EURUSD has bounced from sub 1.0900 levels boosted by monthly profit taking and good German IFO. Additionally lower oil prices had a positive impact on CPI number (Core CPI). We are slowly entering into thin liquidity month (August) . Liquidation sales usually happen close to holiday season and the overall volume traded is usually 1/3 normal volume.

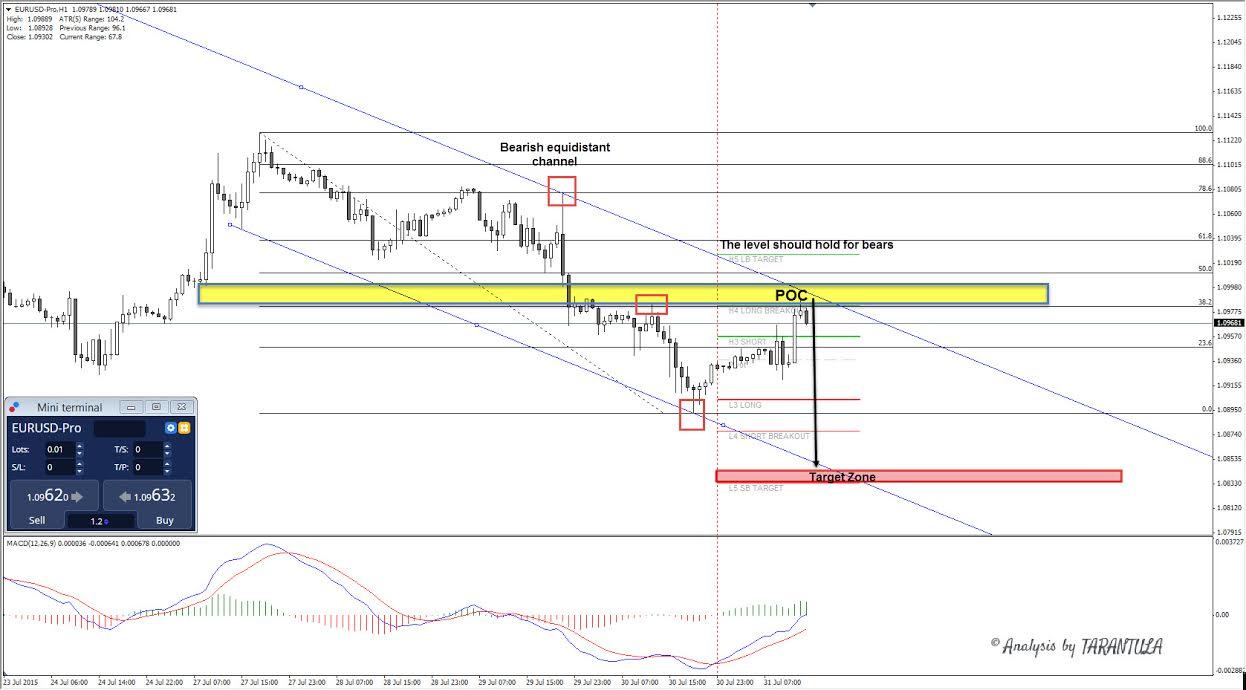

Technically EURUSD is rejecting POC zone (equidistant channel top, 38.2, previous retest, historical sellers) which marks 1.0980-90 area. The pair is held within the angled bearish zig zag which accounts for a slow grinding down trend. Rejection from the zone should target 1.0950-30 and the close below 1.0930 targets 1.0895.Momentum breakout and/or 4h close below 1.0930 will target 1.0850-30 target zone which makes L5 and equidistant channel bottom.

In order for this setup to be valid 1.1020 should hold.

The analysis and the article presents Nenad's opinion. Remember, financial trading is highly speculative & may lead to the loss of your funds. Proper risk management is the Holy Grail of trading.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.