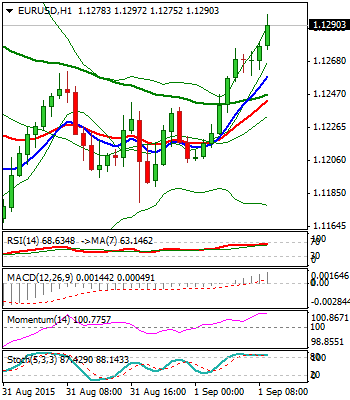

The Euro resumes recovery from near-term base at 1.1154, extending above yesterday’s high at 1.1261, where daily 10EMA capped the action. The pair approaches next layer of strong resistances at 1.13 zone, psychological barrier and 200SMA. Sustained break here is required to confirm recovery and trigger extension towards next pivot at 1.1367, Fibonacci 38.2% of 1.1712/1.1154 downleg. Positively aligned near-term technicals and bullish daily studies, are supportive. Reversing daily slow Stochastic in oversold zone, requires break into positive territory, to generate bullish signal for fresh recovery extension. Yesterday’s high at 1.1261, offers initial support, ahead of daily low at 1.1206 and rising daily 20SMA that underpins at 1.1272, guarding breakpoint at 1.1154/36, higher base / daily Ichimoku cloud top.

Res: 1.1308; 1.1367; 1.1387; 1.1433

Sup: 1.1261; 1.1206; 1.1172; 1.1154

GBPUSD

Cable trades in near-term consolidative range, entrenched between 1.5333, 28 Aug fresh low, which was retested yesterday and 1.5434, range’s top. Choppy near-term trading, with yesterday’s close in red and below 200 SMA, keep the downside under pressure, but signal hesitation ahead of key short-term support at 1.5327, low of 08 July. Daily studies are bearish and favor further downside, however, prolonged consolidation could be expected, ahead of final push through 1.5327 breakpoint, to trigger further retracement of larger 1.4563/1.5928, Apr/June rally. Peaks of yesterday / Friday at 1.5434/41, marks initial resistances and sustained break here would sideline immediate downside risk, in favor of stronger correction of 1.5816/1.5336 downleg.

Res: 1.5441; 1.5487; 1.5518; 1.5548

Sup: 1.5365; 1.5333; 1.5327; 1.5300

USDJPY

The pair came at the back foot, following recovery stall on approach to 121.78, Fibonacci 61.8% target and subsequent easing that made yesterday’s close in red. Fresh bearish extension, seen today, with probe below 200SMA at 120.74, tested initial support at 120.34, Fibonacci 23.6% of 116.13/121.64 rally, so far. Near-term structure is weakening and sees risk of stronger corrective pullback, as daily studies are bearish. Next supports lay at 120.14, daily Tenkan-sen and 119.54, Fibonacci 38.2% of 116.13/121.64, with violation of the latter, to sideline near-term bulls off 116.13, 24 Aug low.

Res: 121.25; 121.64; 121.78; 122.01

Sup: 120.31; 120.14; 119.54; 118.89

AUDUSD

The pair remains in near-term choppy mode, moving sideways above fresh lows at 0.7068/36. Yesterday’s close in red that came after Friday’s Doji candle, increases downside pressure, with psychological 0.71 support being tested so far. Near-term studies are back to bearish mode and maintain the pressure, as overall structure remains bearish and favors final push through 0.7036, 24 Aug low, for attack at short-term target at psychological 0.7000 level. Initial resistance lies at 0.72 zone, last Friday’s recovery rejection, reinforced by falling daily 10SMA. Only break here would sideline downside threats and expose next pivotal barrier at 0.7279, falling daily 20SMA.

Res: 0.7151; 0.7200; 0.7248; 0.7279

Sup: 0.7080; 0.7068; 0.7036; 0.7000

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.