Light positioning is the Friday theme as the G-20 summit begins. Asian indexes are mostly lower, while European stocks rise ahead of the highly anticipated meeting between the Presidents of the world’s two largest economies. Price action with the bond markets suggest both leaders are expected to deliver a fresh trade truce that will not see any escalation in tariffs. Some of the more optimistic analysts are expecting details to be hashed out for a timeline on when to finalize a long-term deal.

For the markets to believe both sides are inching closer to a deal, we may need to see the US offer some concessions on Huawei and for the Chinese to agree to go through the legal process of delivering structural reform. China can offer more on SOE reform, eliminating government subsidies, further changes to IP, and greater access to their markets.

The presidents’ Saturday lunch meeting after the G20 summit in Osaka should see a reset in trade talks with both sides delivering some minor changes to their respective red lines.

Dow Futures are higher by 0.3%, while the S&P is up 0.2% and the Nasdaq is little changed. European indexes are also mostly positive, while Asian markets closed down on their day.

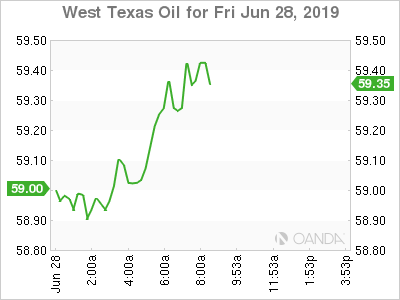

Oil

Crude prices remain stuck in tight ranges ahead of two big events, the Trump and Xi Saturday meeting and next week’s OPEC and allies decision on extending production cuts. A trade breakthrough could provide a nice surge for crude prices, as some global growth uncertainties will be alleviated. On the production side, it appears the oil-producing countries are keen on extending their production cuts till the end of the year. The question for OPEC will be what will they do in 2020 as US production is expected to continue to grow. Will the oil-producing cartel be willing to continue to give up global market share to the US? Next week’s OPEC meetings is likely to see the production cuts kept in place, but markets will start to doubt that they will be willing to continue them beyond that.

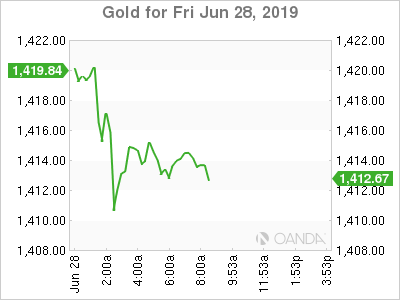

Gold

Gold traders may be skeptical holding positions going into this weekend. The Trump-Xi Saturday meeting will deliver the latest chapter in the US-China trade war. Positive progress could see the yellow metal slump 1% when trading resumes on Sunday night (Monday for Asia). A complete collapse in trade talks or even lack of substance behind a reset in trade talks could see fresh six-year highs.

Once we get beyond the G20, a wrath of fresh stimulus from the world’s largest central banks should provide a nice backdrop for higher gold prices once the G20 dust settles.

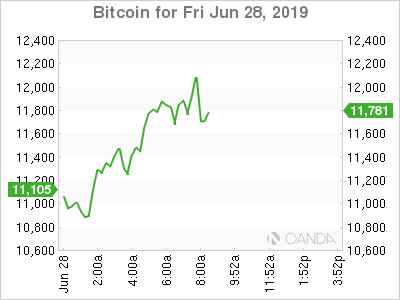

Bitcoin

Bitcoin volatility remains on ludicrous speed as yesterday’s $3,000 drop has seen Bitcoin optimists buy up the cryptocurrency and defend $10,000 level. Call it bubble-like or tulip-mania, it doesn’t matter, Bitcoin appears it is not going anywhere anytime soon. The main bullish catalysts for digital coins was the strong vote of confidence it got from institutional investors and as mainstream commerce interest was reinvigorated with Facebook’s launching of their stablecoin.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.