Rates

Uneventful session with slightly weaker US Treasuries

Global core bonds were narrowly mixed yesterday with the US underperforming Europe. German yields fell less than 1 bp across the curve. The US yield curve slightly bear steepened with yields between 1.8 and 3.6 bps higher. On intra‐EMU bond markets, 10‐yr yield spread changes versus Germany dropped up to 3 bps with Greece underperforming (+13 bps).

Initially a mild risk‐on climate pushed core bonds lower, as Asian stocks and commodities found their composure. In the afternoon session, Bund trading gradually morphed into some upside movement. Very weak US consumer confidence was a positive for bonds, but it was mitigated by a stronger Richmond Fed business survey and stronger equities. Today, the focus is on the FOMC meeting. The eco calendar only contains US pending home sales. They are forecast to have increased for a sixth consecutive month. The consensus is looking for a 0.9% M/M and 11.1% Y/Y rise in June We see risks for a downward surprise given the very strong data of the last few months.

No FOMC hints about timing liftoff

We expect no policy changes from the Fed. We still see the September meeting as the likely lift‐off. Ms. Yellen showed optimism on the economy and suggested that rates would be raised this year. She also sees still slack in the economy and labour market and cited global developments like Greece and China as concerns. Greece should now be off her list, but China is still a potential source of market distress. The timing of the lift‐off will be the main focal point of markets, but we don’t expect the statement to become more specific on this point. The FOMC is looking meeting by meeting whether they need to act and it makes little sense to prepare markets already now for an eventual September move. There will still be two full months of data before that key meeting. We are aware that a number of governors like Bullard, George and Williams, but also less outspoken Powell, Fisher and even Dudley marked the September meeting as a likely start of the tightening cycle, but giving today guidance towards that meeting remains unlikely. The Fed will evaluate the situation via the prism of the labour market and inflation data with some attention for the financial market conditions. The labour market is going in the right direction with the unemployment rate at 5.3% in June (from 5.5%), but a number of indicators suggest remaining slack.

Wages were flat in the previous payrolls report and while some other wage data (ECI) show an increase, the Fed probably wants more signs of accelerating wages. The economy is doing ok, but no euphoria. Consumer confidence fell sharply lower in July, June retail sales disappointed and business investment is lacklustre. On the inflation side, the most recent data were a shade below expectations and low or lower (core measures). The recent oil price decline suggests headline inflation will remain lower for longer. We agree with the Fed that inflation will move towards target in medium term, but various Fed governors are very sensitive to the current low inflation. We don’t want to sound negative, as we still believe in a September lift‐off, but psychologically the time doesn’t seem ripe yet to give guidance for the lift‐off. We doubt whether the statement will be more optimistic on growth and inflation than in June. We saw in recent weeks sometimes a bear flattening of the curve, but these trading days were few and so no consistent bear flattening has taken place, which would be the traditional signal that tightening is coming (much) closer.

Today: No changes expected from the Fed

Overnight, most Asian equity indices trade marginally positive with China underperforming (up to ‐1%). However, given recent volatility one might argue that calm returned to Chinese markets while commodity markets rebounded. The US Note future trades stable overnight, suggesting a neutral opening for the Bund.

Today’s only relevant trading item is the Fed decision. In the run‐up to the statement, after European closure, trading risks being dull and range bound. We don’t expect a policy change from the Fed, while also a verbal hint for a September rate hike is unlikely. We believe that such scenario is discounted by markets and shouldn’t leave a big stamp on trading. In case the Fed does flag a September hike (wildcard), US Treasuries will suffer with the front end of the curve underperforming. We hold our sell‐on‐up ticks approach for the US Note future around the recent highs (127‐23) based on our own September rate hike bet.

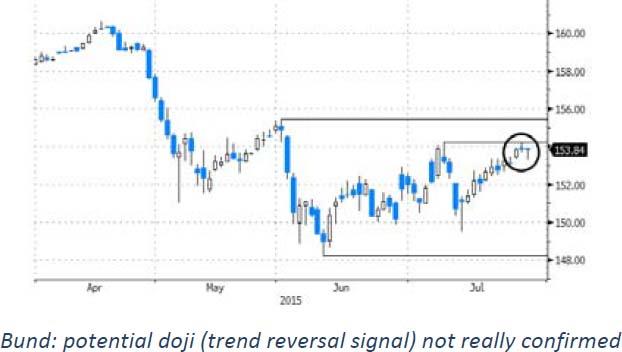

The technical picture of the German Bund showed a potential short term trend reversal signal (doji) on Monday. While we didn’t set a new high yesterday, the doji wasn’t really confirmed. Nevertheless, we’d still prefer to short the Bund around current levels for return action towards the lower bound of range.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.