SNB more dovish than expected

Swiss floor supported by potential forex intervention

SNB inflation projections lowered

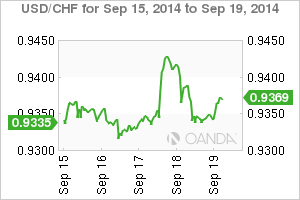

The Swiss National Bank (SNB) provided no major surprises in its quarterly policy review earlier this week, but the tone of its statement was probably more dovish than the market had expected. For the 13th consecutive quarter, the SNB chose to keep its target range for three-month Libor (London Interbank Offered Rate) at 0.0% to 0.25%.

SNB policymakers noted that the economic outlook has “deteriorated considerably," certainly backed up by disappointing second-quarter gross domestic product (GDP) data and weak eurozone growth. The central bank repeated that it will intervene in the forex market to prevent CHF from surpassing the €1.2000 limit with the "utmost determination." The Swiss ceiling was imposed three years ago on fears that a strong CHF would threaten the competitiveness of Swiss exporters within the European Union.

The Swiss Hold Firm

The SNB kept its outlook for 2014 inflation rate unchanged at +0.1%. However, it lowered its projections for next year to +0.2% from +0.3% while acknowledging that the risk of deflation has increased again. Lowering the inflation outlook would suggest that the SNB sees the CHF weakening less-than-expected and means that the floor will remain in place for the foreseeable future. The bank also trimmed its forecast for GDP this year to "below +1.5% from the +2% projected in June."

Many would argue that the dovish talk could be laying the groundwork for monetary easing at a later date. Any suggestion of the SNB introducing negative deposit rates is too rash. Realistically, the SNB would only ever consider using negative deposit rates once the €1.2000 floor comes under significant pressure when forex intervention seems to be failing.

For now, the threat of intervention is likely to limit the EUR/CHF downside (€1.2080) as traders will continue to focus on the central bank’s commitment to defending the floor. Short-term EUR/CHF resistance will now be around €1.2120-25, the level from where it fell on the SNB announcements.

What to Expect Next Week

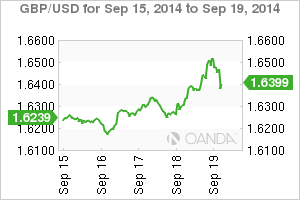

Whatever happens, the market will miss the Scots. Their national sovereignty debate on its own brought back some much needed volume and volatility to the forex space. In a matter of 10 days, the pound has been trading robustly within the £1.6052-£1.6645 range.

European Central Bank President Mario Draghi kickstarts the week on Monday testifying on monetary policy before the European Parliament's Economic and Monetary Committee in Brussels. Flash manufacturing comes to us from China, France, and Germany, and by midweek, Germany will also release its latest Ifo business climate results.

Meanwhile Down Under, traders will be listening to Reserve Bank of Australia Governor Glenn Stevens speak at the Melbourne Economic Forum. Investors with long AUD carry-trade positions will want to know what he has to say as he has a penchant for talking the AUD down to low levels.

The week will end with U.S. durable goods orders and weekly jobless claims on Thursday.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.