Dollar weak, euro weaker…

Yesterday, the news flow was euro negative. Low inflation in the UK and in Sweden, a poor ZEW investor confidence and weak EMU production data all weighed on the euro. EUR/USD dropped to the mid 1.26 area. Euro weakness rather than dollar strength was the name of the game. The dollar tried to regain the 107 level against yen as the equity sell-off slowed down.

Overnight, Asian equities show moderate gains, even as the price action in the US was disappointing. China price data, PPI and CPI, both came out slightly below the consensus respectively at -1.8% Y/Y and 1.6% Y/Y. So, Chinese authorities have a good reason to continue their policy of selective stimulus of the economy. EUR/USD is little changed in the 1.2640 area. USD/JPY is in slightly better shape, changing hands in the 107.25 area. Yesterday evening, Fitch put the AA+ rating of France on Rating Watch Negative. For now, this had no big impact on the single currency.

Later today, the focus will be on the US, with the retail sales, the Empire manufacturing survey and the PPI scheduled for release. We put the risk on the downside of consensus for the three indicators. Such an outcome could fuel market fears that the US economy might also be affected by a disinflationary slowdown, as is the case in many other countries. If so, markets will remain cautious to anticipate an ‘early’ normalisation of the Fed policy. In this respect, markets will also keep a close look at the Fed beige Book. The tone of the Beige book might still be constructive.

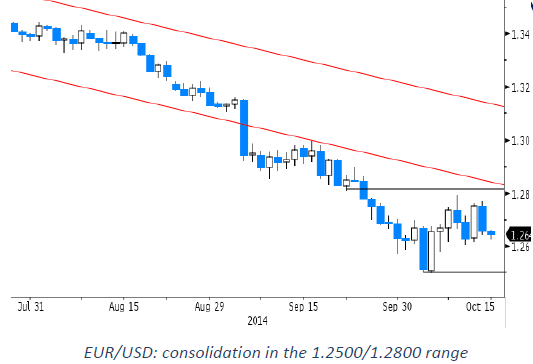

All in all, we don’t see much data support for the dollar. At the same time, (interest rate) markets have already discounted a lot of negative news. For now, markets also didn’t react much to a first set of decent earnings data in the US. If bond yields would bottom out, it could also improve the dollar sentiment. For now, this is nothing more than a hypothesis. For EUR/USD we expect further consolidation in the 1.25/1.28 sideways range. Despite risks from today’s data for the dollar, we still assume that the topside in EUR/USD is well protected. The picture for USD/JPY remains very fragile, but we also look out for a tentative bottoming out process. For the performance of the dollar overall we keep a very close eye at the 2-year US bond yield. How far will its rout go?

From a technical point of view, USD/JPY came close to the key 110.66 resistance, but the rally finally ran into resistance. The difference in monetary policy between the US and Japan should be supportive for USD/JPY longer term. However, short-term the pair is in correction modus. The reaction of USD/JPY (and of US bond yields) after the payrolls and after the Fed Minutes also suggests that the topside in USD/JPY is difficult short-term. Risk-off sentiment is a short-term negative, too. We stay on the side-lines and look for signs of a bottoming out.

The technical picture of EUR/USD deteriorated after the break below the key 1.2662 support level (Nov 2012 low). We have a LT negative bias on EUR/USD, but recently, we were a bit surprised by the fast pace of the EUR/USD decline. The trend is intact, but the price action last week suggests that the market was too long USD. It might take time for the pair to work through oversold conditions. The 1.2043/1.1877 support is the next LT target. The 1.2791 correction top is a first (tough?) resistance. We expect some more consolidation in the 1.2501/1.2791 range. Within this range a sell-on-upticks approach is preferred.

Weak (USD), weaker (Euro), weakest (sterling)!

Of late, sterling trading was mostly driven by global factors, but yesterday the UK data finally came to the forefront. UK CPI inflation dropped more than expected in September to 1.2%Y/Y. Core inflation declined from 1.9%Y/Y to 1.5% Y/Y. So, the BoE can take time to implement its policy normalisation. Sterling lost ground against the euro and the dollar. Especially cable was hit hard and set a new cycle low in the 1.59 area. EUR/GBP extended its gradual uptrend despite poor EMU eco data.

Today, sterling traders will get another piece of key economic information with the UK labour market report. The unemployment rate and employment data are expected to improve further, but expectations of wage growth remain moderate. We see a risk for slightly less buoyant activity data. If so, it could prologue the sterling correction. Over the previous months, low wage growth already weighted on sterling and this probably won’t change today. Sentiment on sterling is fragile and we don’t see a reason to row against the tide at this stage.

Strategy. Of late, we indicated that it might be difficult for EUR/GBP to break the key 0.7755 support. After the rebound of sterling and the soft comments from the BoE (minutes), investors are pondering the chances for further sterling gains. The focus for sterling trading should now return to the economic fundamentals and to the guidance from the BoE on policy normalization. We look for a more pronounced uptick to reconsider EUR/GBP shorts. However, for now we are not in a hurry as sterling momentum stays fragile. The breach above 0.79 is a further short-term negative for sterling.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.