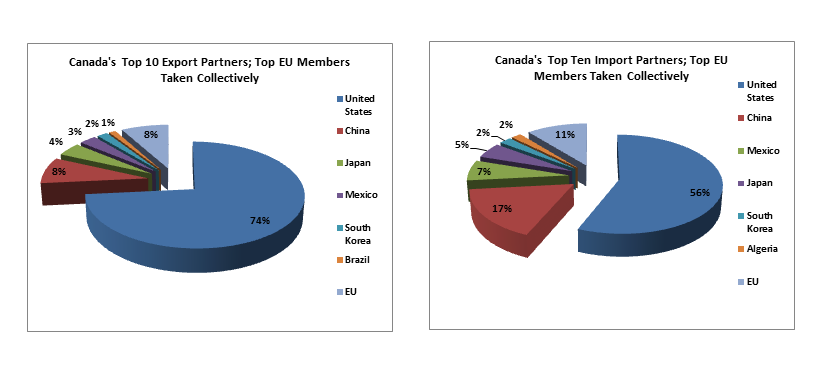

Canada’s second and third trade partners are China, at nearly 7% of all exports and Japan at 3.55% of all exports. EU members in the top ten taken collectively account for about 8% of all exports. It’s important to note that the three Asia-Pacific nations listed currently account for approximately 14% of Canada’s exports.

Similarly, Canada’s biggest import partner is the United States accounting for over 45% of imports, followed by China at 13.665 and fellow NAFTA partner, Mexico, third at 5.43% and Japan at 4.07%. When taken collectively, the EU accounts for about 11% of Canadian imports and the top Asia-Pacific nations account for nearly 20% of imports.

Are common strategic or cyclically sensitive commodities or goods exchanged between the EU and Canada? Indeed, there are. These are mostly Crude or Refined Petroleum, Copper, Iron, Aluminum, Nickel, Titanium Ferroalloys and precious and industrial metal scraps and residues. When taken into account along with the commodity excesses in the Asia-Pacific region, Canada’s commodity export trade is bound to weigh on the Canadian economy to a significant degree, even if offset by a reasonably strong US economy.

It’s necessary to turn attention to events in the Asia-Pacific region, in particular, the global asset markets corrections initiated by a sudden deterioration in China’s growth expectations and the devaluation of the Yuan which in turn drove industrial commodity prices lower. The initial reaction was a ‘flight to quality trade’ which strengthened the Euro against other majors. Of particular note is the strengthening of the Euro vs the US Dollar. Because of the close economic and strategic relation between the US and Canada, Canadian dollar trading bears great similarity to US Dollar trading, which is clearly demonstrated in the YTD log chart.

The Canadian dollar has steadily weakened against the Euro since the beginning of April, which coincides with the decline of commodity prices, whereas the USD has traded in a steady channel, which had, in fact, narrowed from about June until the recent global market correction. This seems to indicate stabilization in the Eurozone in spite of the impasse between Greece and the European Commission. Although the Canadian Dollar steadily weakened as the US Dollar remained in a steady channel, there is an unmistakable similarity in the pattern, best exemplified towards the recent reaction to the China devaluation and subsequent asset market readjustments. It’s also worth noting that the tightening of the EUR/USD channel began around the same time EUR/CAD began to weaken.

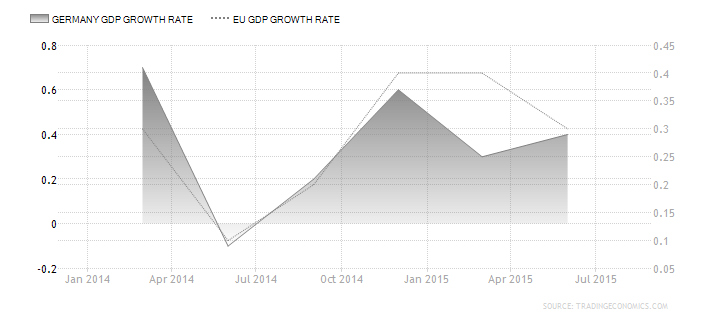

On 6 April, Bank of Canada Governor Poloz bluntly stated that growth for the remainder of 2015 would be “atrocious”. Although criticized for his ‘wording’, it seems to have proved prophetic. On the other hand, on 5 May the European Commission announced a stabilization of the overall EU economy and increased GDP expectation to 1.5% from 1.3%. Commissioner Pierre Moscovici noted that “...The European economy is enjoying its brightest spring in several years, with the upturn supported by both external factors and policy measures that are beginning to bear fruit...”ii Germany expected 1.9% full year GDP as well as 2% in 2016. It should be noted that Germany is one of Canada’s top trade partners and importer of petroleum as well as Gas Turbines, Iron Ore, Copper Ore, Nickel, Aluminum, Transmissions, Aircraft Parts and Refined Petroleum. Lastly, it’s important to note that Germany ranks 4th behind Japan with a £2.17 trillion economy.

When taking both the US and EU into account, it adds up to about 70% of Canada’s top ten export market whereas about 14% of those top ten account for the Asia-Pacific export market. Hence, as long as the US, UK, Germany and the EUi grow at a moderate pace, Canada will lag, but growth may be far less than ‘atrocious’.

The BOC may have no other choice than to keep the Loonie weak in order to compete with the large oversupply of just about every industrial commodity and the nations which produce them. When viewed as vectors pulling on a central point the magnitude and direction of demand from US and European trade partners, it far exceeds the magnitude of the weaker Asia-Pacific market and in the opposite direction. It’s not unreasonable then to expect the Canadian dollar, with its 0.50% overnight rate, to continue to parallel the US Dollar and revert at least back to the mean vs the Euro once market readjust to reduced global growth expectations.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.