Outlook:

We are in a strange environment in which central banks are holding their cards close to their chests, leading to an excess of speculative ramblings. No bad news, as in the US data and eurozone flash CPI, is good news. It can be hard to remember that this is not so. As the FT puts it, the eurozone remains on the edge of deflation—we must not forget falling commodity prices.

What we really need is definitive news, not just news that doesn’t change the underlying bias. Today we get the employment cost index, sometimes an important number for the Fed. Market News, quoting Brown Brothers, notes that ECI has been on the rise, and is expected up 0.7-0.7% in Q2, or a y/y pace of 2.6%, the same as Q1 and the best since 2008. We say this belongs in the same category as “no bad news.” It doesn’t necessarily mean the Fed will suddenly become hot to trot in September. It’s an absence of drag rather than a boot in the rear.

Today is month-end but positioning for month-end was already done earlier this week. August is supposed to be a dull month with most of Europe supposedly on vacation, but we have not found August to be particularly calm. Thin, yes, but calm, no. And next week is going to be a doozy. We get both ISM reports, factory orders, vehicle sales, and the biggie, nonfarm payrolls (with the ADP private sector estimate on Wednesday).

Looming over everything is the Chinese equity debacle. As noted yesterday, fewer than 10% of Chinese actually engage in equities in any way, so sentiment will not change much or at all because of losses.

But confidence in the government is being damaged over and over again with each new initiative to control the market. It’s death by a thousand cuts. And the spillover is not trivial. The FT “Investors pulled a net $4.5bn from EM funds in the week through July 30, according to data from EPFR, compared with $3.3bn a week earlier. A total of $14.5bn has now been redeemed from EM funds over the past three weeks alone.

“Emerging Asian equities have borne the brunt of withdrawals, with the cumulative $12.1bn taken out over the past three weeks marking the swiftest exit from stocks in the region since the data set began in 2004, according to ANZ.” And China is a double whammy for emerging market currencies. They were long expected to fall out of favor because of expected rises in US yields, but now “Some EM currencies — notably the Malaysian ringgit and the Turkish lira — have also been hit by political uncertainty. Many currencies are now trading at or near 15-year lows against the dollar.”

“Of the $2.7bn in weekly fund withdrawals from Asia, $1bn came from domestic Chinese investors pulling cash from onshore exchange traded funds, which ….has the effect of exaggerating the global nature of the redemptions.”

On another front, major multinationals are starting to report disappointing results from China due to slowing growth. Nobody is saying out loud that the 7% rate is bilge, but the sales numbers say it. Names include the automakers (Audi and Ford, among others ), big industrial companies like United Technologies, Caterpillar and Siemens, and consumer companies (Anheuser-Busch), according to the FT. We keep saying the Fed doesn’t put much weight on external events like the Chinese equity meltdown, but if the meltdown is the tip of an iceberg, maybe we should all be getting out our compasses and calculators.

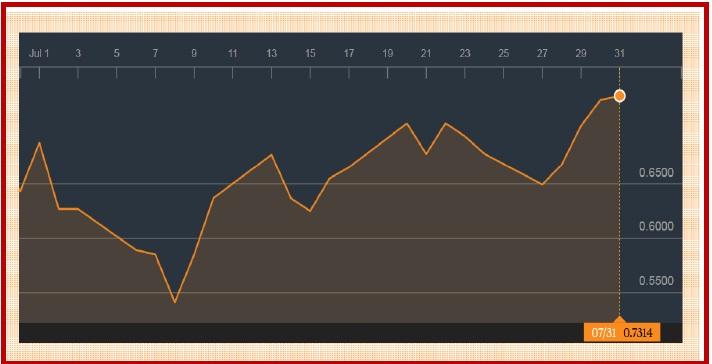

We could be in for a massive re-balancing out of the riskier stuff. That is dollar favorable and favorable for US assets, if not for the 10-year itself (higher demand, lower yields). It also has unhappy implications for “commodity currencies” like the AUD and CAD.

We will be off the grid for a week. What do we expect while we are gone? A stronger dollar, albeit with reluctance and not without game-playing and chops. Remember that the dollar usually rises in the few days before payrolls, but that may come after the usual Tuesday pullback after a big move the week before.

Remember: We will not publish any reports the week of Aug 3-7. Cape Cod beckons. Two-year note below.

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.