Financials: June Bonds are currently 3 higher at 164’17, 10 Yr. Notes 1 higher at 130’13.5 and 5 Yr. Notes 0.5 higher at 121’05.7. June 2017 Eurodollars are unchanged at 99.08. Estimates for today’s Unemployment Report are in the 200,000 range for new non-farm payrolls. I will be a seller in June 2017 Eurodollars on a rally to the 99.10 level.

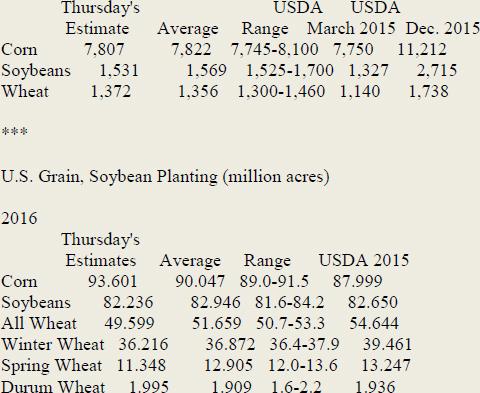

Grains: Yesterday’s Grain Report showed the following:

Thu Mar 31 12:05:08 2016 EDT

Following are key numbers from the USDA's March 1 Quarterly Grain, Soybean Stockpiles and 2016 U.S. Grain, Soybean Prospective Planting reports Thursday and how the government's estimates compared to analysts' forecasts in a Wall Street Journal survey.

U.S. Stockpiles on March 1, 2016 (million bushels)

As expected more Corn acreage and less Soy acreage. I will be a buyer in Beans on a set back to the 893’0 level and a buyer in Corn (May) below 343’0. Currently: May Corn 2’2 lower at 349’2, Beans 2’4 higher at 913’2 and Wheat 3’0 lower at 470’4.

Cattle: Yesterday Live and Feeder Cattle closed sharply higher with FC posting limit up gains and possibly making a key reversal. We have covered all back spreads in Live Cattle. I will be looking to the buy side of the market on breaks next week.

Silver: May Silver is currently 10 cents lower at 15.36 and June Gold 4.00 lower at 1230.00. We remain long. Take profits in Gold above 1265.00.

S&P's: June S&P’s are currently 8.50 lower at 2043.00. We were stopped out of recent short positions. Treat as a trading market between 2024.00 and 2060.00. today’s Jobs number could move the market sharply in either direction. Most global mkts. Are sharply lower this morning.

Currencies: As of this writing the June Euro is currently 31 higher 1.1440, the Yen 34 higher at 0.8938 and the Pound 73 lower at 1.4300. Normally I would be a seller in the Euro above 1.1400 but I am going to error on the side of caution at the moment and stand aside.

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The Price Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever. Past performance is not indicative of future results. Information provided on this website is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.