Outlook:

Market players are clamoring for Yellen to confirm “rate hike this year” in her speech at the University of Massachusetts tonight at 5 pm. We might get a “buy on the rumor” effect although we are coming to the deduction that disappointment lies in store, again. At the beginning of the day, we have the Pope addressing Congress at 9 am. In a way, his comments so far mirror Bobby Jindal’s—the Republicans need to stop being the party of stupid. It was all Pope, all day yesterday. Chinese leader Xi’s Seattle shindig and speech was covered by exactly one TV channel—BBC America.

We get some actual data to chew on today, starting with weekly jobless claims. We also get durables, a choppy series that may make the GDP revision on Friday less than lovely. And we get new homes sales, forecast at an annual pace of 515,000 (from 403,000 in July last year).

Yesterday we had dueling comments from former Pimco bigshot Gross and Pimco itself. Gross said “Zero bound interest rates destroy the savings function of capitalism, which is a necessary and in fact synchronous component of investment. But the world’s central bankers are lost in a world of Taylor Rules and Phillips Curves, and obsessed with inflation. What they’re missing, he said, is that these policies “act as a weight or an economic ‘sinker’ that ultimately lowers economic growth as well.”

Bravo, Mr. Gross. He says companies are doing stupid things like borrowing not to invest, but to buy back their own stock. “The time has come for a new thesis that restores the savings function to developed economies that permit liability based business models to survive – if only on a shoestring – and that ultimately leads to rejuvenated private investment, which is the essence of a healthy economy.”

For its part, Pimco addressed the world at large in a “Cyclical Forum” paper, predicting better growth in Europe at 1.75% but the absence of inflation prodding the ECB into more and more long-lasting QE. It likes Italian and Spanish bonds but is underweight the euro. The UK will get good growth, too, 2.5% over the next year, but the BoE will wait until May to hike. China, meanwhile, will slow from 7% to 5.5-6.5%.

Worries about China are hard to judge. As we saw in August, the Shanghai crash and ham-fisted response scared the pants off traders around the world. The yuan devaluation was simultaneously brave and upsetting. Everybody worried about a hot money outflow and noted the drop in official reserves. Then a slew of analysts came out with soothing remarks, including the perspective that a 2% drop in growth is only to be expected in the grand cycle of development and it still leaves China growing at a decent pace. Even if growth is 5.5%, that’s still very, very good.

Ah, but is it good enough? Some traders are continuing to bet on a giant collapse in China as well as other EM’s. Brazil is the other biggie. The ratings downgrade and yesterday’s FX market intervention show that serious trouble could be brewing in Brazil that is potentially contagious. You don’t have to be an ancient mariner to remember the Asian crisis of 1997-98 that led to turmoil everywhere.

The message from Xi in Seattle is “send money.” He said China welcomes investment and will always allow foreign ownership of Chinese assets. Given the Commies’ penchant for expropriation, this is an important promise, if not entirely credible. Those who see a dark side to the invitation to foreign investors are not conspiracy fruitcakes, at least not all of them. China is over-indebted, especially in the state-owned enterprises. Nobody knows the extent of the non-performing loans to SOE’s, let alone the regional governments and private enterprises.

If China can substitute foreign investment for some of this debt, it may have a fighting chance at avoiding some massive bankruptcies. So far it is avoiding them by hiding the data and government support. The question is whether foreign investors see the game-plan and will ignore it for the chance, after decades, of getting a decent foothold in China. We have warning signs of some foreign companies already closing up shop, like Ford, but maybe there is always a greater fool beguiled by the magic of the world’s biggest population.

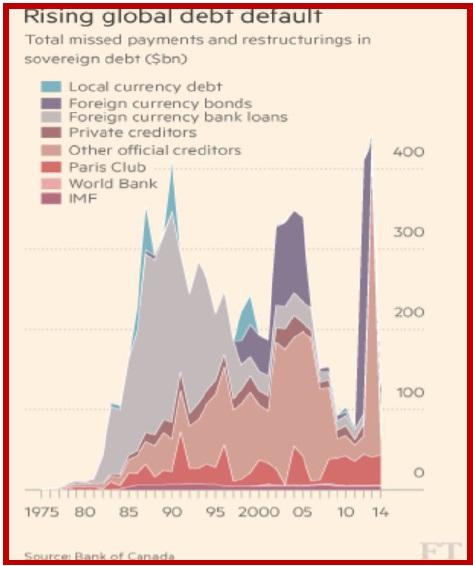

Earlier in September, the FT published an article about new research from the Bank of Canada showing the scary rise in defaults and missed payments by EM’s, this time including official sovereign entities. The authors say the frequency of defaults “may be increasing, and could be more closely correlated with rising public debt burdens than at any time since the 1930s.” A lot of it can be laid at the door of falling commodity prices. See the chart. The world is at a non-trivial risk of a new crisis.

This is the sense in which Brazil’s intervention and Xi’s seeking foreign investors are probably warning signs. We also have the South African rand and the Turkish lira at record lows against the dollar this morning, and let’s not forget Norway cutting rates and probably cutting more. This puts us back where we were a month ago—focusing on the Fed and China—but with perhaps a little more clarity. Does it mean a run into safe-haven assets? Yes, but starting at a walk. We hate to admit it, but normalization does not look near. That leaves a battle between dollar bulls (safe-haven) and dollar bears (ZIRP forever). The winner tends to be the euro, even if analysts continue to think more QE and for longer is in the cards.

| Current | Signal | Signal | Signal | |||

| Currency | Spot | Position | Strength | Date | Rate | Gain/Loss |

| USD/JPY | 119.90 | SHORT USD | WEAK | 08/25/15 | 119.60 | -0.25% |

| GBP/USD | 1.5269 | SHORT GBP | STRONG | 09/22/15 | 1.531 | 0.27% |

| EUR/USD | 1.1206 | SHORT EUR | WEAK | 09/22/15 | 1.1134 | -0.65% |

| EUR/JPY | 134.36 | SHORT EURO | WEAK | 09/22/15 | 133.8 | -0.42% |

| EUR/GBP | 0.7338 | LONG EURO | WEAK | 08/13/15 | 0.7117 | 3.11% |

| USD/CHF | 0.9757 | SHORT USD | WEAK | 09/18/15 | 0.9545 | -2.22% |

| USD/CAD | 1.3337 | LONG USD | WEAK | 06/30/15 | 1.2389 | 7.65% |

| NZD/USD | 0.6284 | SHORT NZD | STRONG | 08/25/15 | 0.6514 | 3.53% |

| AUD/USD | 0.6946 | SHORT AUD | NEW*STRONG | 09/24/15 | 0.6946 | 0.00% |

| AUD/JPY | 83.29 | SHORT AUD | WEAK | 06/29/15 | 94.04 | 11.43% |

| USD/MXN | 17.1453 | LONG USD | WEAK | 05/27/15 | 15.2944 | 12.10% |

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.