Hence, here are two, almost completely disconnected economies, both exporters and both trying to weaken their currencies. The question then becomes which of the two will have greater success?

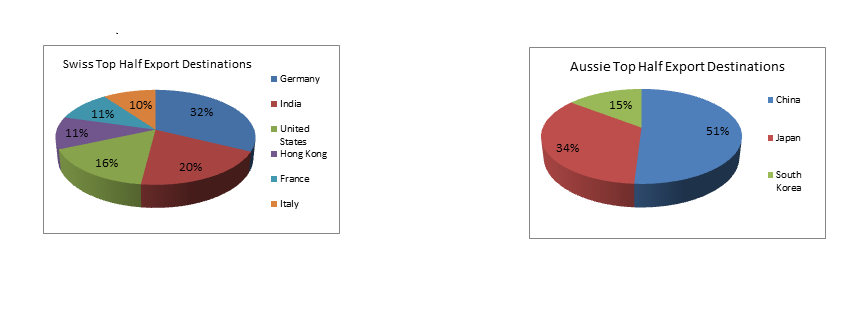

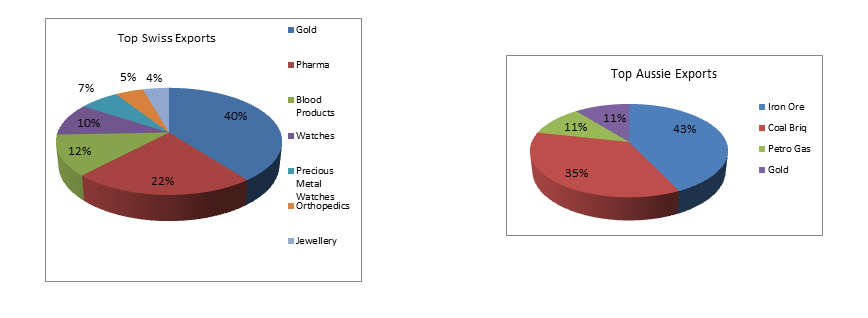

The EU and the Asia-Pacific region combined account for over 80% of the Swiss export market. However, China is not in that top half of all Swiss exports. It ranks #8 in the list accounting for only 3.30% of all Swiss exports. On the other hand, China accounts for more than 50%, of the top half of all Aussie exports. So much for market share. What then of products?

The above charts demonstrate that Switzerland and Australia do not compete over export products, to say the very least.

The Swiss National Bank wasn’t through rocking FX markets when Vice-Chair Jean Pierre Danthine told the press that, “...Giving up the cap means a tightening of monetary policy. We accept this, but only up to a point. We are fundamentally prepared to intervene in the foreign exchange marketi...”

The next day the Reserve Bank New Zealand officially abandoned its tightening bias in response to the potential of negative annual inflation. China is New Zealand’s second biggest export market after Australia. Economists were expecting the Reserve Bank of Australia to follow the RBNZ, particularly in reaction to slowing metal ore demand from Chinaii. The Franc weakened against the Aussie by nearly 3.58% in two trading sessions. Rumors continued to weaken the Franc in Europe. AUD/CHF seemed to stabilize between 0.723 support to 0.7252 resistance for about a month following the SNB decoupling action. On 3 February, the RBA did indeed reduce its benchmark cash rate by 25 basis points to a record low 2.25%.

AUD/CHF convincingly broke 61.8% resistance level, 0.7253 on SNB Chair Thomas Jordan’s remarkiii that the Swiss Franc, “... is still trading at a significantly overvalued level ...” This, perhaps initiated the strong AUD/CHF upward trend to the six month high of 0.77444, a 12.73% gain in six weeks. It should be noted that to this point the Swiss benchmark overnight deposit was already negative at -0.75% whereas, the equivalent Aussie cash rate was well positive at 2.25%. In other words Switzerland was in a strong deflationary trend whereas the Australian economy was, at best, dis-inflating. There was one other factor affecting RBA rate decisions. Housing prices were rapidly inflating in Australia causing concerns of a potential asset bubbleiv.

Concerns over this dilemma for the RBA became clear to the 2 March meeting at which the RBA stated that further rate cuts were needed, but held the cash rate at 2.25%. It’s worth noting at this point that the SNB’s hand was being forced by events in the Eurozone in order to defend the Franc. Similarly, inflating housing prices most likely forced the hand of the RBA to maintain the cash rate at 2.25%. The result was a 300 basis point spread between the respective benchmark rates, driving AUD/CHF to the six month high. At the 19 March policy meeting the SNB decided to maintain its -0.75% deposit rate, negative LIBOR and once again expressed concerns over the too strong Franc.

The Aussie dollar weakening corresponded with the global sovereign bond correction and in anticipation of a rate cut at the April policy meeting. At that meeting, contrary to expectations, the RBA decided to hold the cash rate at 2.25% and express the need for future rate reductions. Clearly, the RBA had to strike a balance between slowing commodity demand and inflated housing prices. Consequently, the Aussie strengthened, testing resistance at 0.7547 AUD/CHF. During this period, the SNB firmly held its negative interest rate policy. The RBA made good on its promise to reduce the cashv rate 25 basis points to 2.00% at the May meeting. The differential with the SNB deposit rate was still a hefty 275 basis points. AUD/CHF traded between 0.7343 support and 0.7434 for the month of May.

China’s influence on the Aussie economy is demonstrated in the broken 61.8% retracement level when the Shanghai Composite collapsed and the PBOC seemed powerless to stop it. At the 2 June policy meeting, the RBA dug in its heels and held the cash rate at 2.00%. At the SNB policy meeting, Chair Jordan expressed optimism that the negative policy rate would correct the imbalance ‘over time’ and that ‘there was no easy fix’. The SNB maintainedvi at -0.75%. This trading pattern continued, AUD/CHF in a range with support: 0.7124, resistance: 0.7253 for the remainder of June.

The pattern continued for the RBA at the 6 July meeting: holding firm on the cash rate, indicating future rate cuts. China’s stock market had by this time imploded with all out PBOC intervention and in Europe, the Greek parliament approved a plan to resolve the crisis.

The point of the entire sage is that the Swiss and Aussie export economies do not compete. Their largest export markets are experiencing severe macro-economic events. The Swiss rates seem to have bottomed out, but the Eurozone ties their hands. The RBA is far from bottoming out. The SNB has publically stated that it will maintain current rates and let the market correct over time, intervening further if necessary. The RBA is in a tough spot with falling export demand and a potential domestic asset bubble.

It’s not unreasonable to conclude that a slowing Aussie economy will cool the housing market. That done, the RBA will have a lot more flexibility to reduce rates further. On the other hand, the SNB has far less room to maneuver having a benchmark rate well below 0.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.