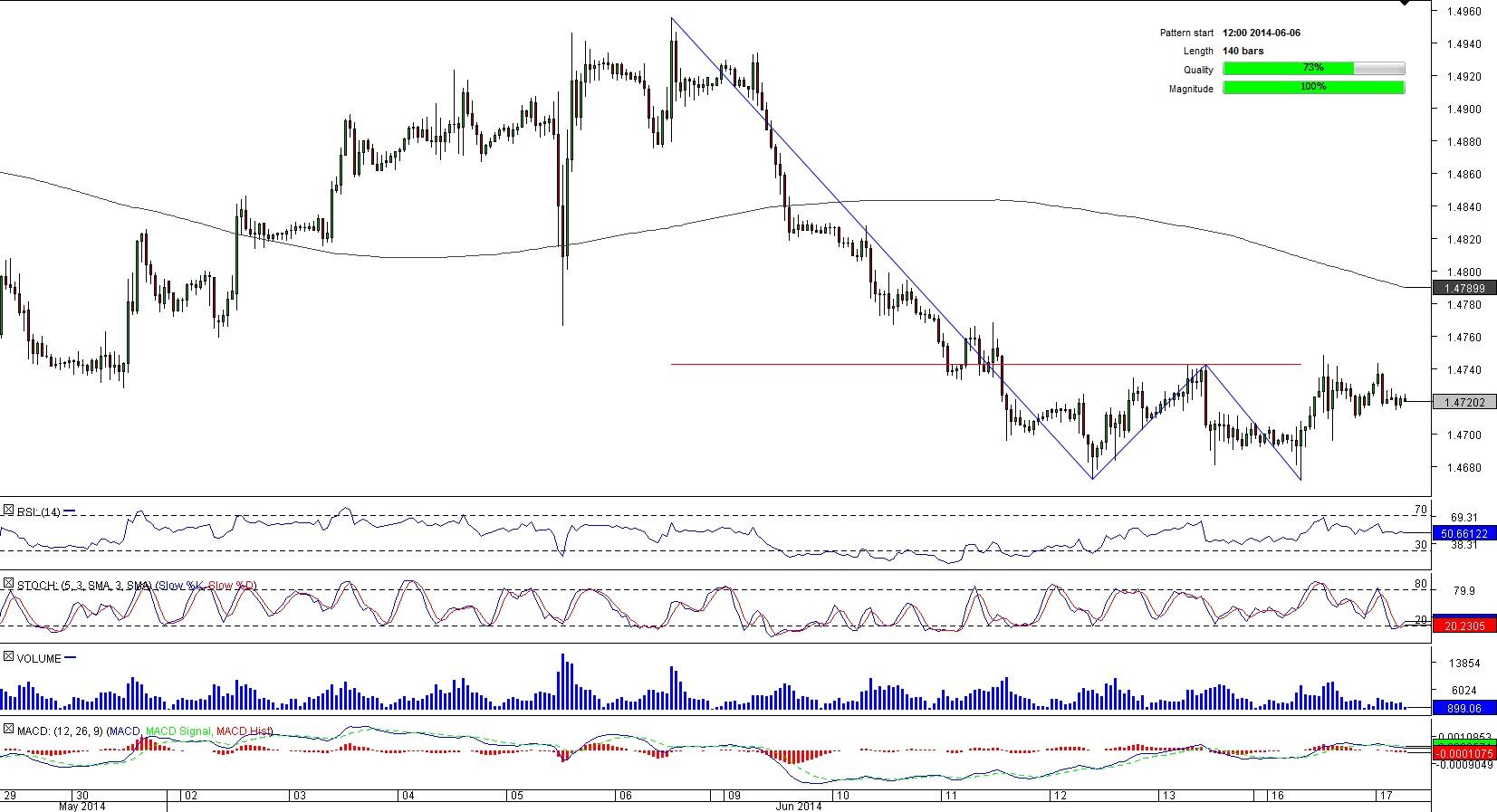

EUR/CAD 1H Chart: Double Bottom

Comment: Following a massive sell-off that occurred earlier this month, EUR/CAD hit a strong support level at 1.4671 that did not allow the Euro to depreciate any further. As a result, there is a possibility the currency pair has formed a double bottom, a pattern that implies a reversal. Accordingly, in case the resistance at 1.4742 is broken, EUR/CAD will have a decent chance to recover all of the recent losses. However, on its way to the Jun 6 high at 1.4956 the rate will have to face a number of fairly tough resistances, such as the one at 1.4793, formed by the daily R2 and 200-hour SMA. On the other hand, the sentiment of the SWFX market is strongly bullish—62% of open positions are long.

USD/SEK 1H Chart: Channel Down

Comment: As USD/SEK failed to cross the Jun 12 high at 6.7082, it was forced to decline. Considering that the currency pair formed a bearish channel, the sell-off is likely to persist. Moreover, most of the hourly and four-hour technical indicators are pointing downwards, hardening the case of further depreciation of the U.S. Dollar.

In order to confirm this USD/SEK needs to bounce off the upper boundary of the pattern at 6.6394 and then plunge down to the lower boundary at 6.6106, which is currently reinforced by the daily S1. At the same time, most of the market participants expect the greenback to underperform—merely 28% of positions are long.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD alternates gains with losses near 1.0720 post-US PCE

The bullish tone in the Greenback motivates EUR/USD to maintain its daily range in the low 1.070s in the wake of firmer-than-estimated US inflation data measured by the PCE.

GBP/USD clings to gains just above 1.2500 on US PCE

GBP/USD keeps its uptrend unchanged and navigates the area beyond 1.2500 the figure amidst slight gains in the US Dollar following the release of US inflation tracked by the PCE.

Gold keeps its daily gains near $2,350 following US inflation

Gold prices maintain their constructive bias around $2,350 after US inflation data gauged by the PCE surpassed consensus in March and US yields trade with slight losses following recent peaks.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.