Global Market

The already vulnerable Sterling was dealt a sharp blow on Tuesday as CPI y/y for the UK printed below expectations at -0.1%. Inflation has failed to pick up in the UK and this combined with the chain of negative PMI data experienced in September will push back the BoE’s interest rate increase to 2016. The GBP may be exposed to further losses and the risk-off environment which has been a product of market instability will continue to leave the GBP vulnerable moving forward. Market participants will digest this weak inflation reading as a signal that the BoE will not be raising rates until at least the second half of next year and because of this, the GBP may continue to decline heavily against most of its counterparts.

An unappetizing trade balance from China illustrating a decline in imports has shaken investor confidence. With concerns over the health of the China economy renewed, a fresh wave of risk aversion rippled through the Asian session. The world’s second largest economy is still facing difficulties with trade growth and this may result in additional downwards pressures. Most Asian equities that had enjoyed an extended period of gains last week have ventured back into red territory with the Shanghai Composite meandering between gains and losses concluding +0.17% higher. Sentiment for the China markets remains bearish and if CPI y/y for China fails to meet expectations on Wednesday, this may lead to additional vulnerability. This vulnerability offers a compelling argument as to why further monetary policy from China may be impending in the near future.

Declining commodity prices complimented with the slowdown in Asia has punished the cultivation of Europe’s 2% inflation target. Tuesday’s unimpressive German ZEW Sentiment of 1.9 which has drawn closer to zero, indicates that the European economy may be under pressure. Additional Dollar weakness derived from the diminishing expectations of a 2015 US rate hike has resulted in the EUR appreciating against the USD which has mounted more pressures on the ECB. The unexpected weakness in inflation from Europe in August and September may act as a reason for the ECB to induce additional QE measures in the near future.

USDCAD

The USDCAD is technically bearish on the daily timeframe. Prices are trading below the 20 Daily SMA and the MACD has crossed to the downside. A breakdown below the 1.2900 support may open a path to the next relevant support at 1.2650.

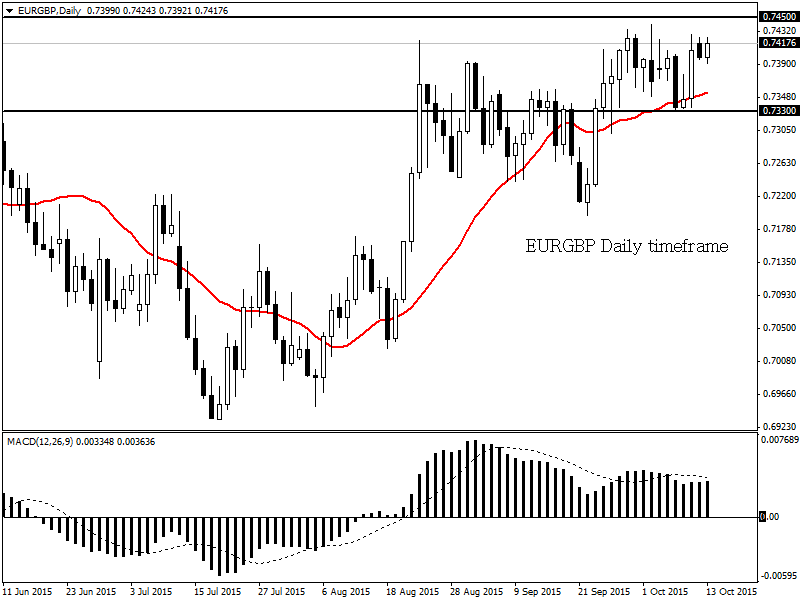

EURGBP

The EURGBP remains technically bullish on the daily timeframe as long as prices can keep above the 0.7330 support. A breakout above the 0.7450 resistance may open a path to the next relevant resistance at 0.7600.

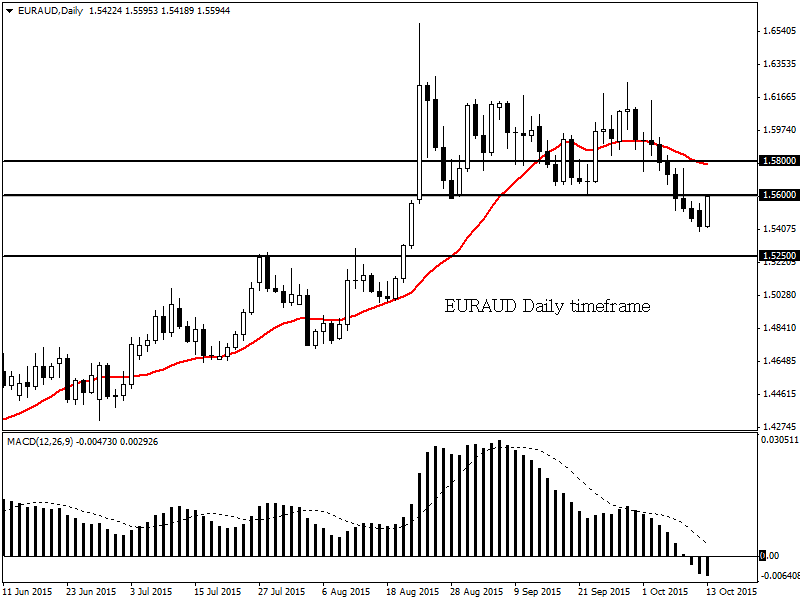

EURAUD

The EURAUD is technically bearish on the daily timeframe. Prices are trading below the daily 20 SMA and the MACD has crossed to the downside. Previous support may become resistance which should aid a decline to the next relevant support at 1.5250. A move back above 1.5800 suggests bearish weakness.

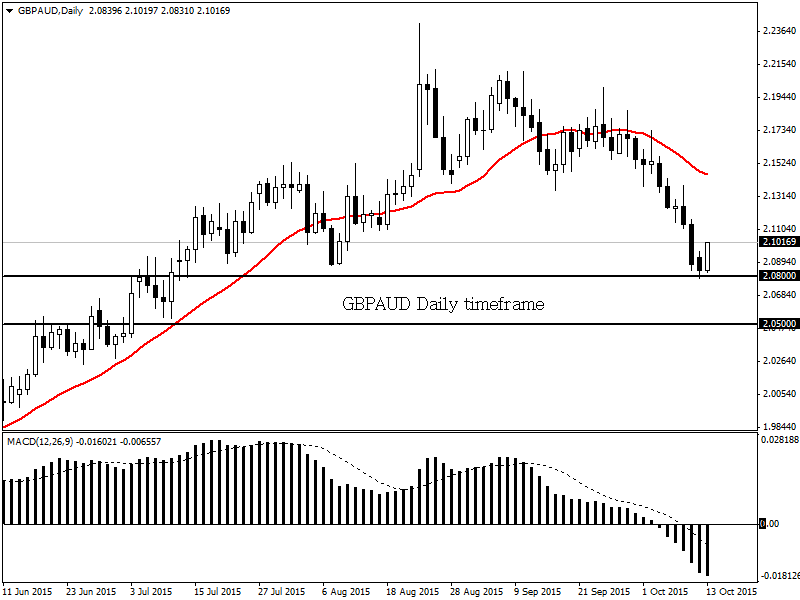

GBPAUD

The GBPAUD is technically bearish on the daily timeframe. A breach below the 2.0800 support may open a path to the next relevant support at 2.0500.

Disclaimer:This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 90% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.