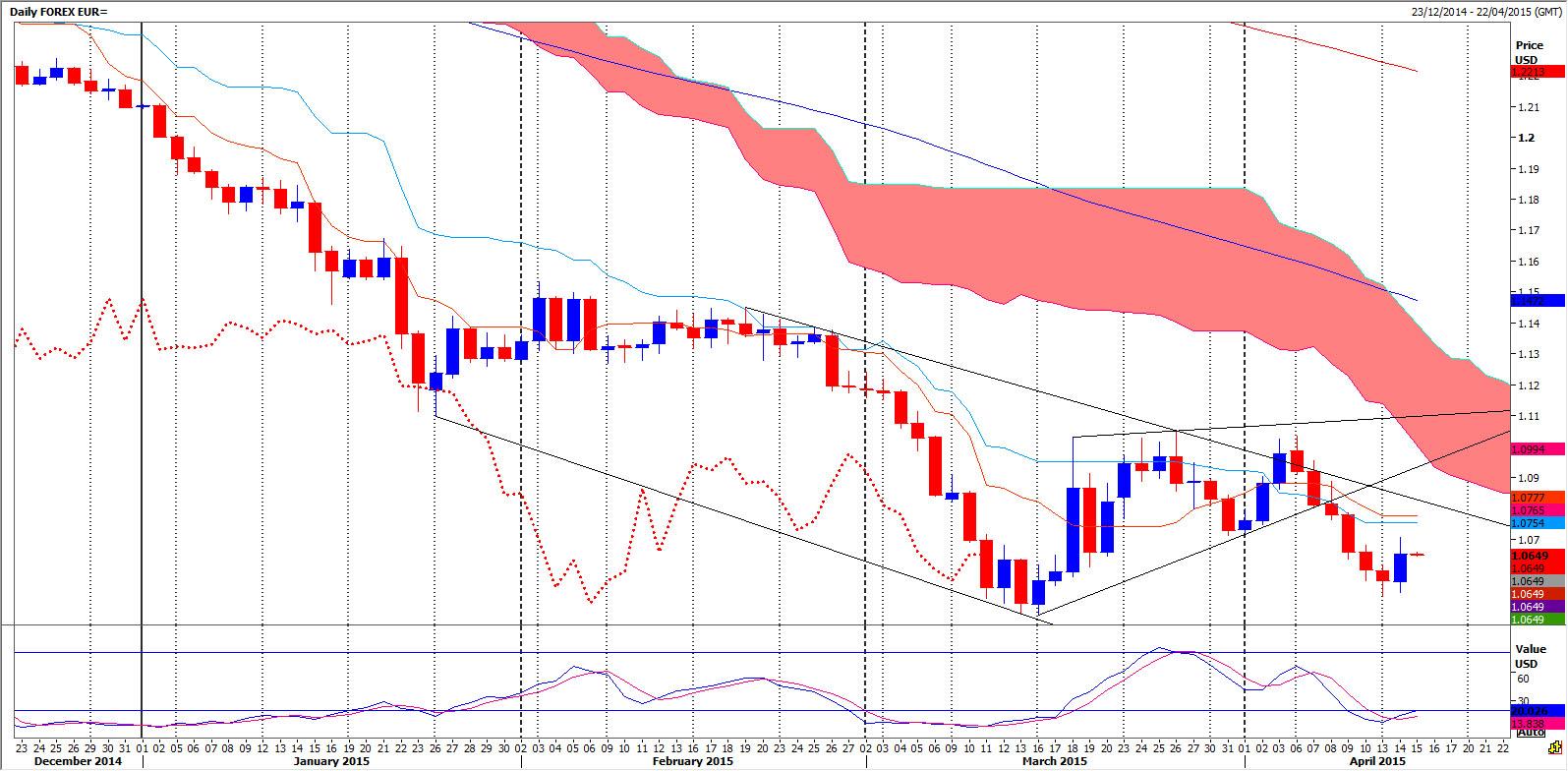

EURUSD Spot

Daily Forecast - 16 April 2015

EURUSD has burst through 1.0710/15 over night to hit our next target of 1.0745/50 & topped exactly here as I write for a dip to 1.0695/90. This could hold the downside but below here look for a buying opportunity at 1.0670/65. Longs need stops below 1.0640. An unexpected break lower meets strong support at 1.0615/10.

Holding 1.0695/90 targets 1.0715 then first resistance at 1.0745/50. we should struggle here again on a retest but be ready to go with a break higher to target 1.0775/80. Unlikely we can make it any higher at this stage but look for strong resistance at 1.0810/20. Sell with stops on a move above 1.0840.

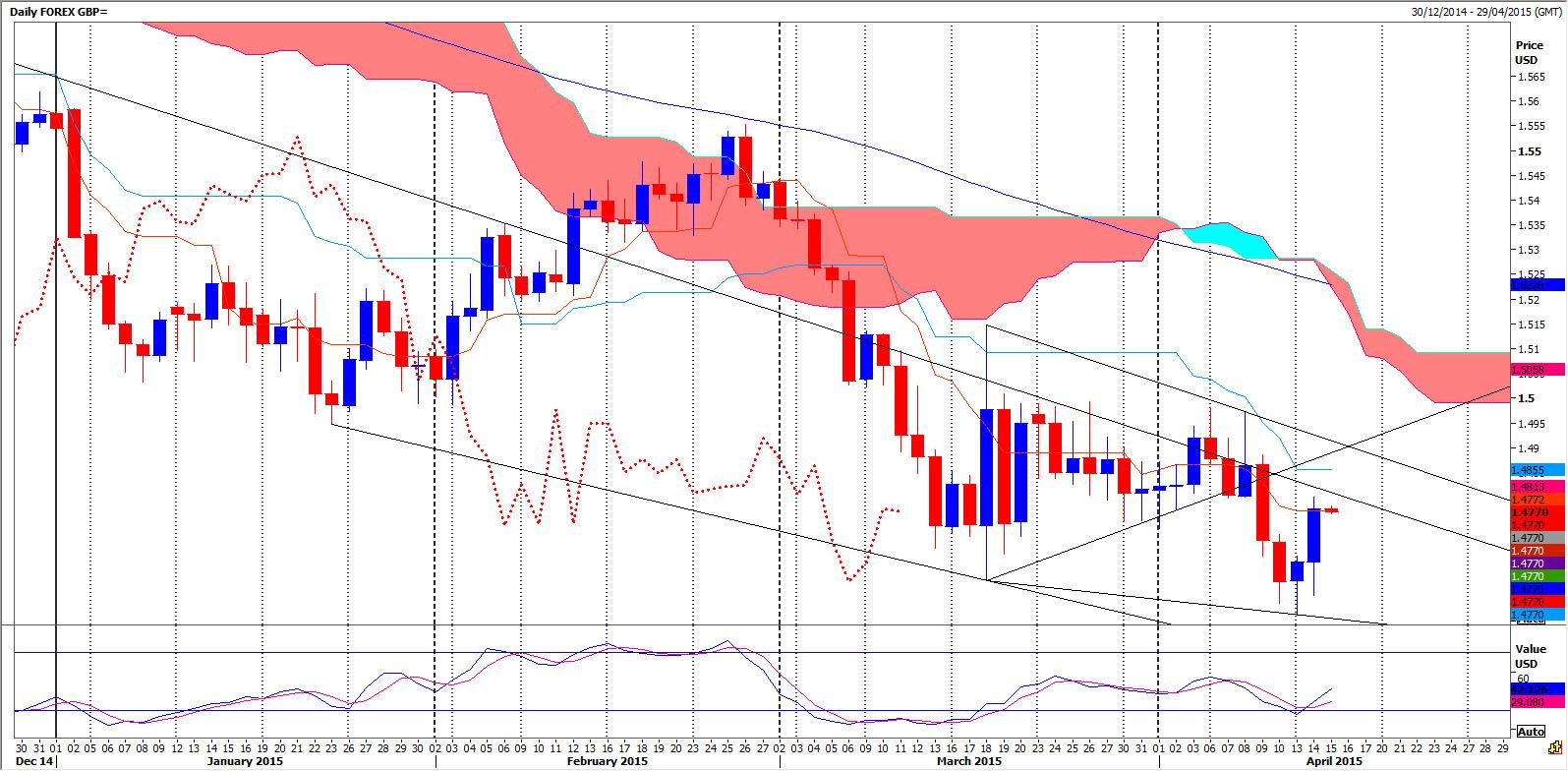

GBPUSD

GBPUSD has continued higher over night to beat 1.4845/50 & hit our next target of 1.4880/85. We have topped exactly here as I write. First support at 1.4840/35 but below here a buying opportunity at 1.4810/05. Longs need stops below 1.4785 to target next support at 1.4760/55. Buy with stops on a move below 1.4735.

Holding first support at 1.4840/35 re-targets 1.4880/85. Be ready to go with a break higher to target strong resistance at 1.4900/05. A high for the day possible but shorts need stops above 1.4920. A break higher meets resistance at 1.4940/45 but if we continue higher look for an excellent selling opportunity at 1.4970/80.

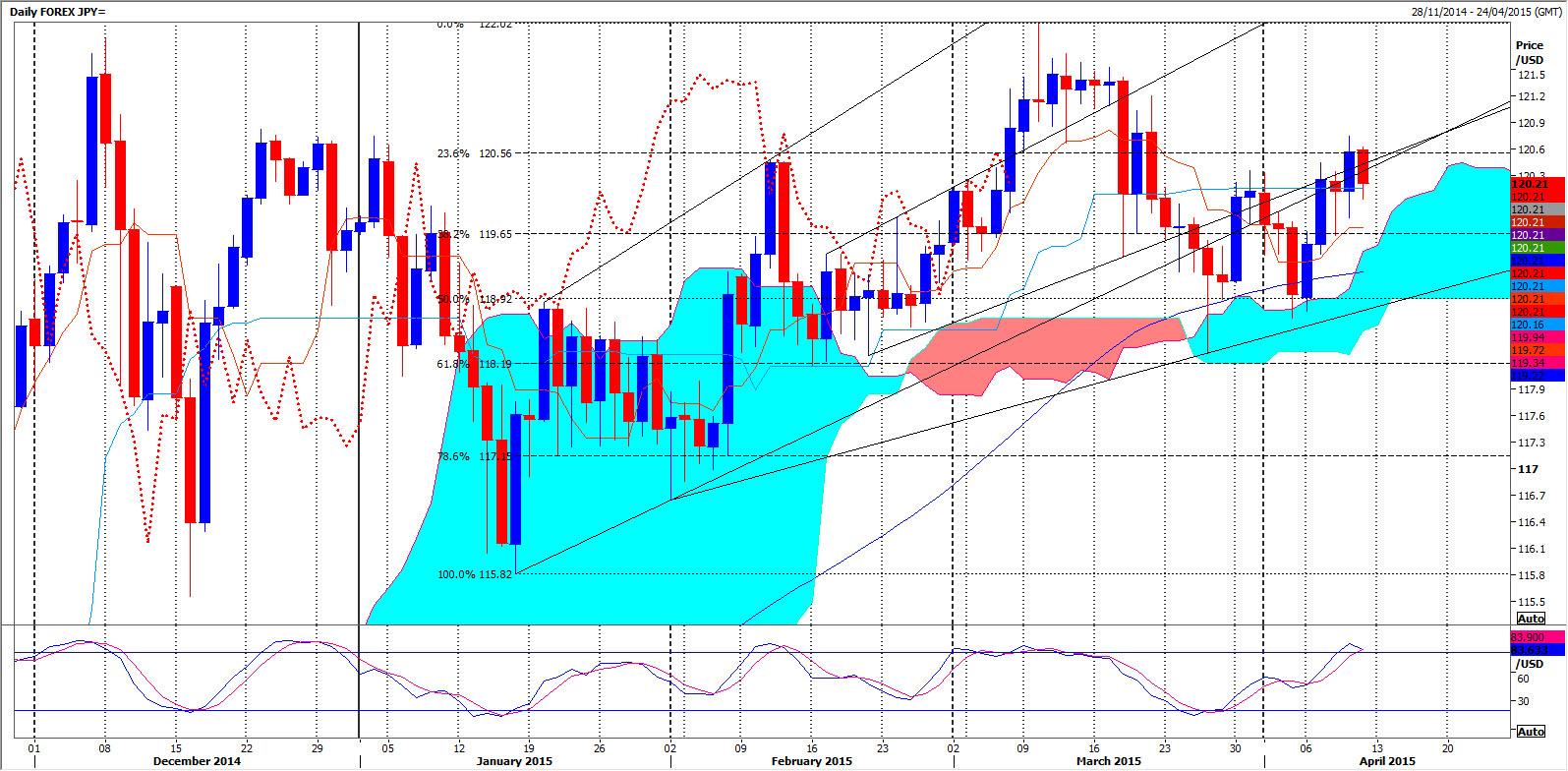

USDJPY Spot

USDJPY has a small double bottom pattern and being oversold in the short-term this could trigger a move up to the first resistance at 119.25/30. This could hold a move higher but above here look for selling opportunity 119.55/60. Our shorts need a stop above 119.70 but an unexpected break higher meets further resistance at 119.80/85.

Important support at 118.76/70 but be ready to go with a break lower. This would be a sell signal and we could quickly target March lows at 118.30. Exit shorts and try longs in the 118.30/20 area. There is a good chance of a low for the day here but our longs need a stop below 118.00.

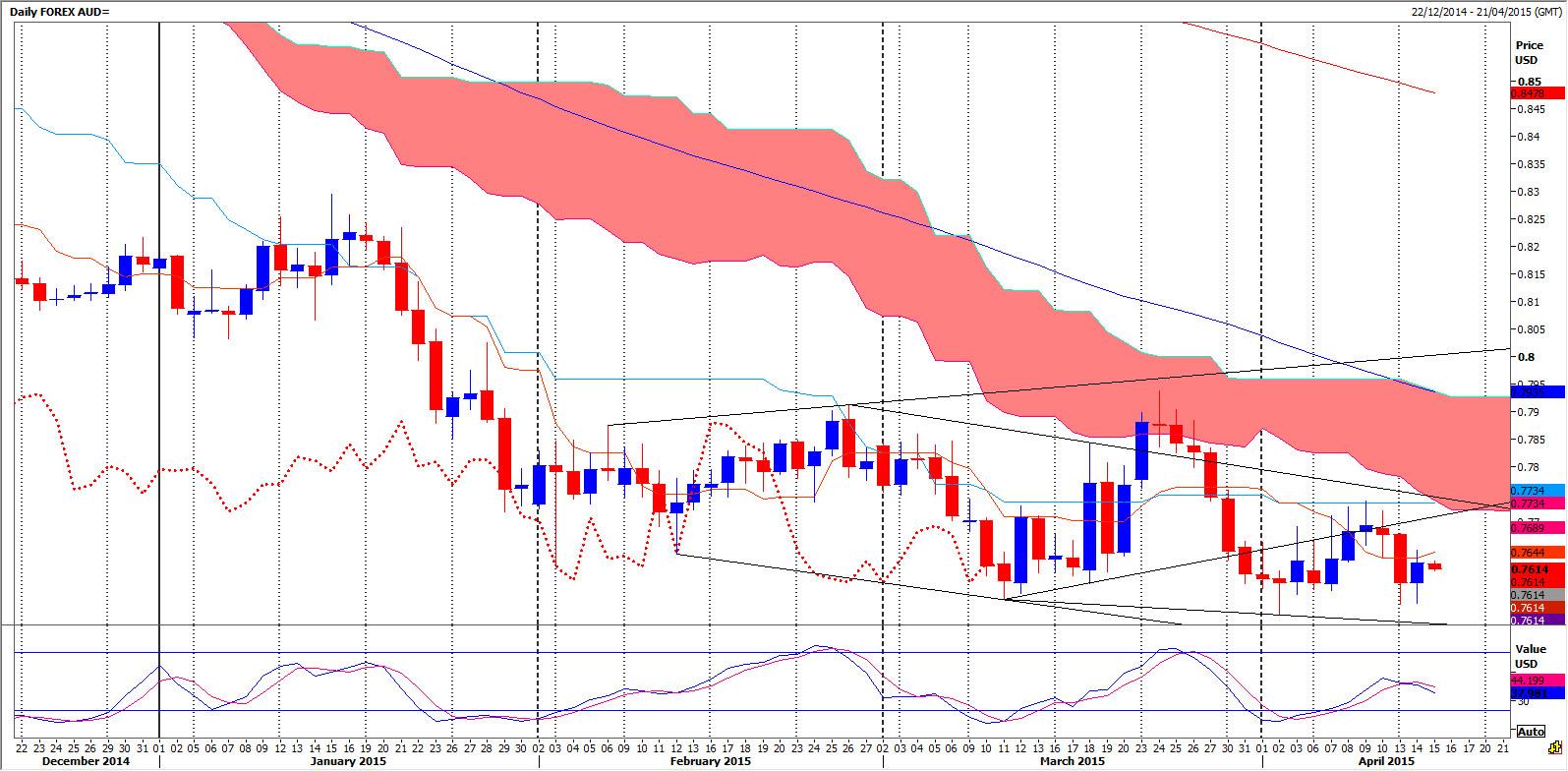

AUDUSD

AUDUSD has burst through 7680/85 over night & has also cleared the 7 week trend line resistance. We now meet strong resistance at 7777/7782. Although the outlook is quite positive, we should struggle here today but shorts need a stop above the 100 month moving average at 7800/05. Be ready to go with a break higher to target strong longer term resistance at 7822/7828. A good chance of a high for the day and even for the week. Try shorts with a stop above 7845.

Failure to beat 7777/7782 could trigger a move back to first support at 7725/20. Try longs with a stop below 7710. On a break lower look for better support at 7695/7690 which should hold the downside at this stage.

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.