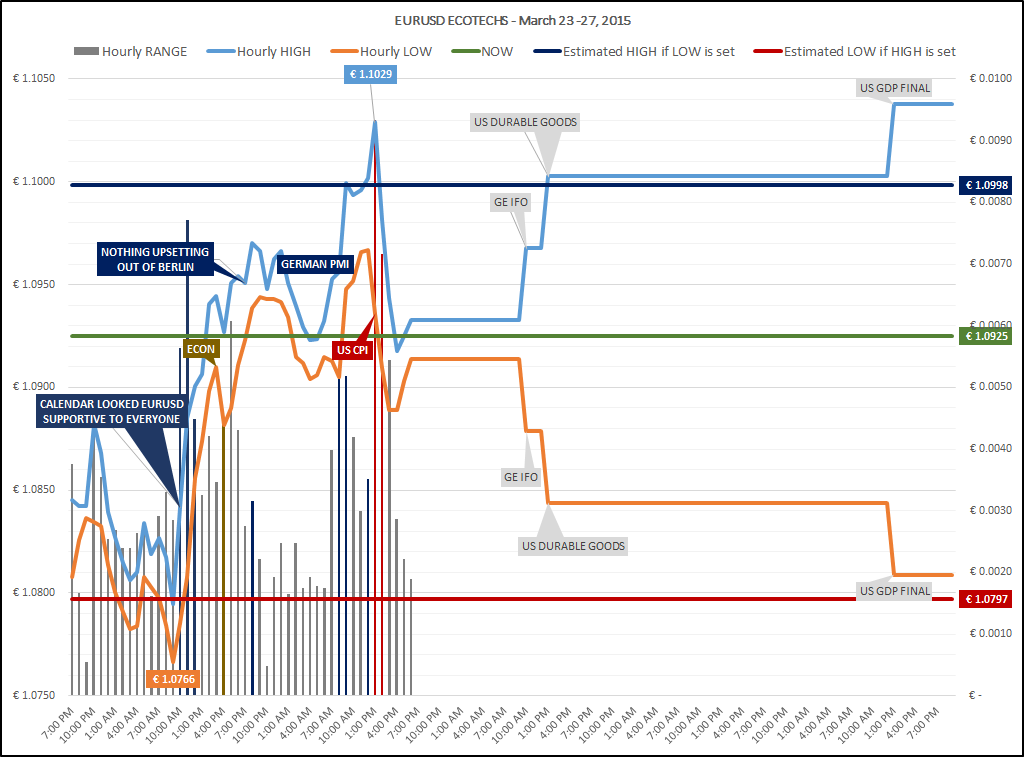

Good intraday volatility triggered by good Euro area PMI flash releases, taking the pair up almost 100 pips throughout the European morning session, just to be halted by a notch higher core consumer prices in the US. That release gave room for a 60 pips dip, which shorts saw as a relief and a possibility to reduce their positions. Up we went again and this time around with stops above 1.1000 – just to peak a bit lower than the high of last week.

Someone decided that neither of this made any sense and settled for a more decisive move south – taking us to a new low of the day.

I think that was seen as enough runs for a day’s session and the steam run a bit out of the pair into NY lunchtime.

There could be a bit more of the same tomorrow when we get German IFO which could be good reading and the later US Durable Goods Orders, which is more of a question mark.

While the Euro see more of support on lower levels, I would think “troubled” shorts are up and dealt with. Most of them were likely closed out Wednesday last week and some latecomers were likely done on the move above 1.1000 today. If so – the landscape is more of an open play field with more equally strong teams playing. That opens up for nice moves both ways – possibly as high as 1.1250-1.1450 should Greece faint from the daily headlines and down to 1.0650-1.0500 should they remain there with renewed focus on their liquidity position.

I still see EURUSD bulls as being pretty absent and that the teams are predominantly made up from shorts being comfortable staying so and shorts being more vulnerable. I think we need more of figures confirming the positive impact on Euro area macros and inflation from a lower euro before bulls are back.

General Risk Warning for stocks, cryptocurrencies, ETP, FX & CFD Trading. Investment assets are leveraged products. Trading related to foreign exchange, commodities, financial indices, stocks, ETP, cryptocurrencies, and other underlying variables carry a high level of risk and can result in the loss of all of your investment. As such, variable investments may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall Witbrew LLC and associates have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to investment trading or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Recommended Content

Editors’ Picks

EUR/USD alternates gains with losses near 1.0720 post-US PCE

The bullish tone in the Greenback motivates EUR/USD to maintain its daily range in the low 1.070s in the wake of firmer-than-estimated US inflation data measured by the PCE.

GBP/USD clings to gains just above 1.2500 on US PCE

GBP/USD keeps its uptrend unchanged and navigates the area beyond 1.2500 the figure amidst slight gains in the US Dollar following the release of US inflation tracked by the PCE.

Gold keeps its daily gains near $2,350 following US inflation

Gold prices maintain their constructive bias around $2,350 after US inflation data gauged by the PCE surpassed consensus in March and US yields trade with slight losses following recent peaks.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.