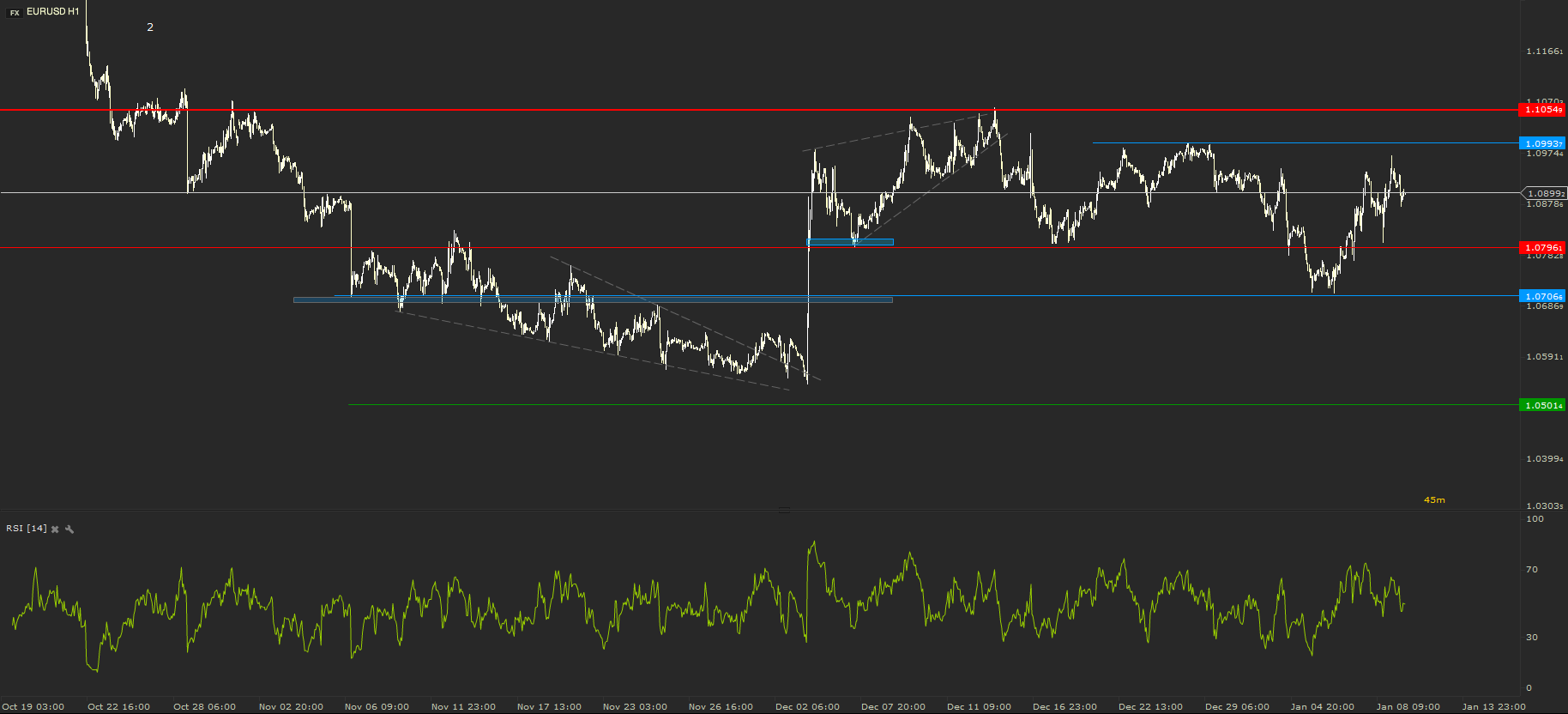

EURUSD - Breaking the Lows

I was expecting last week for the EURUSD to be a bit lazier in the first part of the week. But it surprised me with a strong down move which started on the 4th. After breaking 1.0800 support, the drop continued towards the next round number level, 1.0700, where it found a good support. The price rallied back towards 1.0900 in the second part of the week.

Today EURUSD is trading in a range of up to 100 pips around 1.0900. A good resistance level remains at 1.0993. A break above this one would signal a continuation of the up move towards the key resistance from 1.1055. A break below 1.0800 would again signal a fall to 1.0700 and maybe towards new lows.

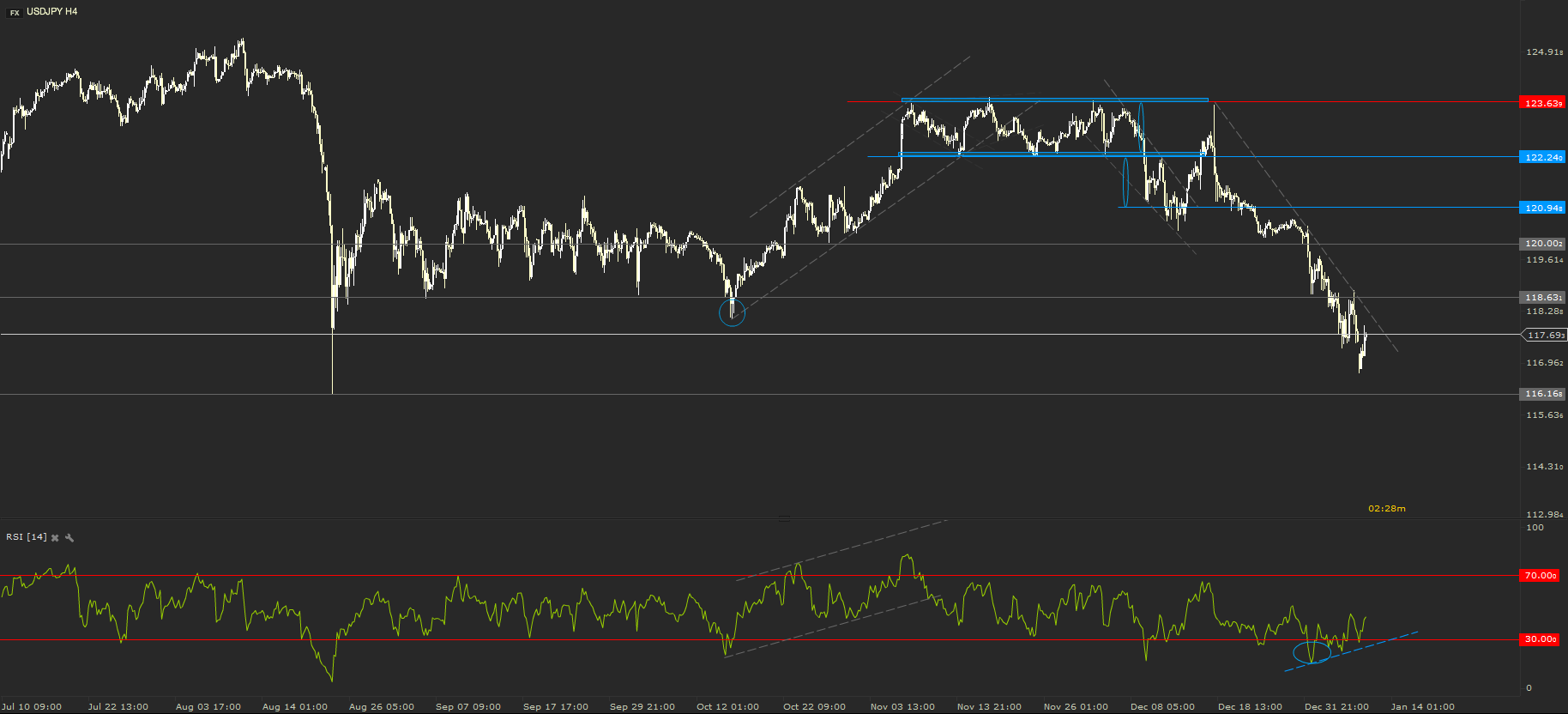

USDJPY - Bullish Signal on the down trend

The US dollar continued to lose against the Japanese yen last week. The price did not reach 120.00 to retest. It broke below 118.63 and headed towards the next key support from 116.16, but did not touch it.

The main trend of this currency pair is still downward. But on the 14 periods RSI a positive divergence can be observed. The price action has drawn lower lows while the RSI has drawn higher lows. This in most of the cases is a strong bullish signal. In my opinion a break and close on a 4 hour chart above the descending trend line would confirm the bullish signal. Until then I am expecting the price to continue its down move towards the key support.

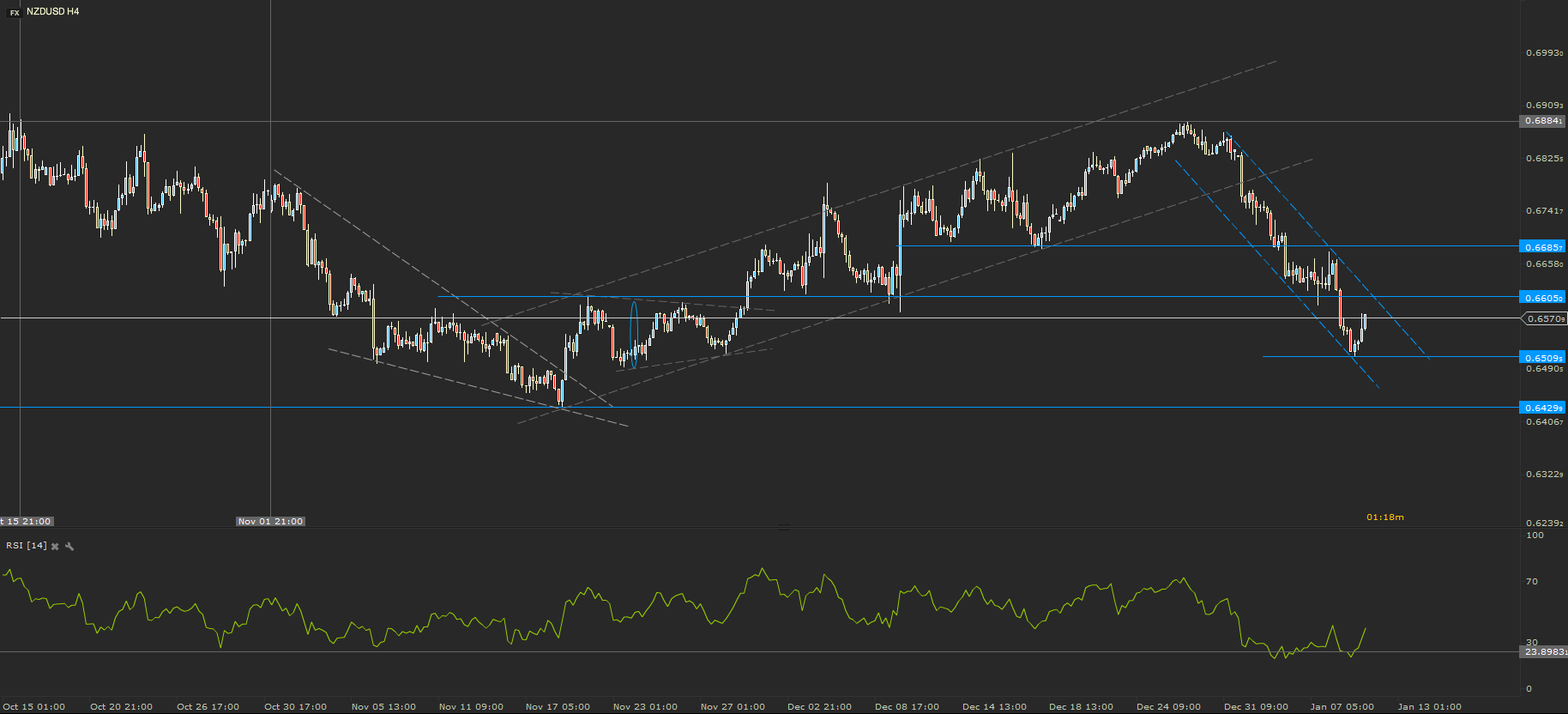

NZDUSD - Broke the Trend

NZDUSD broke the trend line early last week and from that point continued to drop all the way to 0.6509. The down move has respected a pretty tight down the channel.

The bias remains negative for this pair. A drop below the current local support from the round level 0.6500 could signal that the bears are still in power. In this situation, I am expecting for the price to continue down all the way to 0.6430 or even 0.6500. On the other hand a break above the trend line could signal an up move back to 0.6600 or even higher towards 0.6650.

Risk Warning: Financial Derivative Instruments are complex instruments and leveraged products that involve a high level of risk which can result in high losses, including the risk of losing the entire capital invested by the Client. Such instruments might not be suitable for all Clients. The Client should not engage in transactions with such Financial Instruments unless he/she understands and accepts the risks involved by trading Financial Instruments, taking into account his/her investment objectives and level of experience. Forex Rally warns that the information published on this website shall not be considered as a recommendation to buy/sell/keep a certain financial instrument and that past performance of Financial Instruments is not a reliable indicator of future performances.

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

GBP/USD consolidates above 1.2500, eyes on US PCE data

GBP/USD fluctuates at around 1.2500 in the European session on Friday following the three-day rebound. The PCE inflation data for March will be watched closely by market participants later in the day.

Gold clings to modest daily gains at around $2,350

Gold stays in positive territory at around $2,350 after closing in positive territory on Thursday. The benchmark 10-year US Treasury bond yield edges lower ahead of US PCE Price Index data, allowing XAU/USD to stretch higher.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.