Politicians are back!

The US political arena will be the outstanding theme in the week ahead, with the main focus on October 1st, deadline for the US representatives to come to an agreement and help avoid the Government shutdown. The other crucial issue, the debt ceiling discussions, would remain dormant until mid October, when according to US Treasury Secretary Jack Lew, the Treasury could run out of funding resources, pushing the country to the fauces of the default. It is worth recalling the similar situation back to August 2011, when a solution finally turned up. Maybe that’s why markets reaction has been so far muted, although some signs of concern have already emerged in the stock markets. Clearly, the greenback was not benefited from the current uncertainties, while the FX community seems to be struggling between the safe-haven status of the USD and the US being the problem itself, resulting in unnoticeable demand for the world’s reserve so far. I am looking for a solution at the eleventh-hour, as per usual, with markets then shifting the attention to Friday’s Payrolls amidst a context of risk-on trade.

Now, let’s cross the pond back again and take a quick glance at Italy, where former PM Silvio Berlusconi has fulfilled his promises of withdrawing the PdL’s members of the Parliament, pushing the country once again to a political chaos. Undoubtedly, this fact would weigh on the single currency soon after the opening bell in the FX markets, while investors will put under the microscope the next steps from PM Enrico Letta and the President Giorgio Napolitano, amidst another quest for bringing (in the interim, at least) some stability to the country, and somehow allaying the spectre of a downgrade.

In the meantime, in Germany, negotiations between Chancellor Merkel’s CDU and the SPD give all the impression to drag on into December and beyond. In my opinion, this could easily become a snowball, with certainly negative implications for the shared currency, as markets seem to be ignoring the problem so far, let alone price in any consequence.

ECB is looming

The ECB meeting is a key event for the single currency on Wednesday. There has been increasing market chatter regarding the likeliness of another LTRO, although this scenario seems only likely should President Draghi decides to intensify the current forward guidance or the liquidity conditions threaten to put extra upside pressure on short-term rates. The recent dovish tone in speeches and comments by Mario Draghi trying to ‘talk down’ the euro passed almost unnoticed by the pair’s price action, however they allow us to think the same outcome in the upcoming gathering, along with another discussion regarding a refi rate cut, or maybe another measure from the central bank’s toolbox.

And finally, NFP

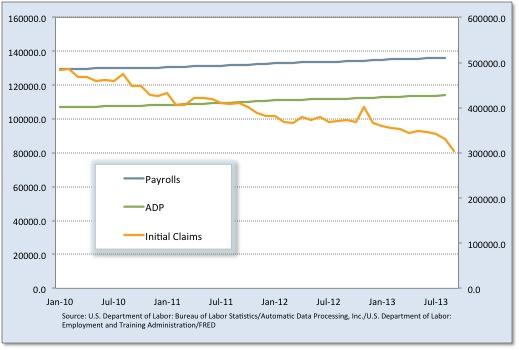

So, the first half of the week would be dominated by the US fiscal debate headlines and the ECB’s monthly meeting, all preceding the biggest event in the FX markets: the Non farm Payrolls. Prior estimates expect the US economy to have created 179K jobs in the month of September and the unemployment rate to stayed put at 7.3%, and thus giving traders more reason to believe that a tapering of QE before year-end is still feasible, thus adding buying interest to the greenback.

In the technical camp, the pair closed the week just slightly below it opened, although keeping the area of 1.3520/30. The likeliness of a visit to ytd highs beyond 1.3700 remains alive as long as the pair quickly leaves behind the developments in Italy and the US fiscal gridlock unwind favourably. Then it will come the US Payrolls, where a decent read has the potential to drag the pair lower via a stronger greenback. The first support area would be the 23.6% Fibonacci retracement of Feb-Apr slide at 1.3340/45, reinforced by the vicinity of the 21-day moving average around 1.3350 followed by the 1.3315/00 area (55-day moving average and psychological level). If further selling pressure sharpens, then the 1.3230/1.3170 region (38.2% retracement, 100- and 200-day moving average) should provide decent support.

…

Back to Italy, although this time from another angle… the ‘aperitivo’ angle, to be more precise. One of the things I miss (cherish?) the most from my days in Italy was that particular time of the day, call it midday or after-office, when people use to gather in bars to enjoy the ‘aperitivo’. One of the drinks I use to make at home in an attempt to remember those days is called Cinquecento. Here we go: 45 ml of vodka (your favourite will do it, I will stick to the Russian Stolichnaya), 15 ml Benedictine, 15 ml Campari, 25 ml grapefruit juice, couple of dashes of Angostura bitters. Shake it well. I prefer single strain into a wine goblet. Grapefruit zest as garnish. Enjoy! Have a great trading week!

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.