Briefly: In our opinion, speculative short positions are favored (with stop-loss at 2,030, and a profit target at 1,900, S&P 500 index)

Our intraday outlook is bearish, and our short-term outlook is bearish:

Intraday (next 24 hours) outlook: bearish

Short-term (next 1-2 weeks) outlook: bearish

Medium-term (next 1-3 months) outlook: neutral

Long-term outlook (next year): bullish

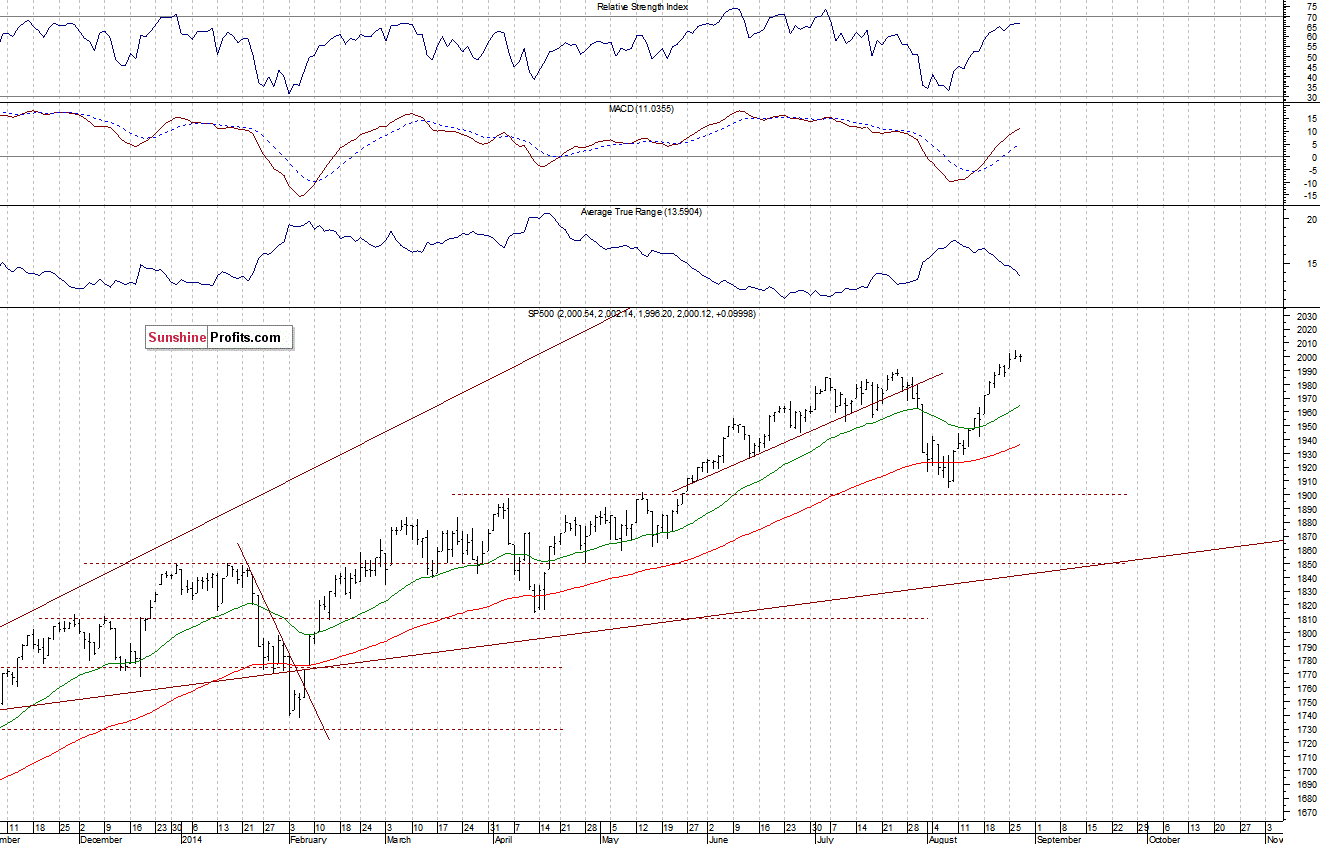

The main U.S. stock market indexes were virtually flat on Wednesday, as investors hesitated following recent rally. The S&P 500 index remains close to its all-time high of 2,005.04, trading along the level of 2,000. The nearest important resistance level is at around 2,000-2,005. On the other hand, the level of support is at 1,980-1,990, marked by some of the recent local lows. There have been no confirmed negative signals so far. However, we can see negative divergences, accompanied by some technical overbought conditions:

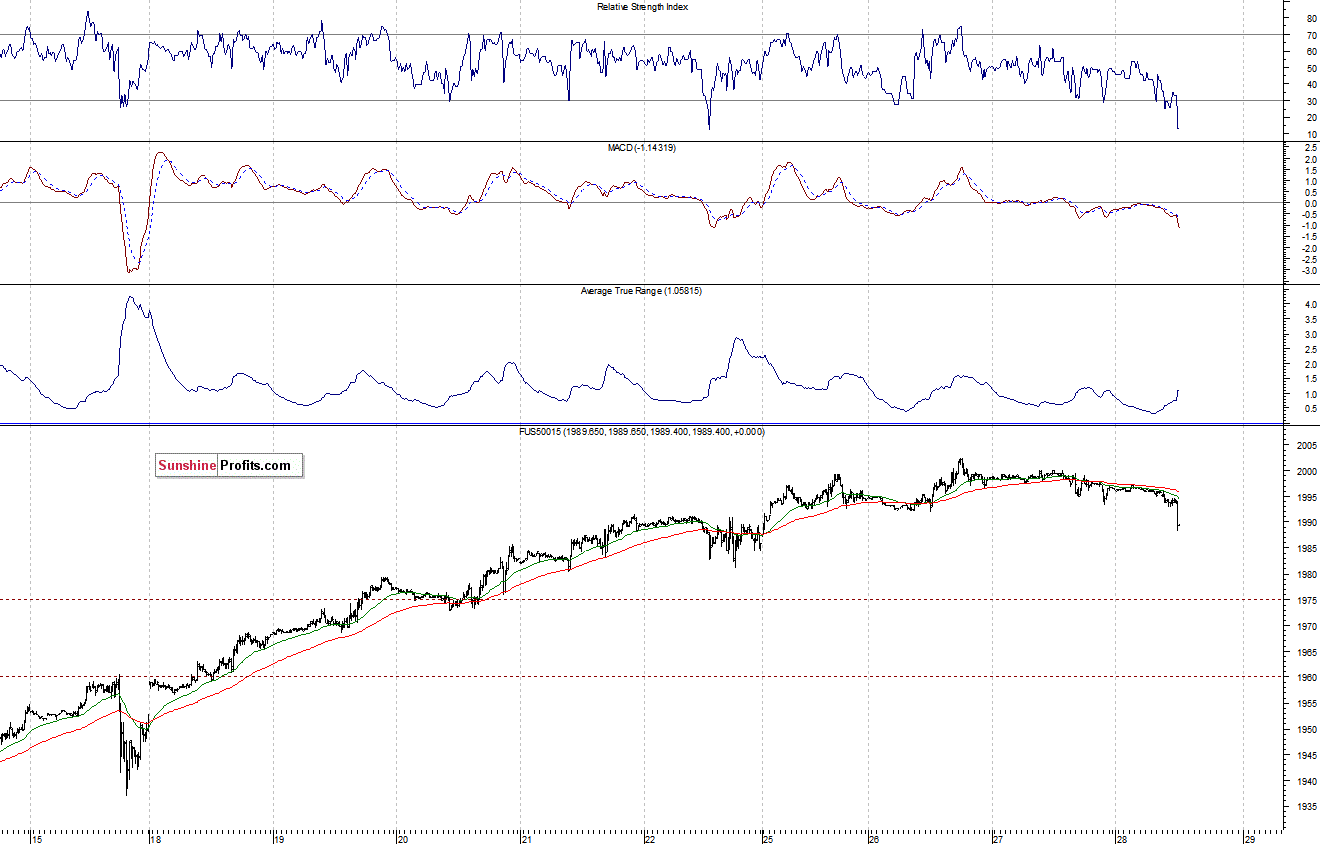

Expectations before the opening of today’s session are negative, with index futures currently down 0.3%. The European stock market indexes have lost 0.4-0.8% so far. Investors will now wait for some economic data announcements: Initial Claims, GDP –Second Estimate at 8:30 a.m., Pending Home Sales at 10:00 a.m. The U.S. GDP figure will be closely watched as markets are expecting a confirmation of an economic rebound. The S&P 500 futures contract (CFD) is in a descending intraday channel, as it trades below the level of 2,000. The resistance level is at around 2,000, and the nearest important level of support is at 1,980-1,985, among others, as we can see on the 15-minute chart:

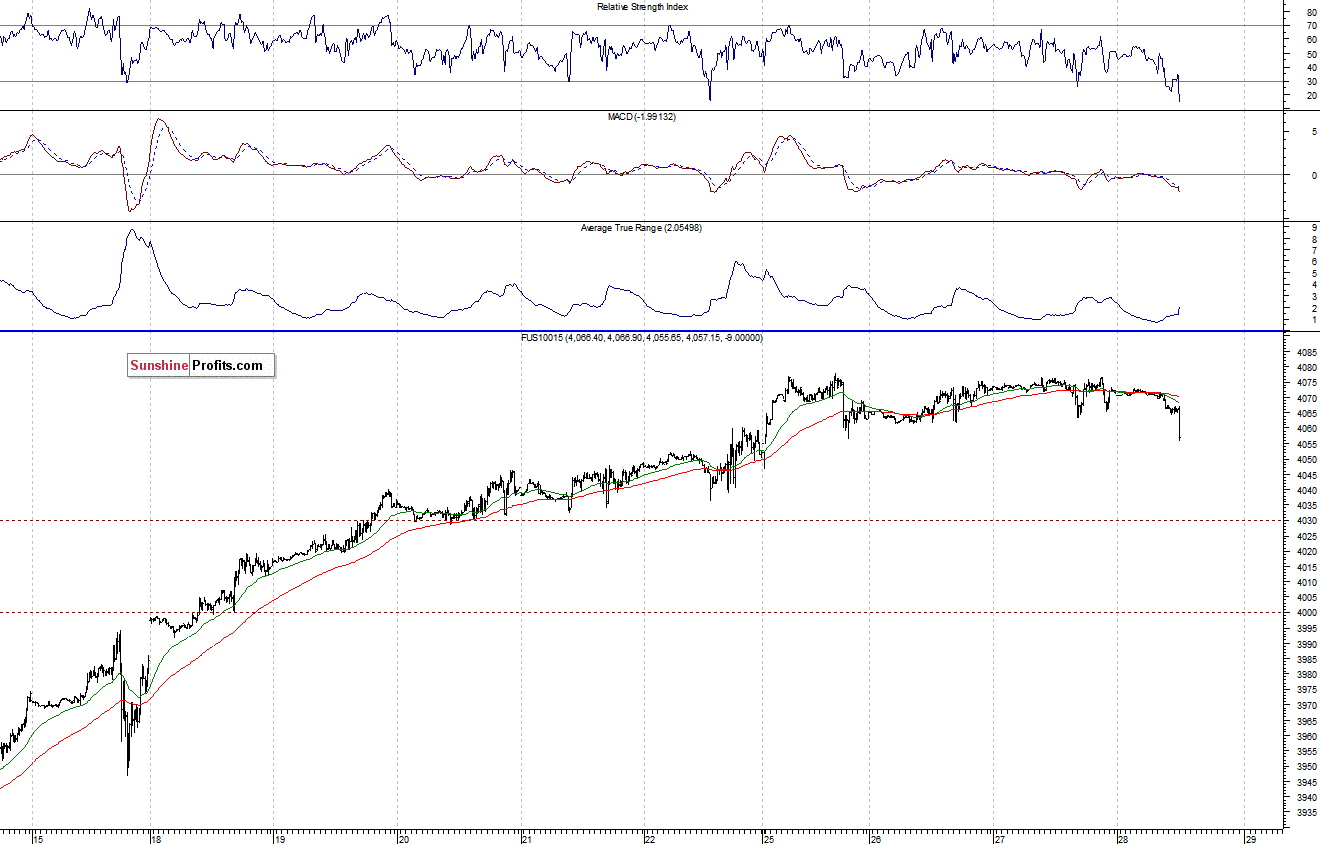

The technology Nasdaq 100 futures contract (CFD) is in an intraday downtrend, as it trades below the level of 4,080. The resistance level remains at 4,080-4,100, and the nearest important level of support is at around 4,050-4,060, as the 15-minute chart shows:

Concluding, the broad stock market remains close to its all-time high. There have been no confirmed uptrend reversal signals so far. However, we can see some negative technical divergences. We remain cautiously pessimistic, expecting a downward correction. Therefore, we continue to maintain our speculative short position (entry point at 2,000.5 - S&P 500 index). The stop-loss is at 2,030, and potential profit target at the level of 1,900 (S&P 500 index).

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' employees and associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.