Crude

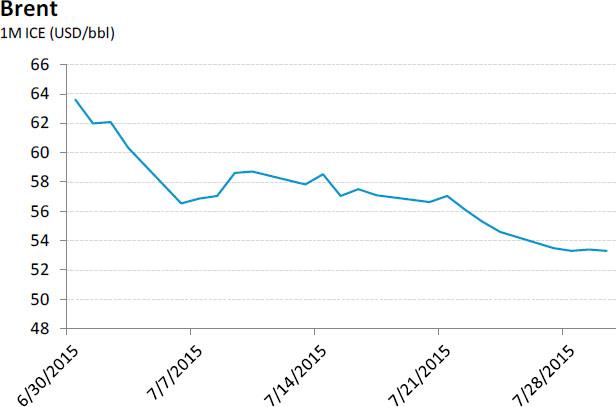

Although being set to decline in the fifth consecutive week, the oil price seems to have stabilized in recent days as the price of the front-month contract on Brent mostly remained in a relatively narrow two dollar band. Although US data on crude and products inventories unveiled that crude inventories fell quite sharply last week, the support for oil prices was eventually only limited. As regards the impact of yesterday’s US GDP estimate, a somehow mixed report rather weighed on prices, mainly via the strengthening US dollar.

Regarding the comments of OPEC Secretary General Badri, though he provided a relatively optimistic view of the market due to expectations of rising oil prices, his comments also suggested that the OPEC is likely to maintain its current policy of high oil production. This represents a negative risk for the oil price for the following quarters, especially due to the possibility of higher oil production in Iran.

Metals

With concern about an official rate hike in the US and in particular about the slow growth of Chinese demand, the price of copper has fallen to its lowest level since the crisis year of 2009. Although we anticipate a significant year-on-year decline in copper prices this year, we consider July’s fall as too strong, and therefore the price of copper might tend to grow in the months to come.

We believe that the affect of the drop in China’s stock markets on the real economy and consequently on demand for copper, will not be very strong. In addition, data for nearly the entire first half of the year indicates a deceleration of growth in the production of refined copper (compared to the end of last year), and thus the final market balance may be a lower surplus than we expected. On the other hand, the risks of our forecast are skewed towards a price decline.

Chart of the day:

Although being set to decline in the fifth consecutive week, the oil price seems to have stabilized in recent days...

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.