EURGBP started last week at 0.86569 to consistently fall over the course of the week to a most recent low of 0.84844 last Thursday. Since then, however, price has stabilized within a range between 0.85800 and 0.84800 over the past four trading sessions. Sterling has benefitted from economic data that has not been as bad as expected especially regarding retail sales, as well as last week’s employment data.

The rest of this week sees various data to be released for both currencies; of particular importance will be the Consumer Price Index for the Euro area. This number will be released tomorrow at 10am; market consensus is for an increase of 0.3% compared to last month’s release at 0.2%. Unemployment data is also expected at the same time and forecasts are for a small decrease to 10.0% from last month’s 10.1%.

This data will be extremely important to gauge how well the European Central Bank’s stimulus program is helping the economy, which in turn may give indications as to how much more liquidity or for how much longer the stimulus program will run.

Also, on Thursday there will be data released for the Euro area, at 9am, and the UK, at 9:30am, for the Purchasing Managers Index, an important measure of economic activity.

If you think that volatility for this pair will increase over the next week then all you need to do is Buy a Straddle strategy, which consists of simultaneously buying a Call option and a Put option with the same strike, expiry and amount.

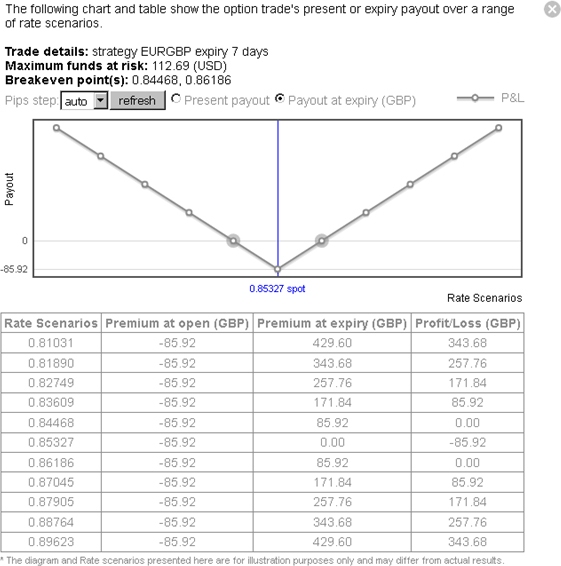

The screenshot below shows a EURGBP Buy Straddle with a strike of 0.85314, 7 day expiry and for €10,000 would cost $112.70, which would also be the maximum risk.

This screenshot shows the profit and loss profile of the above EURGBP Buy Straddle, just click on the Scenarios button.

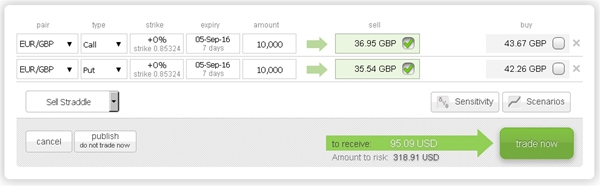

On the other hand, if you think volatility will stay flat or decrease over the next week then all you need to do is Sell a Straddle strategy, which consists of simultaneously selling a Call and a Put option with the same strike, expiry and amount.

The screenshot below shows a EURGBP Sell Straddle, with a strike of 0.85324, 7 day expiry and for €10,000 would generate $95.09 in revenue, with a total risk of $318.91.

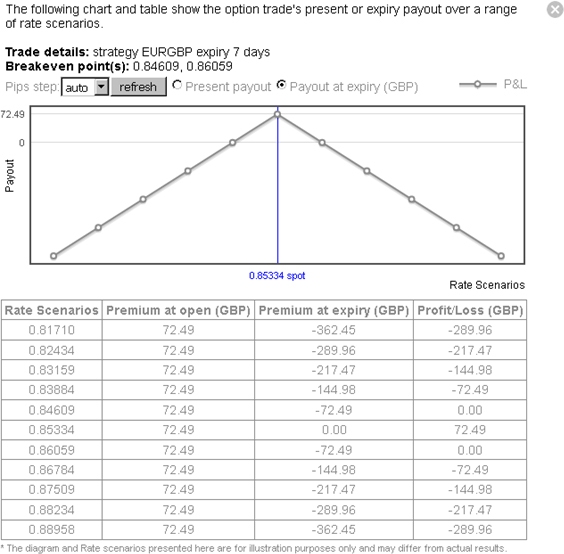

This screenshot shows the profit and loss profile of the above EURGBP Sell Straddle.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

EUR/USD alternates gains with losses near 1.0720 post-US PCE

The bullish tone in the Greenback motivates EUR/USD to maintain its daily range in the low 1.070s in the wake of firmer-than-estimated US inflation data measured by the PCE.

GBP/USD clings to gains just above 1.2500 on US PCE

GBP/USD keeps its uptrend unchanged and navigates the area beyond 1.2500 the figure amidst slight gains in the US Dollar following the release of US inflation tracked by the PCE.

Gold keeps its daily gains near $2,350 following US inflation

Gold prices maintain their constructive bias around $2,350 after US inflation data gauged by the PCE surpassed consensus in March and US yields trade with slight losses following recent peaks.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.