Briefly: In our opinion, speculative short positions are favored (with stop-loss at 2,210, and profit target at 2,050, S&P 500 index).

Our intraday outlook is now bearish, and our short-term outlook is bearish. Our medium-term outlook is now neutral, following S&P 500 index breakout above last year's all-time high:

Intraday outlook (next 24 hours): bearish

Short-term outlook (next 1-2 weeks): bearish

Medium-term outlook (next 1-3 months): neutral

Long-term outlook (next year): neutral

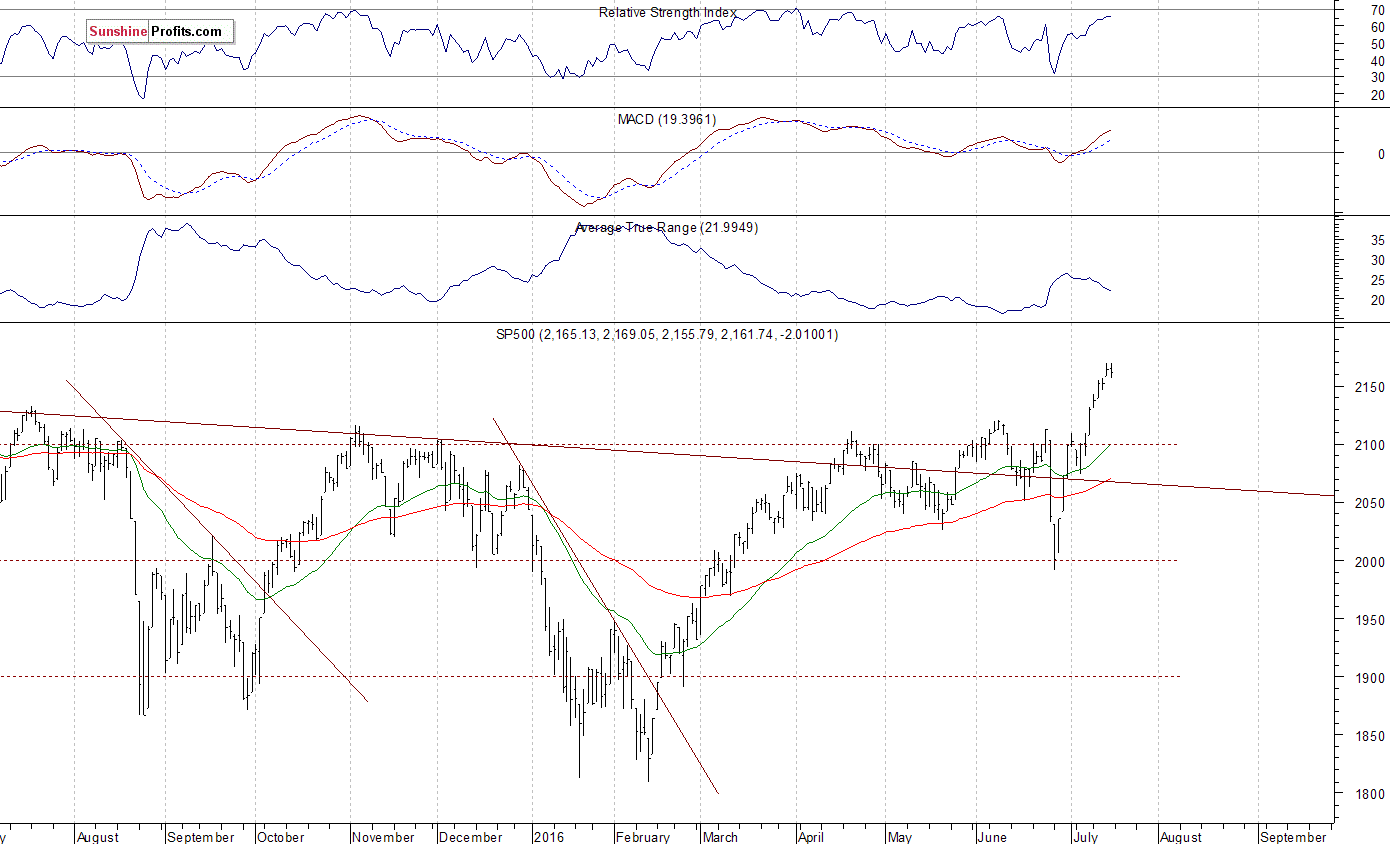

The U.S. stock market indexes were virtually flat on Friday, as investors hesitated following recent rally. The S&P 500 index has managed to reach yet another new all-time high at the level of 2,169.05. The nearest important level of support is at around 2,130-2,135, marked by previous level of resistance (S&P 500 index). The next important level of support is at around 2,100-2,120. On the other hand, potential level of resistance is at 2,200 mark. There have been no confirmed negative signals so far. However, we can see some short-term overbought conditions accompanied by negative technical divergences:

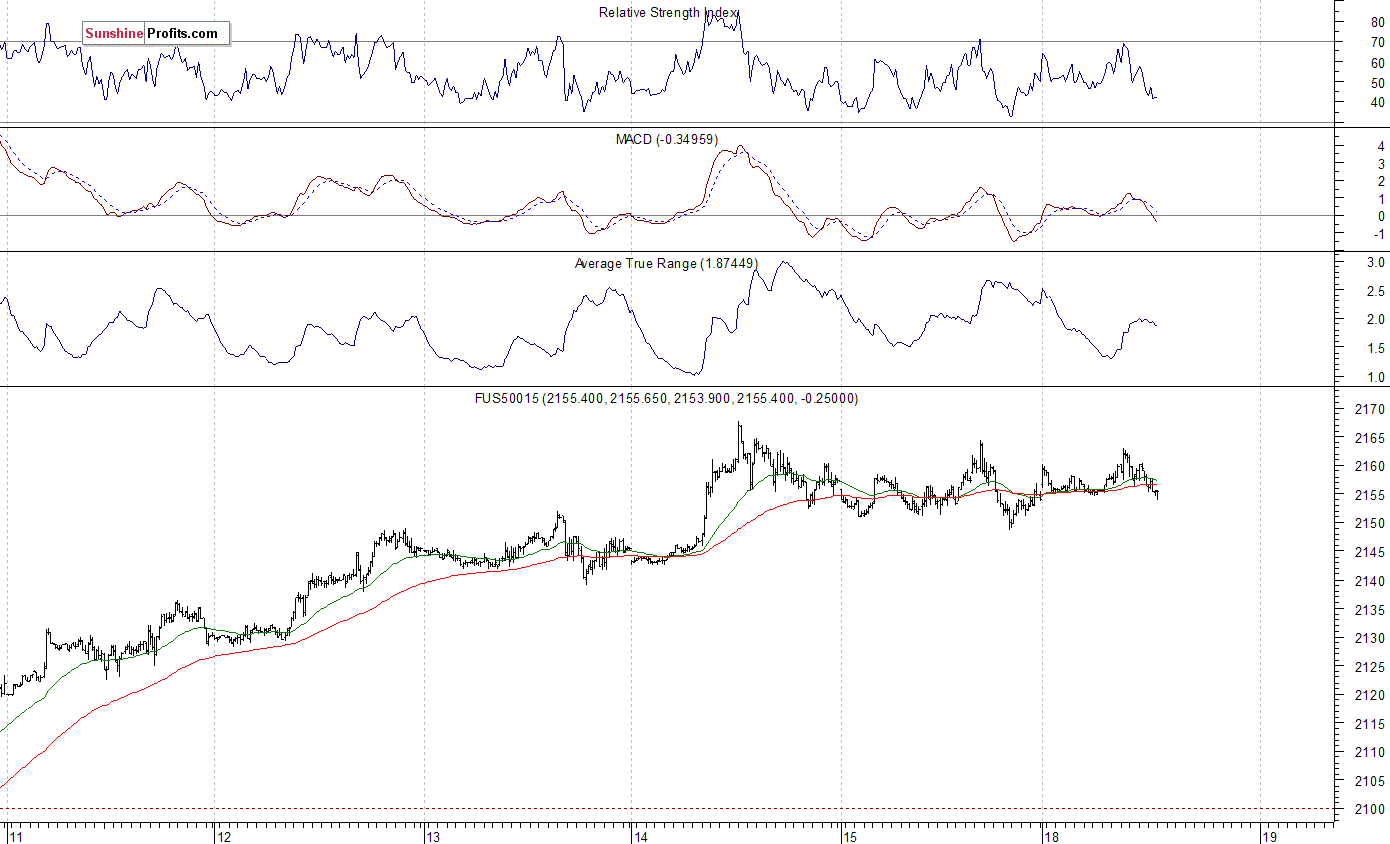

Expectations before the opening of today's trading session are virtually flat, with index futures currently up 0.1%. The European stock market indexes have been mixed so far. Investors will now wait for the NAHB Housing Market Index release at 10:00 a.m. The S&P 500 futures contract trades within an intraday consolidation, as it fluctuates along the level of 2,150-2,160. The nearest important level of resistance is at around 2,160-2,165, marked by recent all-time high. On the other hand, support level is at 2,150. There have been no confirmed negative signals so far. However, there are some technical overbought conditions, as we can see on the 15-minute chart:

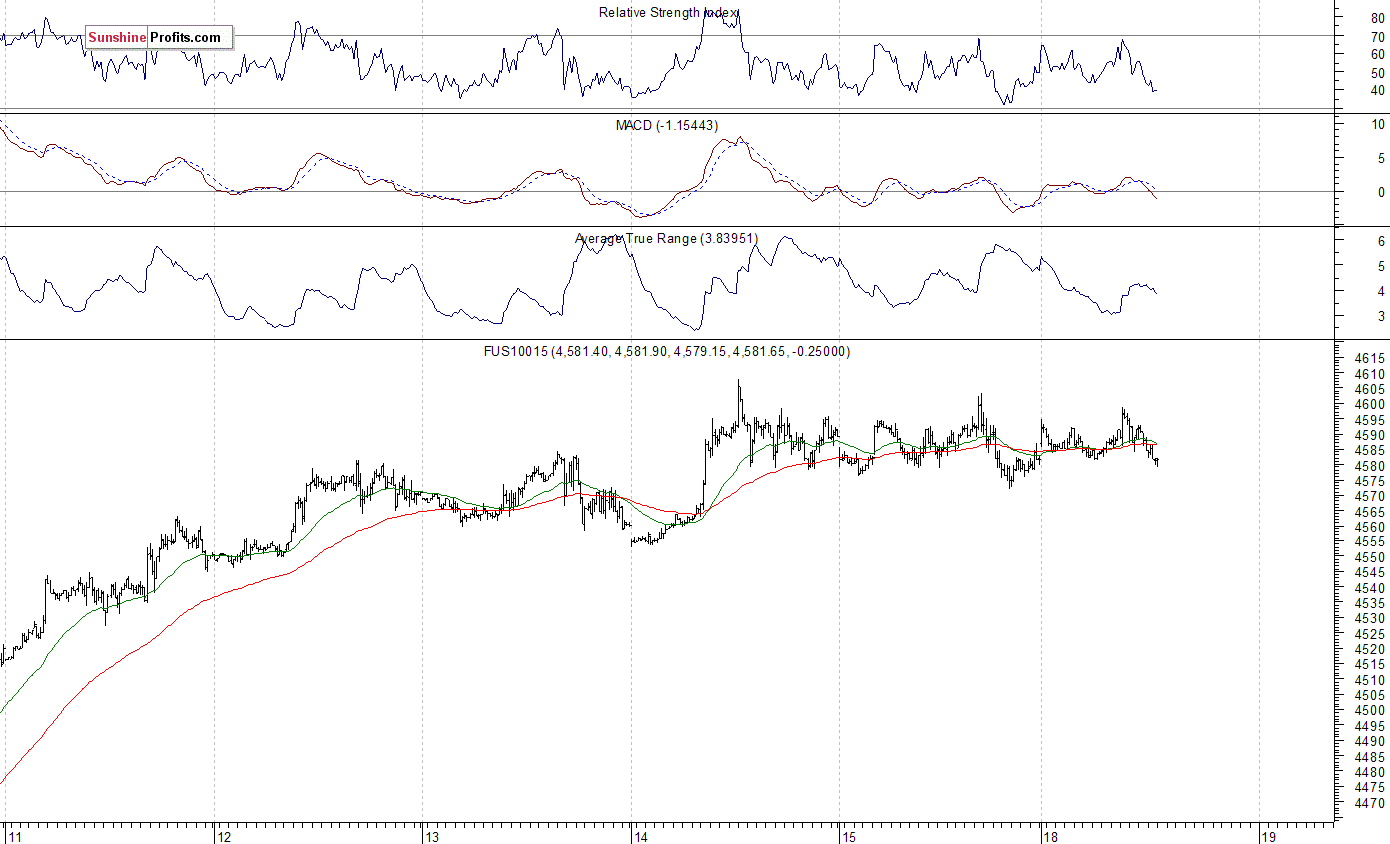

The technology Nasdaq 100 futures contract follows a similar path, as it currently trades within an intraday consolidation along the level of 4,580-4,600. The nearest important level of resistance is at around 4,600-4,610. On the other hand, support level remains at 4,550-4,570, marked by short-term consolidation, as the 15-minute chart shows:

Concluding, the broad stock market remains close to its all-time high, as the S&P 500 index continues to trade above 2,150 mark. We still can see short-term overbought conditions accompanied by bearish technical divergences. Therefore, we decided to open a speculative short position at the opening of today's cash market trading session (S&P 500 index). Stop-loss level is at 2,210 and potential profit target is at 2,050 (S&P 500 index). You can trade S&P 500 index using futures contracts (S&P 500 futures contract - SP, E-mini S&P 500 futures contract - ES) or an ETF like the SPDR S&P 500 ETF - SPY. It is always important to set some exit price level in case some events cause the price to move in the unlikely direction. Having safety measures in place helps limit potential losses while letting the gains grow.

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' employees and associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.