Daily Forecast - 28 January 2015

Nat Gas February contract

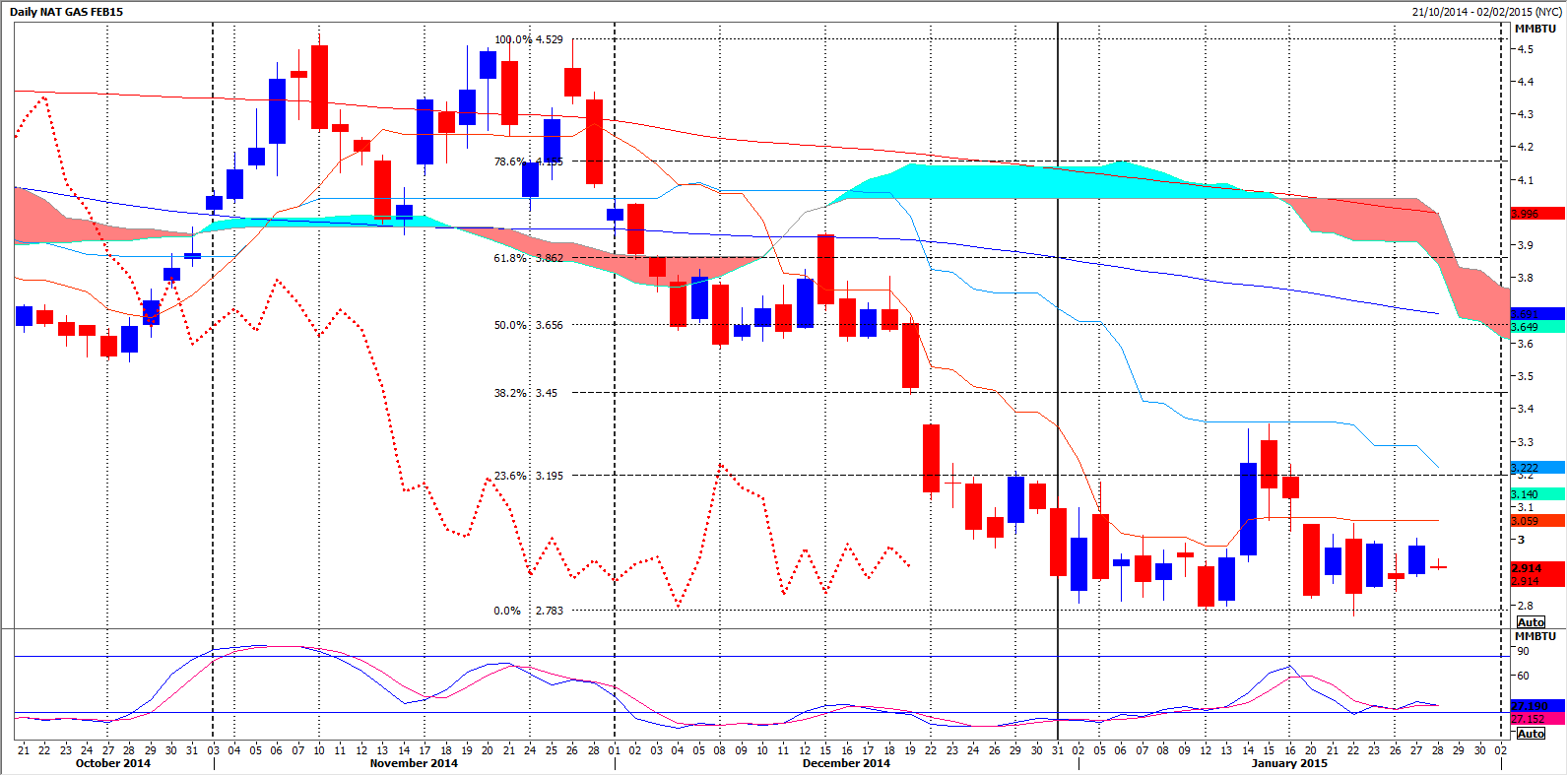

Natural Gas February immediate support at 2855/45 then the 4 week low of 2805-2766. A break lower this week is obviously negative & targets 2720/15. Any further losses could reach 2680/70 & perhaps as far as 2650/45. Below here risks a slide to 2575.

Holding above 2855 re-targets 2950/60 & perhaps a re-test of resistance at 2990/3000. A good chance of a high for the day again today, but if we continue higher look for a selling opportunity at 3055/60 with stops above the gap at 3080. Be ready to go with an unexpected break higher however using 3055/60 as support to target resistance at 3125/30. On any further gains look for a selling opportunity at 3200/3220 with stops above 3245/50.

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended Content

Editors’ Picks

AUD/USD: Extra gains in the pipeline above 0.6520

AUD/USD partially reversed Tuesday’s strong pullback and regained the 0.6500 barrier and beyond in response to the sharp post-FOMC pullback in the Greenback on Wednesday.

EUR/USD meets support around 1.0650

EUR/USD managed to surpass the key 1.0700 barrier in response to the intense retracement in the US Dollar in the wake of the Fed’s interest rate decision and Chair Powell’s press conference.

Gold surpasses $2,300 as Dollar tumbles

The precious metal maintains its constructive stance and trespasses the $2,300 region on Wednesday after the Federal Reserve left its FFTR intact, matching market expectations.

Bitcoin price reclaims $59K as Fed leaves rates unchanged

The market was at the edge of its seat on Wednesday to see whether the US Federal Reserve (Fed) would cut interest rates during the Federal Open Market Committee (FOMC) meeting.

The market welcomes the Fed's statement

The market has welcomed the Fed statement, and the S&P 500 is higher in its aftermath, the dollar is lower and Treasury yields are falling. There is still only one cut priced in by the Fed.