The Euro holds below last Friday’s fresh recovery high, with positive near-term tone and Friday’s ticks higher, marking positive daily close, after the price broke above bear-trendline, drawn from 1.2987 high. Immediate price action, however, lacked momentum for further upside, despite gap-higher opening, as gains were pared after failure to clear last week’s high, which is ticks away from 05 Sep pivotal 1.2987 high. Friday’s closing level, also 38.2% retracement of 1.2907/1.2977 upleg, offers so far good resistance, above which fresh attempts towards 1.2987/1.3000 barriers, are expected to commence and confirm near-term recovery resumption on a break higher. Alternatively, loss of 1.2950 handle and broken bear-trendline at 1.2938, as well as 1.2930, bull-trendline, drawn off 1.2858 low / Fibonacci 38.2% of 1.2858/1.2977 upleg, would soften near-term tone and look for fresh retracement of near-term corrective rally.

Res: 1.2948; 1.2967; 1.2977; 1.2987

Sup: 1.2930; 1.2900; 1.2882; 1.2872

GBPUSD

Near-term price action trades in consolidative mode, with 1.62 support holding the downside, while fresh recovery peak at 1.6275, also daily Tenkan-sen line, caps for now. This keeps psychological 1.63 barrier and previous week’s closing level and the upper limit of 08 Sep opening gap, intact. Near-term studies are neutral/positive and unless 1.63 hurdle is taken out, which would allow for stronger recovery and confirm near-term bottom, risk will remain at the downside, as overall picture remains negative and fundamentals are putting additional pressure on Sterling.

Res: 1.6275; 1.6300; 1.6338; 1.6357

Sup: 1.6200; 1.6184; 1.6155; 1.6123

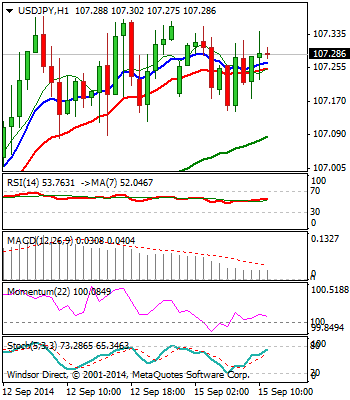

USDJPY

The pair remains positive and closed above 107 handle, with weekly chart showing long green candle, which confirms overall bulls and further attempts towards 108/110, next target zone. Near-term price action holds in narrow-range, consolidative mode, with 107.00 offering initial support, ahead of 106.50. On the upside, 107.50 is initial barrier, ahead of 108.28, Fibonacci 161.8% projection of the upleg from 100.81.

Res: 107.50; 108.00; 108.28; 109.00

Sup: 107.00; 106.50; 106.00; 105.70

AUDUSD

The pair maintains negative tone, with additional pressure seen on weekly gap-lower opening, which brought the price below psychological 0.90 support. Long red previous week’s candle and retracement of 61.8% of 0.8658/0.9503 ascend, seen so far, supports the notion of further weakness and potential attempts to fully retrace 0.8658/0.9503 rally. Corrective rallies are for now expected in light mode, with session highs at 0.9015, offering initial barrier, ahead of last week’s closing levels at 0.9040, where the next strong resistance lies.

Res: 0.9000; 0.9015; 0.9040; 0.9071

Sup: 0.8980; 0.8950; 0.8923; 0.8900

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.