The Euro holds within consolidative range for almost one month, after bounce from fresh nearly 12-year low at 1.1096 was capped at 1.1532. The price remains entrenched within narrowed range of 1.1280/1.1450, with neutral near-term technicals and flat daily 10/20SMA’s / Tenkan-sen line and contracting 20d Bollingers, favoring further sideways trade. Initial support and range floor at 1.1280, guards more significant 1.1260 higher base and Fibonacci 61.8% retracement of 1.1096/1.1532 rally, loss of which is required to revive bears and signal acceleration of larger picture’s downtrend towards key 1.1096 support. Alternatively, violation of the range top at 1.1450 to expose pivotal 1.1532 barrier, for possible extended corrective action.

Res: 1.1387; 1.1400; 1.1428; 1.1450

Sup: 1.1334; 1.1300; 1.1287; 1.1260

GBPUSD

Cable remains supported and extended rally to a fresh 2-month high at 1.5551, after break and close above daily Ichimoku cloud top. Yesterday’s long green candle bullish signal, with price action approaching daily 100SMA at 1.5576, en-route towards pivotal 1.5618 lower top of 31 Dec 2014. Strong bullish setup of daily technicals, favors further upside, with rising 10SMA and Tenkan-sen line underpinning the action, however, overbought conditions of near-term studies, suggest correction before fresh attempt higher. Corrective easing should be ideally contained at 1.5470 zone, Fibonacci 38.2% of 1.5330/1.5551 upleg, also25 Feb trough and previous highs of 23/24 Feb, to keep bulls intact.

Res: 1.5551; 1.5576; 1.5585; 1.5618

Sup: 1.5500; 1.5470; 1.5430; 1.5400

USDJPY

The pair remains in near-term directionless mode, following false break above 119.40 barrier, consolidating around 119 handle. Tone of near-term studies remains neutral, as well as daily picture that shows price entrenched between sideways-moving Kijun-sen and Tenkan-sen lines, which mark initial support / resistance at 118.66 and 119.00. Support is also reinforced by ascending daily 20SMA and break here to expose pivotal support at 118.25, higher base and daily Ichimoku cloud top. On the upside, sustained break above 119.00 is required to shift focus higher, for renewed attempt through pivotal 119.40 barrier, break of which to signal resumption of recovery leg from 118.25 and open barriers at 120.00 and 120.46.

Res: 119.08; 119.40; 119.82; 120.00

Sup: 118.66; 118.25; 118.00; 117.71

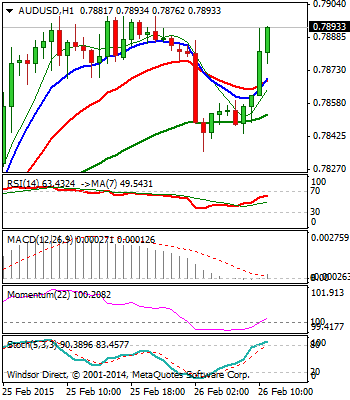

AUDUSD

The pair corrected rally that peaked at 0.7900 yesterday, where descending daily Kijun-sen line capped the acceleration. Corrective pullback found footstep at 0.7840 zone, near Fibonacci 38.2% retracement of 0.7738/0.7899 rally, seen as ideal reversal point. Support zone is reinforced by rising daily Tenkan-sen at 0.7820. Fresh recovery rally recovered the most of corrective pullback and shifted near-term focus higher again. Break above 0.7900 barrier to open immediate targets at psychological 0.8000 barrier and 0.8023, lower top of 28 Jan, ahead of 0.8071, Fibonacci 38.2% of 0.8794/0.7624 descend. Only close below daily 20SMA at 0.7800 would undermine near-term bulls.

Res: 0.7900; 0.7950; 0.8000; 0.8023

Sup: 0.7860; 0.7837; 0.7820; 0.7800

Recommended Content

Editors’ Picks

EUR/USD alternates gains with losses near 1.0720 post-US PCE

The bullish tone in the Greenback motivates EUR/USD to maintain its daily range in the low 1.070s in the wake of firmer-than-estimated US inflation data measured by the PCE.

GBP/USD clings to gains just above 1.2500 on US PCE

GBP/USD keeps its uptrend unchanged and navigates the area beyond 1.2500 the figure amidst slight gains in the US Dollar following the release of US inflation tracked by the PCE.

Gold keeps its daily gains near $2,350 following US inflation

Gold prices maintain their constructive bias around $2,350 after US inflation data gauged by the PCE surpassed consensus in March and US yields trade with slight losses following recent peaks.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.