On Monday, the dollar was under some slight downward pressure, but moves were insignificant from a technical point of view. It seems that, despite a few interesting news items, investors are largely sidelined awaiting the FOMC meeting that starts today. That keeps EUR/USD firmly in its sideways range. Investors shrugged off the AQR/stress test results. EUR/USD fell back on a very disappointing German IFO business sentiment report. In the afternoon session, it went up again on WSJ rumours on a possible decision of the FOMC to delay to end of QE as an appreciating dollar weighs on exports. However, once more resistance kicked in and the EUR/USD pair slid lower towards 1.27 in the close, a 30 pips daily gain. USD/JPY showed less volatility and fell consistently (but very gradually) throughout the session to close at 107.82 (108.16 prev)

Overnight, Asian equities trade rather uneventful near opening levels with the exception of China that gains about 1.5%, ending a 5 day losing streak. There is little news behind the gains though. Twitter disappointed markets with its results. UBS missed profit expectations on litigation charges. Sentiment on risk is fairly neutral at this stage, reflected in stable US Treasuries. FX main crosses are little changed too. EUR/USD changes hands around 1.2780; USD/JPY around 107.85.

Today, European eco data are few and second tier, limited to Italian business confidence. US data, durables, S&P house prices, consumer confidence and Richmond Fed survey ones are slightly more important, but we see outcomes mixed versus consensus. If confirmed, they would be neutral for Fx trading. Whatever, ahead of the FOMC decisions tomorrow, the data shouldn’t have too much impact. Regarding the FOMC meeting, we see the FOMC end its QE purchase programme, despite some earlier comments of St-Louis Fed Bullard who suggested that they could postpone the end of QE buying. We see no good reason for such postponement. Economic data were sufficiently strong since the previous FOMC with the unemployment rate also dropping to 5.9% and inflation broadly stabilizing. Finally, calm returned to markets. If we and most analysts are wrong on this point, the dollar should sell off. Secondly, what about the forward guidance. Most likely it will be kept at least until the December meeting when new forecasts are available and a press conference follows. An, albeit unlikely change in the forward guidance like replacing the considerable period of time phrase, would likely give the dollar a boost. It will be seen as a step closer to the rate lift-off. While we have a longer term dollar bullish view, we wouldn’t anticipate a resumption of the dollar rally on the FOMC decision. Most likely, the Fed will be steady as she goes keeping EUR/USD in its 1.25 to 1.2995 range. A weakening of the dollar toward 1.2995 is worth a dollar buy, as would be a break below 1.25. However, none of these is likely on the FOMC decision.

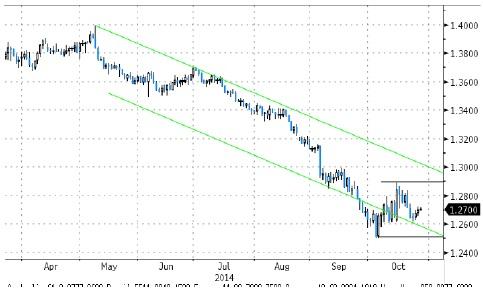

The technical picture of EUR/USD deteriorated after the break below the key 1.2662 support level (Nov 2012 low). We have a LT negative bias on EUR/USD. The trend is intact, but the price action over the last two weeks suggests that the market was too long USD. In the meantime, dollar overbought conditions have been worked off. The 1.2043/1.1877 support is the next LT target, but a drop below 1.25 is needed before the picture becomes again dollar bullish ST. A re-break above 1.2995 would be really significant and question longstanding EUR/USD downtrend. This is not our preferred scenario though.

Sterling little changed in absence of firm impetus

Yesterday, EUR/GBP followed the EUR/USD price profile till early afternoon trading. EUR/GBP fell in the morning session, following euro strength in the Asian session. A better than expected CBI retail sales report very temporarily helped EUR/GBP setting an intraday low at 0.7862, but finally the pair ended virtually unchanged (0.7877). Given the difference in eco releases between UK (stronger) and EMU (weaker), that’s a minor negative for sterling. Cable went higher in lockstep with EUR/USD in the afternoon trading (dollar weakness).

Overnight, sterling trades little changed versus dollar and euro. Late eve yesterday, BoE deputy governor and MPC member Shafik said she doesn’t see significant evidence of inflationary pressures and has set a high bar for raising rates. She sees mixed data, but looks to wages and unit labour costs as the most important once. Shafik is since summer MPC member and voted always with the majority. Her comments won’t have a major impact on sterling trading.

Today, the UK eco calendar is empty and the EMU one unattractive. Therefore, the EUR/GBP direction will be set by the overall sentiment and by EUR/USD in particular. So, sideways trading looks most likely. Of late, we had a sell-on upticks approach for EUR/GBP. We maintain the view that the trend in EUR/GBP stays downward longer term. Short-term, the trend shows some signs of fatigue. The 0.7850/0.7755 is a tough support, key resistance stands around 0.8066. We take a more neutral approach on the EUR/GBP cross rate short-term.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD alternates gains with losses near 1.0720 post-US PCE

The bullish tone in the Greenback motivates EUR/USD to maintain its daily range in the low 1.070s in the wake of firmer-than-estimated US inflation data measured by the PCE.

GBP/USD clings to gains just above 1.2500 on US PCE

GBP/USD keeps its uptrend unchanged and navigates the area beyond 1.2500 the figure amidst slight gains in the US Dollar following the release of US inflation tracked by the PCE.

Gold keeps its daily gains near $2,350 following US inflation

Gold prices maintain their constructive bias around $2,350 after US inflation data gauged by the PCE surpassed consensus in March and US yields trade with slight losses following recent peaks.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.