Weekly outlook

This week on the Markets

1. Canadian October Gross Domestic Product, Mon., 23rd December, 1:30 p.m.

Canada’s economy grew faster in the third quarter at the fastest pace in two years amid a gain in consumer spending and rebounds in business investment and inventories. September gross domestic product rose 0.2 percent, Statistics Canada reported in Ottawa. Economists were forecasting a rise of 0.3 percent earlier. The world’s 11th-largest economy may need another two years to use up the slack after a period of weaker global growth that hobbled exports and investment. The figures show that the Bank of Canada Governor Stephen Poloz, who dropped the language about the possible interest rate increase, will probably hold the line of borrowing costs at the next meeting. We expect that October gross domestic product will be at 0.3 percent growth from previous month.

2. U.S. November Personal Income and Expenditures, Mon., 23rd December, 1:30 p.m.

Above is the chart of the historical Americans’ spending for the last 10 years. In October it has risen more than forecast, a sign the biggest part of the economy is gaining momentum from a firming employment. Household purchases, which account for about 70 percent of the economy, climbed 0.3 percent after a 0.2 percent increase the prior month, the Commerce Department reported in Washington. The median estimate of the most polled economists called for a 0.2 percent rise. Incomes dropped 0.1 percent, reflecting swings in farm revenue caused by a lawsuit. Rising home values and equity prices are giving lift to households, helping offset the effects of a government shutdown in October and this year’s higher tax rates. October report follows another data, showing household spending up 1.4 percent in the third quarter, the smallest advance since early 2009. Retailers reported a lacklustre Black Friday start to the holiday shopping season. WE expect that November personal incomes and spending will be at 0.5 percent rise from October.

3. Reuters/Michigan December Consumer Sentiment, Mon., 23rd December, 2:55 p.m.

Consumer confidence increased more than forecast in December to the highest level in five months, easing concern about households spending heading into the holiday-shopping season. Then Thomson Reuters/University of Michigan preliminary December consumer sentiment index rose to 82.5, the strongest since July, from 75.1 in November. Economist forecast an increase to 76, according to the median estimate in a survey. Gains in employment, property values and stock portfolios are supporting confidence as concerns east that gridlock in Washington will harm the economy. An improvement in consumer sentiment means households may feed more prone to loosen their purse strings during the holiday shopping season. The figures compare with the Consumer Comfort index, which rose at the end of November to its highest level since early October. Henyep expects that December Reuters/Michigan sentiment index will rise up to 83.0.

4. U.S. November Durable Goods orders, Tue., 24th December, 1:30 p.m.

Orders for durable goods declined in October, pointing to a slowdown in U.S. business investment that will curb U.S. economic growth this quarter. Booking for goods meant to last at least three years decreased 2 percent after a 4.1 percent gain in September, according to the data revealed by Commerce Department in Washington. Other important data indicators show that that any cooling in the expansion will be short-lived. The federal shutdown in October and the prospect of more budget cuts have prompted companies to trim staff and close factories. At the same time rebound in household spending when approaching the holiday-shopping season combined with improved hiring prospects may brighten the outlook for retailers, which are discounting merchandise to boost sales. The durable-goods report has been at odds with the sentiment surveys among manufacturers, where factories continued to expand. The MNI Chicago Report business barometer fell less than forecast in November, to 63 from 65.9. In view of this all earlier mentioned, we forecast for the November durable orders to rise 1.8 percent from October.

5. U.S. November Home Sales, Tue., 24th December, 3:00 p.m.

Most of the important data is of the one taking place in the U.S. The holiday week and the pre-New Year holiday season in scarce in economic releases in other countries. On the 24th of December, The Commerce Department will be updating us on the New Home Sales for November. October data indicated that New home purchases rebound from the lowest level in more than a year, signalling buyers started to take higher mortgage rates in stride. Sales jumped 25.4 percent to a 444,000 annualized pace, following a 354,000 rate in the prior month that was the weakest since April 2012. The median forecast of polled economists called from 429.000. Home sales are regaining strength as gains in employment and stock prices help consumers adjust to this year’s increase in borrowing costs and property values, which have hurt affordability. Builders such as Hovnanian Enterprises Inc. are optimistic about the outlook for the market, which will need to expand to meet the needs of a growing population. Henyep expects that November New Home Sales will be at 440,000 from previous month.

6. U.S. Jobless Claims data, Thurs., 26th December, 1:30 p.m.

Familiar graph to many of you, who closely follow jobless claims data releases. Applications for U.S. unemployment benefits unexpectedly rose last week to an almost none-month high, showing fluctuation in the filings that typically occurs around the year-end holidays. Jobless claims climbed by 10,000 to 379,000 in the period ended Dec 14, the most since the end of March, Labor Department data showed in Washington. Economists were forecasting a decrease to 336,000. In the scenarios like this, it is best to focus on the 4-week averages to determine the underlying trend, a government spokesman said as the figures were released. Unemployment fell last month to a five-year low and progress in hiring helped prompt Federal Reserve policy makers to reduce their $85 billion in monthly bond buying last week at the conclusion of the two-day meeting. Gains in the payrolls are also helping lift consumer confidence, brightening prospects for retailers during the holiday-shopping season. We expect that last week’s employment benefits claims will be at 347,000.

7. Japan November National Consumer Prices, Thurs., 26th December, 11:30 p.m.

A gauge of Japan’s prices rose the most in 15 years as higher energy costs fuelled broader inflation pressures, in a sign Prime Minister Shinzo Abe is making progress in stamping out deflation. Prices excluding energy and fresh food rose 0.3 percent in October on a year, boosted by a weaker yen and electricity costs that have risen 22 percent since March 2011, when an earthquake led to the shutdown of Japan’s nuclear industry. The gain exceeded a 0.2 percent forecast in Bloomberg News survey. Households face the prospect of sustained inflation for the first time in almost a generation, a dynamic that could hurt spending unless wages begin to rise. The focus in turning to salary negotiations early next year that may determine the success of Abe’s bid to reflate the world’s third-largest economy. Inflation measure turned positive for the first time since October 2008, gaining at the fastest pace since August 1998, when it rose 0.7 percent. Stripped of the effect of sales-tax increases in April next year and October 2015, the median forecast of BoJ board members is for prices to rise 1.3 percent in the fiscal year starting April and 1.9 percent the following year. In November though, we still expect for the national consumer price to be 1.5 percent up from the previous year.

Chart of the week

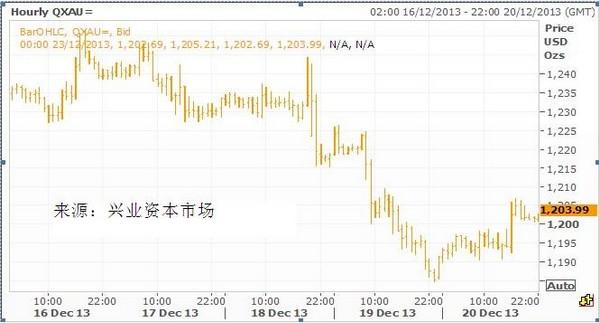

Gold down 2 pct to 6-month low, 'double-bottom' seen

FUNDAMENTALS**

Gold prices fell 2 percent to a six-month low on Thursday in a delayed sell-off after the Federal Reserve's pullback in the U.S. monetary stimulus, but the market could snap back into a rally as a "double bottom" forms on technical charts, some traders cautioned. Bullion fell just modestly on Wednesday after the Fed announced a slight cut in the pace of its monthly asset purchases that marked the central bank's first step in rolling back the era of easy money that drove gold to record highs.

In Thursday's session, the market reacted further, plumbing to its lowest level since June, as speculation about further stimulus taperings by the Fed heightened deflation fears. A double bottom refers to a technical-chart market pattern made up of two consecutive troughs that are roughly equal, with a moderate peak in between.

Investors and analysts are pessimistic that gold will regain in near-term the upward momentum that took it to the all-time high of $1,920.30 in September 2011. In announcing the stimulus cut on Wednesday, the Fed also lowered its expectations for both inflation and unemployment over the next few years. The central bank trimmed its monthly asset purchases by $10 billion to $75 billion, leaving markets guessing about the pace and size of future cuts.

COT Weekly Report

HY Markets commitment of traders (COT) weekly report is based on the data published every Friday by the U.S. Commodity Futures Trading Commission (CFTC). It seeks to provide investors with up-to-date information on futures market operations. It contains reportable (commercial and non-commercial holdings) and non-reportable positions. However, the non-commercial holding is an important signal of the futures traders’ sentiment that can be a very powerful trading tool to help anticipate market direction. Therefore, by looking at the net position changes, it will help determine the likelihood of a trend continuing or coming to an end in the near future.

How do I read the Non-commercial net position changes?

Positive means a net long position, and negative means a net short position. When the net position changes show that the net long position is decreasing, this indicates the market sentiment is down and vice verse, when the net long position is increasing, it indicates the market is optimistic.

How to read the open interest net changes?

The information set forth herein was obtained from sources which we believe to be reliable, but its accuracy cannot be guaranteed. It is not intended to be an offer, or the solicitation of any offer, to buy or sell the products or instruments referred herein. Any person placing reliance on this commentary to undertake trading does so entirely at their own risk.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.