The Canadian dollar improved for a second straight week, as USD/CAD dropped 170 points. The pair closed at 1.3974, its lowest level in 4 weeks. This week’s highlight is Employment Change. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

The Federal Reserve was cautious in its policy statement, lowering the chances of a hike in March, and US durables looked awful last week. Canadian GDP posted a gain of 0.3%, matching the forecast.

Updates:

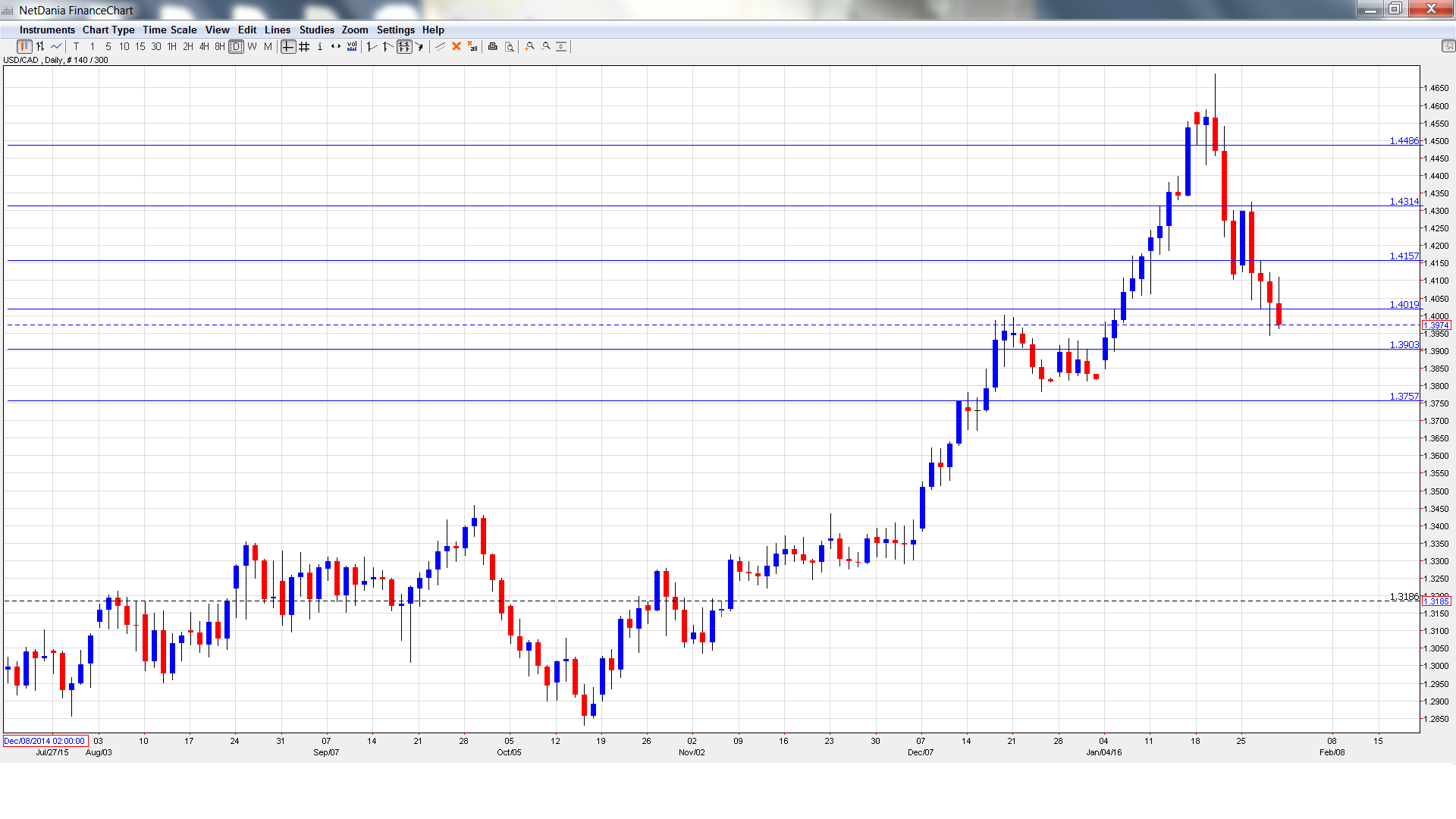

USD/CAD daily graph with support and resistance lines on it.

RBC Manufacturing PMI: Monday, 14:30. This PMI has posted five straight readings below the 50 point-level, indicative of ongoing contraction in the manufacturing sector. Will the index push above the 50 line in the January report?

Employment Change: Friday, 13:30. This key indicator can have a sharp impact on the movement of USD/CAD. The indicator rebounded in December with an excellent gain of 22.8 thousand, crushing the estimate of 10.4 thousand. The unemployment rate has been steady, coming in at 7.1% in the past two months.

Trade Balance: Friday, 8:30. Canada’s trade deficit narrowed to C$-2.0 billion, better than the forecast of C$-2.6 billion. Will the deficit continue to drop in the December report?

Ivey PMI: Friday, 15:00. The index plunged in December to 49.9 points, compared to 63.6 points a month earlier. This weak figure missed expectations and marked a 9-month low. The markets are expecting a slight improvement, with the estimate standing at 50.3 points.

USD/CAD Technical Analysis

USD/CAD opened the week at 1.4143 and quickly climbed to a high of 1.4325. The pair reversed directions and dropped to a low of 1.3943, breaking below support at 1.4019. USD/CAD closed the week at 1.3974.

Technical lines, from top to bottom

We start with resistance at 1.4480. This line was an important cushion in April 2000.

1.4310 is the next line of resistance.

1.4159 has strengthened as USD/CAD trades at lower levels.

1.4019 has switched to a resistance role. It is a weak line and could see further action early in the week.

The round number of 1.39 is the next support line.

1.3757 was a cap in December.

1.3587 is the final line for now.

I am bullish on USD/CAD

The Canadian dollar has posted strong gains in the past two weeks, but is still vulnerable, trading close to the 1.40 line. The US economy continues to outperform the Canadian economy, and the markets will be speculating about a March rate hike in the US, a move which would bolster the greenback.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD alternates gains with losses near 1.0720 post-US PCE

The bullish tone in the Greenback motivates EUR/USD to maintain its daily range in the low 1.070s in the wake of firmer-than-estimated US inflation data measured by the PCE.

GBP/USD clings to gains just above 1.2500 on US PCE

GBP/USD keeps its uptrend unchanged and navigates the area beyond 1.2500 the figure amidst slight gains in the US Dollar following the release of US inflation tracked by the PCE.

Gold keeps its daily gains near $2,350 following US inflation

Gold prices maintain their constructive bias around $2,350 after US inflation data gauged by the PCE surpassed consensus in March and US yields trade with slight losses following recent peaks.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.