Breakdown of the Cliff Deal

Following months of discussions and political wrangling, the Fiscal Cliff deal included most of what had already hit the newswires.

Taxes on Top Earners – Income taxes are to be raised for top earners, effectively cancelling the Bush era tax cuts for individuals making $400,000 or more, and families earning over $450,000. The measure will raise the top tax rate to 39.6% from 35%. The hardest hit will be the top 1% of income earners in the US.

Capital Gains and Dividends Tax – Capital gains and dividend taxes on investments will increase, rising to 20% from 15%. This measures will include carried interest income used by most private equity managers.

Estate Tax - Taxes on estates will now experience a top tax rate of 40%. However, the rate isn’t expected to kick in on any estate worth less than $5 million.

Unemployment Benefits Extension – Under the current measure, unemployment benefits will be extended for one year along with tax credits for low income families.

Payroll Tax Expiration – A casualty of the Fiscal Cliff deal, the payroll tax holiday enacted two years ago will expire at the beginning of 2013. Although it only represents a 2% increase in payroll taxes, it is likely to effect up to 77% of taxpayers and their paychecks. The rate will increase to 6.2% on all income up to $114,000.

What Now?

With the bill set to be signed into law by US President Barack Obama, focus has now shifted to the impending debt ceiling debate – likely to begin in mid-February. The concern remains over the fact that Democratic leaders will need to make further concessions on spending to Republicans in order to allow an extension of the $16.4 trillion ceiling.

An inability to do so would plunge the government into a plausible shutdown. This will likely include cutbacks in entitlement spending and other programs in order to equalize Republican concessions for the Fiscal Cliff deal.

Outlook

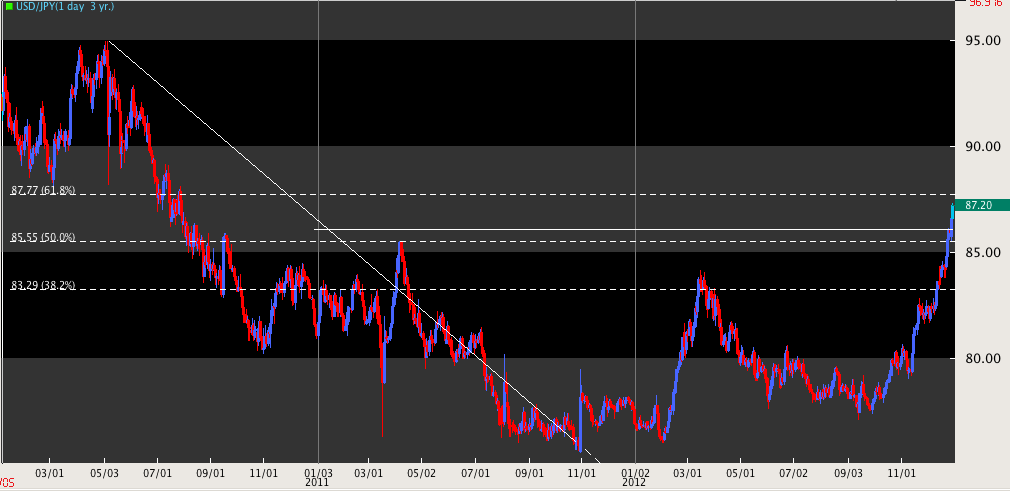

For now, however, it seems that sentiment has calmed in the face of a Fiscal deal – and is likely to power markets and risk tolerance higher temporarily. In particular, the notion is expected to push USDJPY higher through till medium term resistance targets at 88.38. Currently, the major pair advancing on the level on a break higher above 86.00 on Monday.

Source: FXTrek Intellicharts

Source: FXTrek Intellicharts

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.