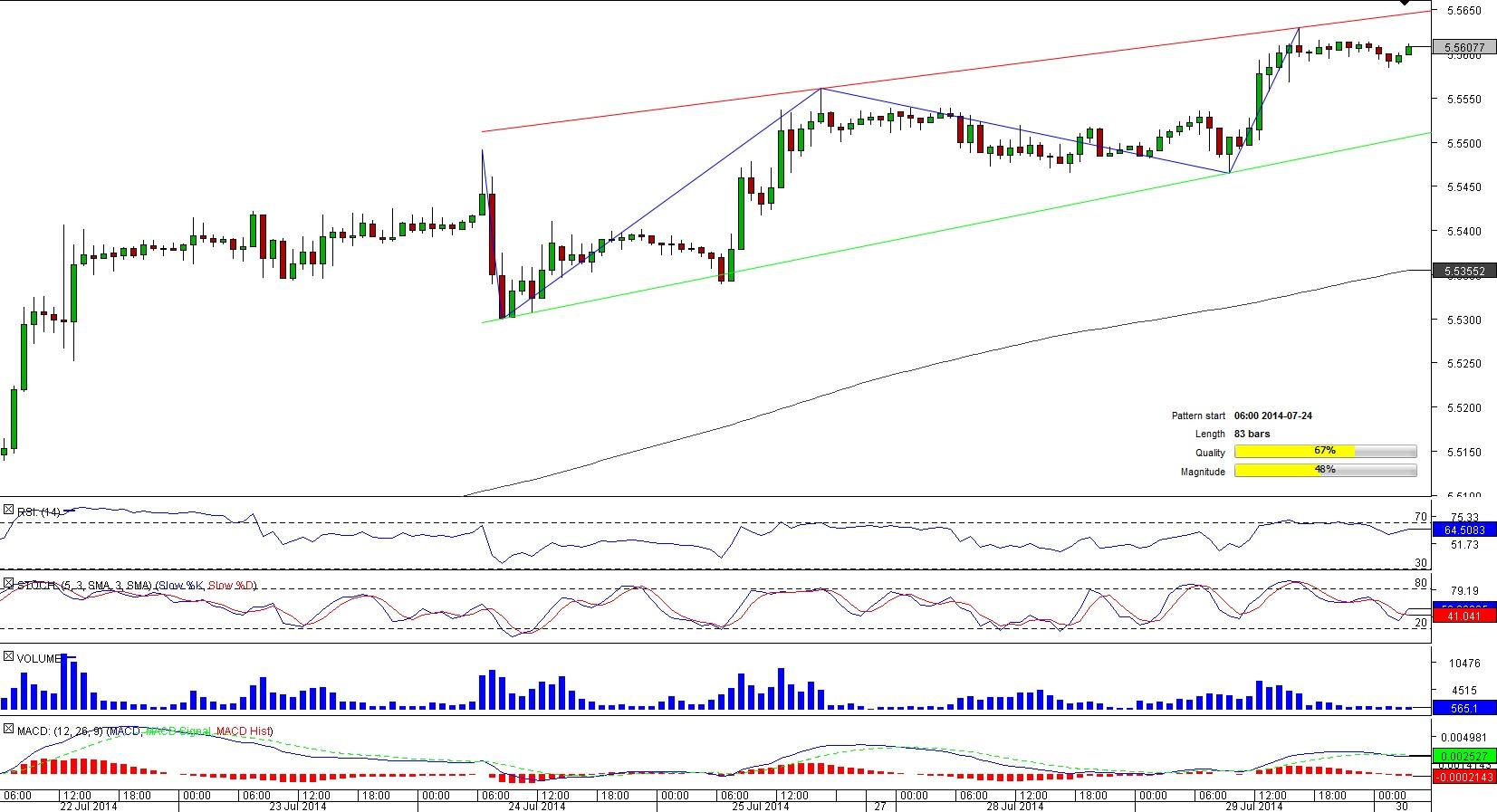

USD/DKK 1H Chart: Rising Wedge

Comment: Almost a one-month long rise performed by USD/DKK helped the pair to form an 83-bar long rising wedge pattern started on Jul 24.

Now the pair is trading near a 10-month high of 5.5632 and is likely to re-approach this peak in the foreseeable future given the overall upside trend and bullishness on the SWFX. Hence, in the hours to come, USD/DKK may target 5.5619/29 (four-hour R1, R2) that if overcome will bring the level of 5.5840 (four-hour R3; pattern’s resistance) to the picture. Technical indicators also point to a possible climb in the next hour but send neutral signals for a longer-term.

EUR/USD 1H Chart: Falling Wedge

Comment: July was the month of a notable weakness of the most popular currency couple that now is trading inside a gradually converging downward sloping channel. In fact, we examined a bearish tunnel shaped by EUR/USD a day earlier but today we will focus on a slightly different formation – falling wedge.

EUR/USD has recently touched a one-year low of 1.3404 and now is not in hurry to rebound from this low. However, the SWFX data suggests the pair has not lost its favour among traders – long positions on the SWFX slightly outweigh the short ones.

AUD/JPY 1H Chart: Triangle

Comment: AUD/JPY entered a symmetrical triangle in the second part of July and now is on the verge of a breakout. Considering that the instrument has been sticking to the upper limit of the triangle for the last 15 hours as well as the fact that four traders out of five bet on appreciation of the pair in the hours to come, the breakout is likely to be bullish. If this comes true, AUD/JPY may bounce off the 50-hour SMA at 95.78 that would trigger a rally towards the next level of 95.85/9 (four-hour R1; daily R1) lying outside the pattern. In case the pair is capable to consolidate above the latter mark, it may attempt to jump to 95.92 (four-hour R2) and then to 96.00 (four-hour R3; daily R3).

CHF/JPY 1H Chart: Triangle

Comment: Another Yen cross, CHF/JPY, also has been trading inside a symmetrical triangle pattern since the second part of July. This time the pair has more time to determine the direction of the looming breakout since the apex will be reached only on Jul 31. However, the pair is unremittingly trying to break the lower limit of the pattern that coupled with a moderate bearishness on the SWFX – 55% of all orders are placed to sell the currency couple – may lead to the breakout sooner than the pair attains the crossing point of the pattern trend-lines. This is further supported by technical indicators that send a strong ‘sell’ signal for short and long terms.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.