On Tuesday, there was no important news to inspire EUR/USD or USD/JPY trading. In technical trade, the dollar lost some ground against the euro as short-term players locked in some profits on the recent rally. At the same time, the dollar maintained its gains against the yen even as equities were under moderate downward pressure. EUR/USD returned north of 1.29. USD/JPY held close to the cycle top in the 106.40 area.

Overnight, most Asian markets are in risk off mode. Japan is again outperforming with limited gains as USD/JPY set another correction top in the 106.50 area. BOJ’s Iwate was also remarkably positive on the Japanese economy. EUR/USD is holding north of 1.29. A risk-off context apparently can be a temporary positive for the low-yielding euro (carry trades).

Today, the eco calendar is again thin and devoid of market movers. So, trading could develop similar to yesterday. We keep a close eye at US interest rates and interest rate differentials. Yesterday, short-term differentials moved in favour of the dollar, while at the long end, bunds underperformed Treasuries. The rise in US short-term yields continues to support USD/JPY even as equities lose some ground. At the same time, the rise in short-term interest rate differentials didn’t prevent a correction higher in EUR/USD. This correction shouldn’t go far.

Nevertheless, it will be interesting to monitor the short-term price swings of the low-yielding euro in case of a more pronounced risk-off correction. Will we see some more yen-like behaviour of the single currency? The jury is still out. In a longer term perspective, we still expect rising interest rates to support the rise of the dollar against the euro.

From a technical point of view, USD/JPY confirmed the clearance of the key 105.44 resistance, opening the door for a new up-leg. The negative impact of the weak US payrolls was limited and short-lived. Better US data can still push the pair higher. At the same time, the yen remains in the defensive too, as markets see a decent chance of more BOJ easing down the road. We maintain a positive bias on USD/JPY. 110.66 is the next important resistance.

The technical picture of EUR/USD deteriorated substantially after Thursday’s break below the key 1.3105 level (Sept 2013 low). This level is now the new resistance that will be difficult to regain.

The negative deposit rate is a structural negative for the euro. In a longer term perspective, the EUR/USD downtrend is confirmed. 1.2755/1.2662 is the next key support. A more pronounced correction (EUR/USD rebound), is an opportunity to add to EUR/USD short exposure. The euro is currently working off oversold conditions.

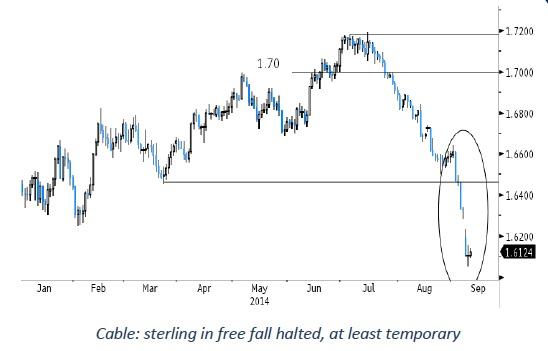

Sterling decline slows, at least temporary

Over the previous days, sterling was sold very aggressively. Investors reduced GBP positions as polls showed that the outcome of the referendum on Scottish independence is extremely uncertain and that a separation is possible. Yesterday, the sell-off slowed, at least temporary. The eco data and a speech from BoE’s governor Carney provided a good excuse for euro shorts to lock in short-term profits. Even so, the global picture for sterling hasn’t changed.

Overnight, cable is holding stable in the low 1.61 area. EUR/GBP tested again the 0.8036 resistance on the broader rebound of the euro, but the attempt failed again.

Later today, there are no important eco data on the agenda. This afternoon, BoE’s Carney and some of his colleagues will present the inflation rapport before the UK parliament. Of late, the BoE’s Carney turned a bit more positive on the economy and even on future wage growth. Normally, sterling should profit if he repeats this message today. Hoverer, even the prospects for the UK economy are highly dependent on the outcome of the referendum on Scottish independence. In case of a yes, uncertainty on the future UK eco performance will be high and probably also affect the BOE rate hike expectations/rate path. There will also be a lot of headlines from the visit of PM Cameron to Scotland to advocate the case of a no vote. It is however unlikely it will remove uncertainty on the issue. Yesterday, there was some consolidation on the recent decline of sterling. However, we don’t see a sustained rebound of sterling until the Scotland issue is out of the way. Don’t catch the falling (sterling) knife.

Uncertainty on the referendum after the recent opinion polls made us change our ST bias on sterling last week. There is a substantial risk that this issue will keep sterling investors side-lined until it is out of the way. We removed our sell-on-upticks bias for EUR/GBP and installed stop loss protection on GBP-longs (both against USD and EUR). The euro decline after the ECB decision last week didn’t change our view. We avoid sterling long exposure short-term.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.