The last few days has seen the GBPUSD slowly edge back towards the key 1.68 level after moving to a multi-year high near 1.6850 within the last week however in the last 24 hours it has moved strongly back to resistance around 1.6850. The last month has seen a steady climb higher from a one month low below 1.65. About a month ago the resistance level at 1.6750 became important as the pound was struggling to make any break above it. This level eventually led the pound to fall to its one month low before the recent resurgence. The 1.6650 level also became important as it provided reasonable support during that period. Throughout the last couple of months the GBP/USD has received solid support from the key 1.66 level after it retraced strongly from the resistance level at 1.68.

In early February, the pound enjoyed a very healthy time moving well from the support level at 1.6250 through 1.6450 before pushing on to the then multi-year high above 1.680. In late January the pound fell sharply and experienced its worst one week fall this year which resulted in it moving to the six week low near the support level at 1.6250. Over the last few months the pound has established and traded within a trading range roughly around the key level of 1.6450, whilst moving down to support at 1.6250 and up to 1.66 and beyond.

The 1.66 level has become quite significant and has loomed large throughout this year providing some resistance to higher prices. This level has resurfaced again as one of significance and it is now providing solid support. In late November it did well to break through the long term resistance level at 1.6250 which had established itself as a level of significance over the last few months. This level continues to play a role in providing support. In early November, the pound bounced strongly off the support level at 1.59 to return back to above 1.6250.

Lending to businesses fell again in recent months but more mortgages were approved, fanning fears of a housing bubble and raising more concerns over the shape of the recovery. Bank of England data showed that lending to companies of all sizes fell in the three months to February on a year earlier despite calls by chancellor George Osborne for businesses to boost growth by investing more. However, there was some let-up in the pace of the fall in lending. The BoE's trends in lending report showed a £0.5bn drop in the three months to February after a £3.3bn annual drop in the preceding three months. The Bank said lending was down 2.1% in February on a year earlier and that much of that weakness was down to the role played by real estate businesses, where a rise in repayments had cut net lending to the sector. Excluding the real estate sector, net lending to businesses was virtually unchanged on a year ago, the Bank added.

(Daily chart / 4 hourly chart below)

GBP/USD April 23 at 00:50 GMT 1.6822 H: 1.6839 L: 1.6792

GBP/USD Technical

During the early hours of the Asian trading session on Wednesday, the GBP/USD is remaining steady around 1.6825 after pushing up through 1.68 in the last 24 hours. Current range: Trading right around 1.6825.

Further levels in both directions:

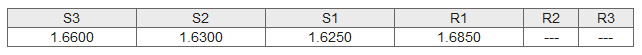

- Below: 1.6600, 1.6300, and 1.6250

- Above: 1.6850.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.