Forex News and Events

Risk-off sentiment dominates ahead of the Brexit referendum (by Yann Quelenn)

Investors are shunning less risky assets in favour of safe havens. While stock indices are declining, USD/JPY is strengthening and currently trading around 104 for a single dollar note. EUR/CHF dropped below 1.0800 for the first time in six months before bouncing back. Gold has reached an 18-month high and silver is trading close to its highest level so far this year. There are several reasons for this. Brexit anxieties are clearly significant and the current patient stance from most central banks is definitely taking its toll on investor sentiment. Indeed, the world’s biggest economy is constantly disappointing markets by failing to raise rates and not leading other economies on a sustainable recovery path.

Meanwhile, negative interest rates seem to be the new normal. The German 10-year government bond is yielding negative for the first time in its history. This is the symbol of the overall risk-off sentiment. The price of money is negative for most maturities. We are still bullish on precious metals as we think that central banks may continue to ease globally until the end of the year. Yet, in the very short-term, a relief rally is still possible after the Brexit mist clears, but global fundamentals will remain very fragile.

Currency trades for "Brexit" (Peter Rosenstreich)

With the FOMC out of the way, the “Brexit” debate remains the dominant driver of asset prices today. The assassination of pro-EU MP Jo Cox, has forced a suspension of campaigning for next week’s UK referendum, yet we anticipate this weekend to be filled with heated debate, as the realization that the proverbial “clock” is now on the field. Shifting market expectations for Brexit is now a daily occurrence and we expect the noise to reach deafening levels next week. Yet, barring ironclad polling evidence of a directional outcome, we suspect investors will view the vote as coin toss. Intraday volatility, indicated by a surge in GBP option premiums, will likely remain elevated but we suspect that positioning close of Friday will last until morning of Thursday 23rd.

We remain focused on a “leave” vote since that will likely have the most profound and confusing effect on currency prices. Our primary trades on a “leave” vote would be short GBPJPY and short EURCHF. Both the UK and Europe stand to lose should their relationship deteriorate with the possibility of the single currency rising above the sterling.

Second tier trades would be focused on selling currencies with significant exposure to trade with both nations as we anticipate a contraction in growth due to immediate uncertainties. This puts NOK, PLN and SEK at risk. In this current scenario, we doubt counter factors such as safe-haven status and correlation to oil prices will protect SEK and NOK from an immediate sell-off. Finally, we are focused on global risk sensitively where MXN, TRY and ZAR look to be the most vulnerable to a risk-off result. ZARJPY remains below its 21d MA at 6.8485, suggesting a test of the 6.5247 2016 low. As we have stated before on the long side nothing clever but traditional safe-haven USD, JPY and CHF. However, a fear of “Brexit” has once again also put bitcoin/cryptocurrencies back in the spotlight. Bitcoin against USD has surge to 777.01 (bitcoin/sterling 519), representing a two-year high. Cryptocurrencies in theory are the only pure way of escaping the manipulation of fiat currencies, and avoiding the potential distortion caused by central banks in the post UK vote environment.

The Risk Today

Peter Rosenstreich

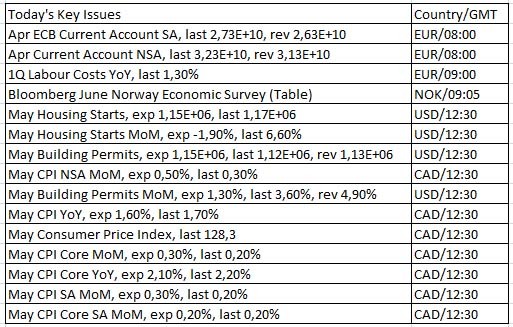

EUR/USD is still moving sideways. Hourly resistance can be found at 1.1303 (13/06/2016 high). Yet, hourly support at 1.1189 (14/06/2016 low) and 1.1137 (03/06/2016 low) have been broken. Expected to further weaken. In the longer term, the technical structure favours a very long-term bearish bias as resistance at 1.1714 (24/08/2015 high) holds. The pair is trading in range since the start of 2015. Strong support is given at 1.0458 (16/03/2015 low). However, the current technical structure since last December implies a gradual increase.

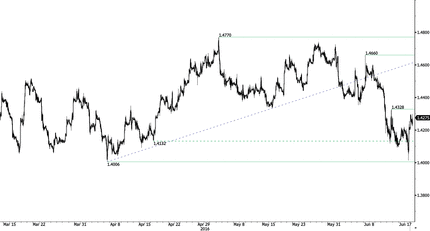

GBP/USD has been very volatile yesterday but is now back below 1.430. Resistance is given at 1.4328 (13/06/2016 high) and a stronger one is located at 1.4660 (07/06/2016 high). The short-term momentum shows that the pair is heading towards support at 1.4006 (06/04/2016 low). Expected to confirm deeper selling pressures. The long-term technical pattern is negative and favours a further decline towards key support at 1.3503 (23/01/2009 low), as long as prices remain below the resistance at 1.5340/64 (04/11/2015 low see also the 200-day moving average). However, the general oversold conditions and the recent pick-up in buying interest pave the way for a rebound.

USD/JPY's selling pressures continue. Supports at 106.25 (04/05/2016 low) and at 105.55 (03/05/2016 low) have been fully erased. Hourly resistance now is given at 104.83 (07/06/2016 high). The medium term momentum is clearly oriented downwards. Expected to continue wekaening weaken. We favour a long-term bearish bias. Support is now given at 103.56 (28/08/2014 low). A gradual rise towards the major resistance at 135.15 (01/02/2002 high) seems now very unlikely. Expected to monitor support at 103.56.

USD/CHF is consolidating below former hourly resistance at 0.9679 (13/06/2016 high). Hourly support is given at 0.9533 (04/05/2016 low). Expected to show growing selling pressures. In the long-term, the pair is still trading in range since 2011 despite some turmoil when the SNB unpegged the CHF. Key support can be found 0.8986 (30/01/2015 low). The technical structure favours a long term bullish bias since last December.

| EURUSD | GBPUSD | USDCHF | USDJPY |

| 1.1616 | 1.4770 | 0.9920 | 111.91 |

| 1.1479 | 1.4660 | 0.9783 | 109.14 |

| 1.1416 | 1.4328 | 0.9679 | 107.89 |

| 1.1280 | 1.4170 | 0.9590 | 104.19 |

| 1.1132 | 1.4006 | 0.9578 | 103.56 |

| 1.1098 | 1.3638 | 0.9444 | 100.78 |

| 1.1058 | 1.3503 | 0.9259 | 96.570 |

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

GBP/USD consolidates above 1.2500, eyes on US PCE data

GBP/USD fluctuates at around 1.2500 in the European session on Friday following the three-day rebound. The PCE inflation data for March will be watched closely by market participants later in the day.

Gold clings to modest daily gains at around $2,350

Gold stays in positive territory at around $2,350 after closing in positive territory on Thursday. The benchmark 10-year US Treasury bond yield edges lower ahead of US PCE Price Index data, allowing XAU/USD to stretch higher.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.