In ancient Greece, the sophists were teachers skilled at using crafty rhetoric as a means of persuasion. Plato and Aristotle vilified the sophists for obscuring the underlying truth. In modern times, the term sophistry is used to describe behavior that is intended to deceive.

The parties to the crisis in Greece have shown themselves to be worthy heirs to the tradition of sophistry. Greece’s leaders have offered false fronts that have brought their country to the brink of financial ruin. But its creditors have been perpetuating a fiction for many years. The emerging truth could have global consequences.

From the very outset, Greece was among the more marginal additions to the eurozone. It joined a year after the common currency was formed, despite an economic and political history characterized by instability. The Greeks hoped that the new association would lead them to a higher plane; its sisters and brothers in the eurozone were more than happy to welcome the cradle of democracy to their exclusive club.

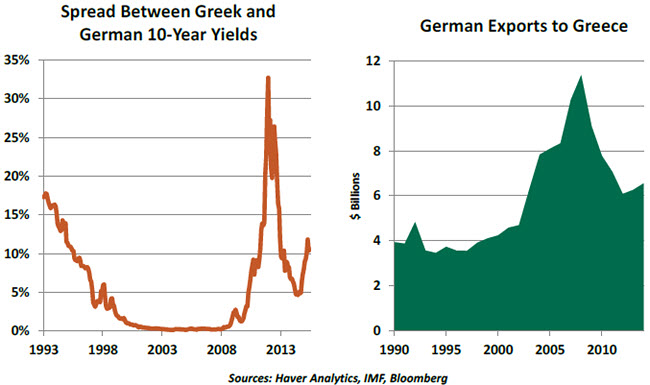

For a time, everyone prospered from the association. Greeks were able to finance themselves at far lower interest rates, and other European nations were delighted to provide capital so that the Greeks could purchase more exports.

Understanding this background makes it difficult to embrace the indignation that Greece’s Northern European creditors have expressed at the country’s reckless use of debt. For many years, they were more than happy to supply it. And they reaped the returns of higher rates of growth and employment.

There were always doubts about Greece’s fitness for membership. Eurostat, the eurozone’s accounting watchdog, had long expressed concerns about the country’s budget calculations, which are critical to membership. In 2009, a new regime took power in Greece and found that the government’s books had, in fact, been cooked to meet eurozone qualification standards. (The country was abetted in this obfuscation by some creative derivatives supplied by investment banks.)

Euro meisters declared their outrage, and demanded the country respect the deficit and debt limits set out in the Stability and Growth pact that eurozone members are party to. Their indignation is somewhat hypocritical: as of this writing, every major eurozone country is in violation of limits set out in that treatise.

The Global Financial Crisis made a difficult situation much worse. Greece required increasing amounts of emergency loans to stay afloat; each new tranche called for additional government austerity. Greece’s economy was, and is, in desperate need of structural reform. But it was also in need of stimulative measures to restore growth so that it might one day repay its debts.

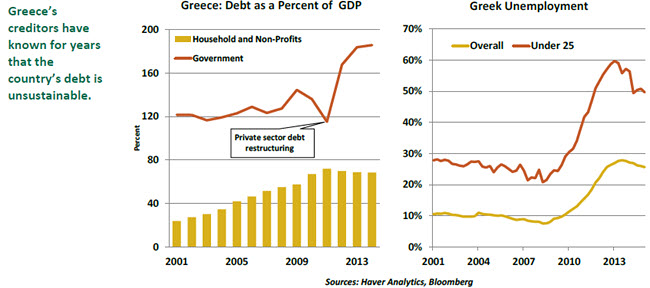

With each round of creative financing, the sustainability of the debt became more questionable. Much of Greece’s current borrowing carries maturities of over 30 years and calls for no interest until 2023. Optimistic economic assumptions were applied to make long-term projections look manageable. Arguably, Greece’s creditors have known for years that the country’s debts could not be repaid in full.

The struggles of the Greek economy under austerity have been monumental. A quarter of workers are unemployed; half of younger workers do not have jobs. The contraction in gross domestic product and the associated loss of tax revenue have perpetuated a negative feedback loop that tightens the vise of excessive leverage.

We might still be kicking the can down the road today, had it not been for a revolt from the plebiscite last January. While his methods have been crude and his motives calculating, Greek Prime Minister Alex Tsipras deserves credit for his willingness to challenge the design of Greece’s support program, which is not serving Greece or its creditors very well.

There are certainly those who will say that Greece got itself into this mess, and it should bear the consequences of its own recklessness. But history suggests that debt crises of the current magnitude cannot be resolved without important concessions from both sides. Germany should know this well, having defaulted on its own debt several times in the last century, and having used the Marshall Plan to rebuild itself into the industrial power it has become.

Unfortunately, political positions on both sides have hardened to a point that there seems no room for equanimity. Tsipras has played to his base, knowing that a backward step could lose him his job. The stance of German representatives to the various layers of negotiations is informed by overwhelmingly negative sentiment toward throwing good money after bad.

None of the potential outcomes from here are particularly pleasant. Even if some new agreement is eventually reached, Greece’s banks are in critical condition. Capital controls may be needed for some time to come; in the case of Cyprus, controls were in force for two full years. Restoring a normal flow of credit to support business will be challenging, and restoring the confidence of the international financial community will be even more so.

On the other hand, the abject depression that might envelop Greece should it exit the euro would create immense human costs and form the grounds for social instability. The country’s trading and financial partners would suffer significant losses. And because Greece is strategically located, it could raise diplomatic risks for the West.  Economically, Greece is a small country. But its departure would be a serious rupture for the eurozone. The cooperative has been described as marriage without the possibility of divorce. (In all the analysis we’ve read about the situation, no one has yet described exactly how a member might be excused.) The currency itself might not reflect it immediately, but the euro’s proponents worry that a revolving door might diminish its standing. And euro cynics would have cause to repeat their mantra that the euro was a flawed idea in the first place.

Economically, Greece is a small country. But its departure would be a serious rupture for the eurozone. The cooperative has been described as marriage without the possibility of divorce. (In all the analysis we’ve read about the situation, no one has yet described exactly how a member might be excused.) The currency itself might not reflect it immediately, but the euro’s proponents worry that a revolving door might diminish its standing. And euro cynics would have cause to repeat their mantra that the euro was a flawed idea in the first place.

Investors have certainly had an opportunity to create a financial ring fence around Greece, and the world’s banks are thought to have very minor exposure. There are certainly other nations, in Europe and elsewhere, that share the combination of high debt levels and a need for structural reform. But none has these dual afflictions to the same degree. If markets are discriminating, there should not be a rush to association.

But when faced with uncertainty, markets may have a tendency to shoot first and ask questions later. Among the lessons of 2008 is that trouble in global markets can start small, but gather steam through unexpected channels as psychology turns negative. And that could bring Greece’s woes closer to home, no matter where you might live.

We do not expect widespread global contagion, but reducing the risk of this outcome will require renewed cooperation between Greece and its creditors. They created the problem together, and neither side can claim the high ground. It is about time that they came back down to earth and worked this thing out.

Chinese Equity Markets: A Worrying Decline

As many a self-taught handyman has learned, sometimes when you tinker with one thing you inadvertently break another. Such is the case with Chinese equity markets over the past fortnight. An attempt at economic stimulus triggered a stock market correction, leaving the government scrambling to shore up markets before a bright spot in the economy burns out.

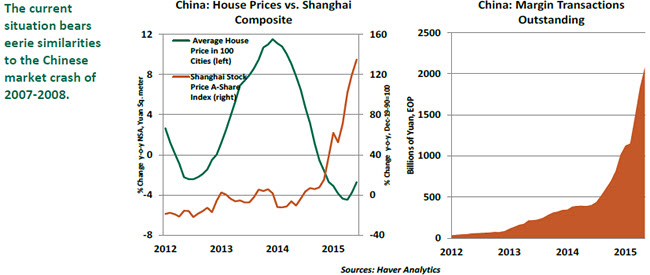

A series of easing efforts undertaken by the People’s Bank of China (PBOC) has increased liquidity, but that has not been passed on to corporate borrowers. Instead, banks have lent money to brokerages, which provide margin financing, which has risen fivefold to 2 trillion yuan ($323 billion) in the past year.

An effort to correct this initiated the market’s recent slide. Chinese investors had come to believe that the government wants the market to rise, and have tried to capitalize on the promised bonanza. (With the housing market no longer offering outsized returns, money has flooded into the equity market.) When the PBOC withdrew some funds from the banking system, investors became concerned that the the party was over.

As the decline gathered steam, government policy reversed course. First, the PBOC decreased interest rates and required reserve requirements at the same time. Then, the Finance Ministry allowed government pension funds to invest an estimated two trillion yuan in equity markets. Recent moves have had some air of desperation.

The current situation bears some similarities with the 2007-2008 Shanghai market bust, when the market fell by more than 65%. The blow was partly cushioned by the massive stimulus package Beijing introduced to combat the effects of the Global Financial Crisis; however, investor confidence still took years to recover. Some additional stimulus may be needed this time around if markets do not stabilize.

While the world’s attention has been focused squarely on Greece, perhaps it should be focused more sharply on events in the world’s second largest economy. There may be a storm brewing in China that the government may not be able to contain.

June U.S. Employment: Nothing Decisive for the Federal Reserve

The June U.S. labor market report was solid, but not spectacular. It will not, by itself, guarantee that the Fed will raise interest rates in the coming months.

The U.S. unemployment rate declined to 5.3% in June, which is close to what the Fed considers full employment (5.0% to 5.2%). However, the improvement in the jobless rate was entirely due to a lower participation rate (62.3%, the lowest since the 1970s). This trend is strongly likely to reverse in the near term; labor force changes can be irregular.

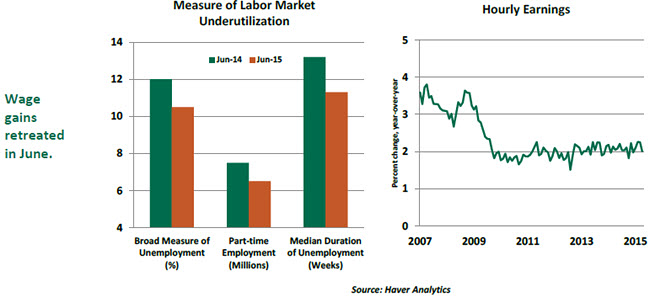

Measures of labor market underutilization show marked improvements. The broadest measure of unemployment declined 0.3% to 10.5%, the lowest since July 2008. The median duration of unemployment stands at 11.3 weeks, the lowest in nearly seven years. Part-time employment, at 6.5 million, is a new cycle-low.

Nonfarm payroll employment increased 223,000 in June; downward revisions to the prior two months reduced job growth by 60,000. Government employment accounted for a large part of the downward revision of April and May payrolls. The three-month moving average of non-farm payrolls at 221,000 is a solid trend and other labor market measures continue to point to strengthening of labor market conditions.

Hourly earnings were flat in June, which puts the year-to-year change back at the 2.0% trend of the past four years. A small calendar bias pertaining to when wage data are collected partly explains the disappointing earnings numbers, which is expected to be corrected next month. Other employment compensation data suggest that wage gains are building.

There is speculation that developments in Greece could keep the Fed steady. At present, markets seem to be assuming that potential contagion will be modest. Unless the situation devolves to a point of affecting U.S. markets or fundamentals, it is unlikely to factor heavily into the Fed’s decision making.

But anything can happen between now and the September Fed meeting, and by then we’ll have two more job reports. That data will drive both markets and monetary policy.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.