1.5699 (intraday high).

In the longer term, the technical structure is negative as long as prices remain below the key resistance at 1.5945 (11/11/2014 high). A conservative downside risk is given by a test of the support at 1.5423 (14/08/2013 low). Another support can be found at 1.5102 (02/08/2013 low).

Await fresh signal.

USD/JPY

Approaching the resistance at 119.56.

USD/JPY has bounced sharply after the successful test of the key support at 115.46 (see also the 38.2% retracement). Resistances stand at 119.56 and 121.85. An hourly support lies at 117.76 (intraday high).

A long-term bullish bias is favoured as long as the key support 110.09 (01/10/2014 high) holds. Key supports to monitor for a medium-term consolidation stand at 115.46 (17/11/2014 low) and 113.17 (04/11/2014 low). Currently, there is no sign to suggest the end of the long-term bullish trend.

Await fresh signal.

USD/CHF

Challenging the key resistance at 0.9839.

USD/CHF has surged higher. However, the key resistance at 0.9839 has held thus far. A support for a short-term consolidation stands at 0.9722 (intraday low). Another support lies at 0.9695 (intraday high).

From a longer term perspective, the technical structure favours a full retracement of the large corrective phase that started in July 2012. A major resistance area stands between 0.9972 (24/07/2012 high) and 1.0067 (01/12/2010 high). A key support can be found at 0.9531 (19/11/2014 low).

Await fresh signal.

USD/CAD

Fading thus far to make a higher high.

USD/CAD has thus far failed to break the resistance at 1.1674, suggesting a weakening buying interest. Coupled with overbought conditions, a short-term consolidation phase is favoured. Hourly supports can now be found at 1.1561 and 1.1516.

In the longer term, the technical structure looks like a rounding bottom whose minimum upside potential is given by the strong resistance at 1.1725 (08/07/2009 high). Given the current overbought conditions, the odds to see a consolidation phase are increasing. Key supports stand at 1.1398 (09/12/2014 low) and 1.1192 (21/11/2014 low). Another resistance is given by the psychological threshold at 1.2000.

Await fresh signal.

AUD/USD

Approaching the strong resistance at 0.8067.

AUD/USD continues to decline and is now close to the strong support at 0.8067. Hourly resistances for a short-term bounce can be found at 0.8236 (17/12/2014 high, see also the declining trendline) and 0.8299.

In the long-term, the break of the strong support at 0.8660 (24/01/2014 low) confirms the underlying long-term bearish trend and opens the way for further weakness. A strong support area stands between 0.8067 (25/05/2010 low) and 0.7947 (61.8% retracement of the 2009-2011 rise). A key resistance can be found at 0.8615 (27/11/2014 high).

Await fresh signal.

GBP/JPY

Challenging the resistance at 185.02.

GBP/JPY has successfully tested the key support at 181.13. However, a break of the hourly resistance area between 185.02 (previous support) and the declining trendline (around 185.34) is needed to improve the short-term technical structure. Another resistance can be found at 187.21 (15/12/2014 high). An hourly support lies at 183.05 (intraday low).

In the long-term, the trend is positive as long as the key support at 178.74 (23/09/2014 high) holds. The break of the strong resistance at 180.72 (19/09/2014 high) opens the way for further strength. A key resistance stands at 197.45 (24/09/2008 high). A key support lies at 180.72 (19/09/2014 high).

Await fresh signal.

EUR/JPY

Weak bounce thus far.

EUR/JPY has successfully tested the support at 144.79. However, the subsequent bounce has thus far been unimpressive. Hourly resistances can be found at 147.03 (16/12/2014 high) and 147.90 (intraday high). Another support lies at 143.35 (12/11/2014 low).

The long-term technical structure remains positive as long as the key support at 141.23 (19/09/2014 high) holds. Monitor the test of the psychological resistance at 150.00. Another resistance stands at 157.00 (08/09/2008 high). A key support stands at 144.79.

Await fresh signal.

EUR/GBP

Weakening.

EUR/GBP is declining after its significant bearish intraday reversal near the resistance at 0.7977 (01/12/2014 high) made on 16 December. The hourly support at 0.7907 (15/12/2014 low, see also the rising channel) has been broken. Other hourly supports lie at 0.7874 (12/12/2014 low, see also the rising trendline) and 0.7833. Hourly resistances stand at 0.7955 (17/12/2014 high) and 0.8007 (16/12/2014 high).

In the longer term, the major support area between 0.7755 (23/07/2012 low) and 0.7694 (20/10/2008 low) has held thus far. However, a decisive break of the resistance at 0.8034 (25/06/2014 high, see also the declining channel and the 200-day moving average) is needed to confirm an improving technical structure.

Await fresh signal.

EUR/CHF

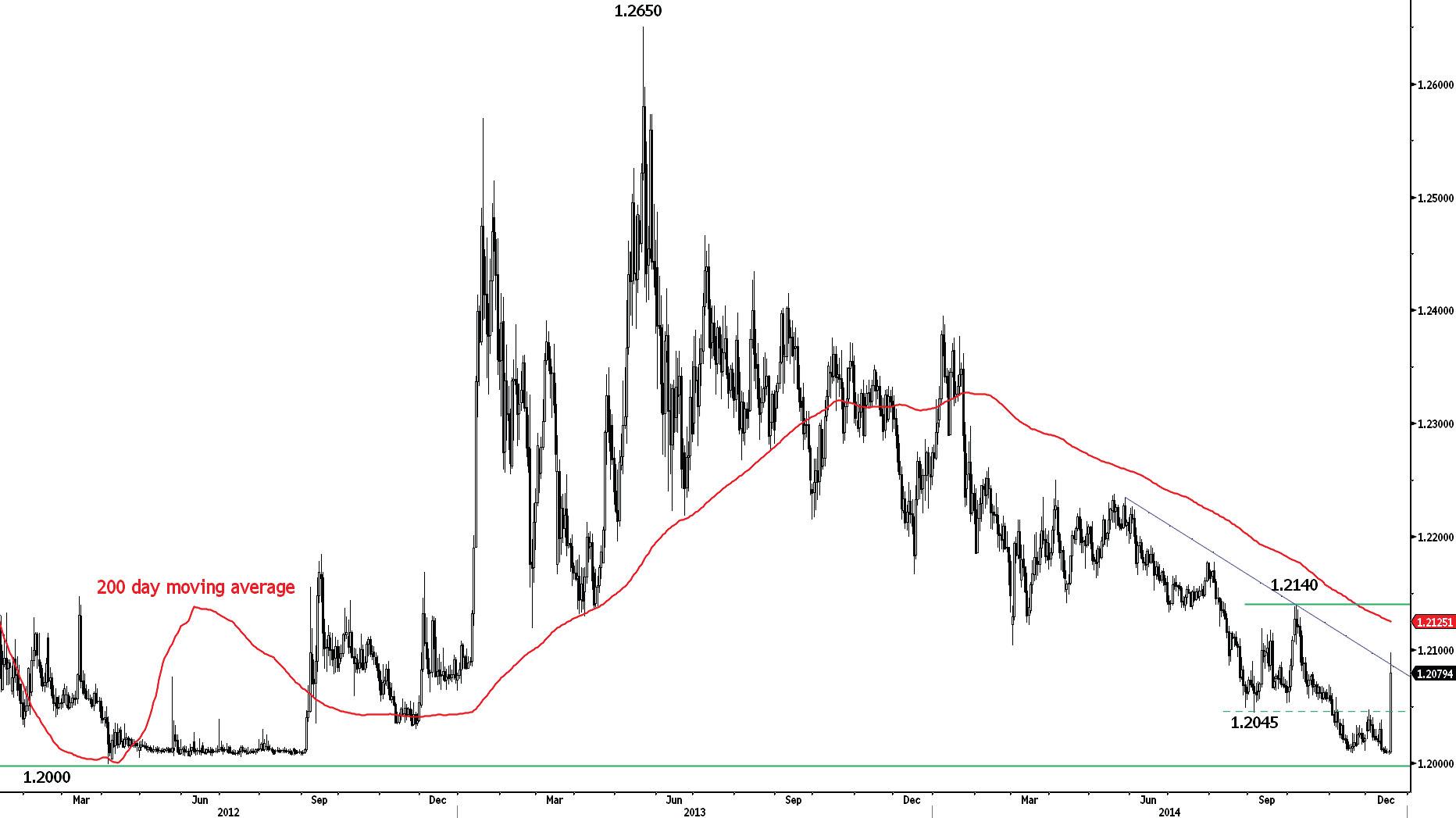

The SNB pushes EUR/CHF higher.

EUR/CHF has risen sharply following SNB's surprise announcement to introduce negative rates on sight deposits. An hourly resistance now lies at 1.2097 (intraday high). • A break of the resistance area defined by the declining 200-day moving average (around 1.2125) and 1.2140 (07/10/2014 high) is needed to suggest a potential change in the underlying longer-term EUR/CHF bearish trend.

In September 2011, the SNB put a floor at 1.2000 in EUR/CHF, which will be enforced with the "utmost determination". For the time being, a break of this threshold is unlikely.

Await fresh signal.

GOLD (in USD)

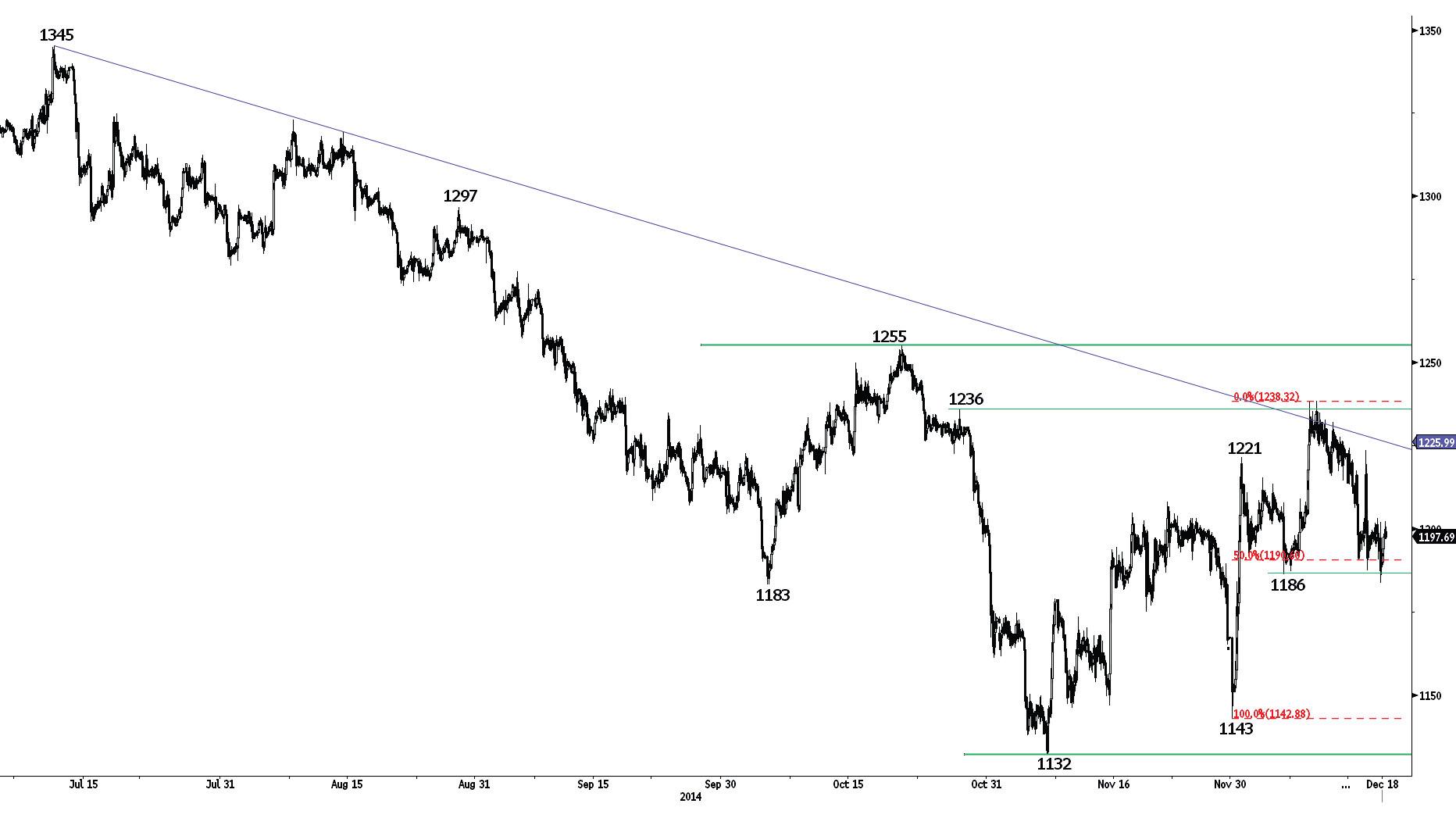

The support at 1186 has held thus far.

Gold has thus far successfully tested the support at 1186. However, Tuesday's large daily upper shadow suggests persistent selling pressures. An hourly resistance lies at 1224 (16/12/2014 high). Other supports stand at 1170 (intraday low) and 1143.

In the long-term, the move below the strong support at 1181 (28/06/2013 low) confirms the underlying downtrend and opens the way for further declines towards the strong support at 1027 (28/10/2009 low). A break of the strong resistance at 1255 (21/10/2014 high) is needed to invalidate this bearish outlook.

Await fresh signal.

SILVER (in USD)

Bouncing.

Silver is bouncing after the break of the support at 16.08. Hourly resistances can be found at 16.08 (previous support) and 16.64 (16/12/2014 high). Supports stand at 15.52 (intraday low, see also the 61.8% retracement) and 14.42.

In the long-term, the break of the major support area between 18.64 (30/05/2014 low) and 18.22 (28/06/2013 low) confirms an underlying downtrend. Although the strong support at 14.66 (05/02/2010 low) has held thus far, the lack of any base formation continues to favour a long-term bearish bias. A key resistance lies at 18.00 (23/09/2014 high). Another key support can be found at 11.77 (20/04/2009 low).

Await fresh signal.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.