A sense of unease scatters across the financial markets ahead of the heavily anticipated European Central Bank (ECB) press conference on Thursday in which the ECB is broadly expected to unleash further stimulus measures to jumpstart the Eurozone economy. The expectation of another 0.1% slash in deposit rates to 0.4% remains elevated, with speculations mounting over whether the central bank will expand its bond buying program in a bid to devalue the Euro further. These heightened expectations of further stimulus measures should pose a threat to the Euro bears as the risk of under delivery is quite high with some stigma of December’s meeting still lingering in the background. It seems that despite all the efforts of the central bank to make amends, the Eurozone remains in a losing battle with falling inflation while external developments such as declining oil prices and China woes have exposed the nation to downside risks. Mario Draghi will undoubtedly repeat his dovish mantra to inspire the Euro bears today but this may fall on deaf ears as market participants are increasingly losing faith in the ECB’s commitment to its mandate and ability to deliver results.

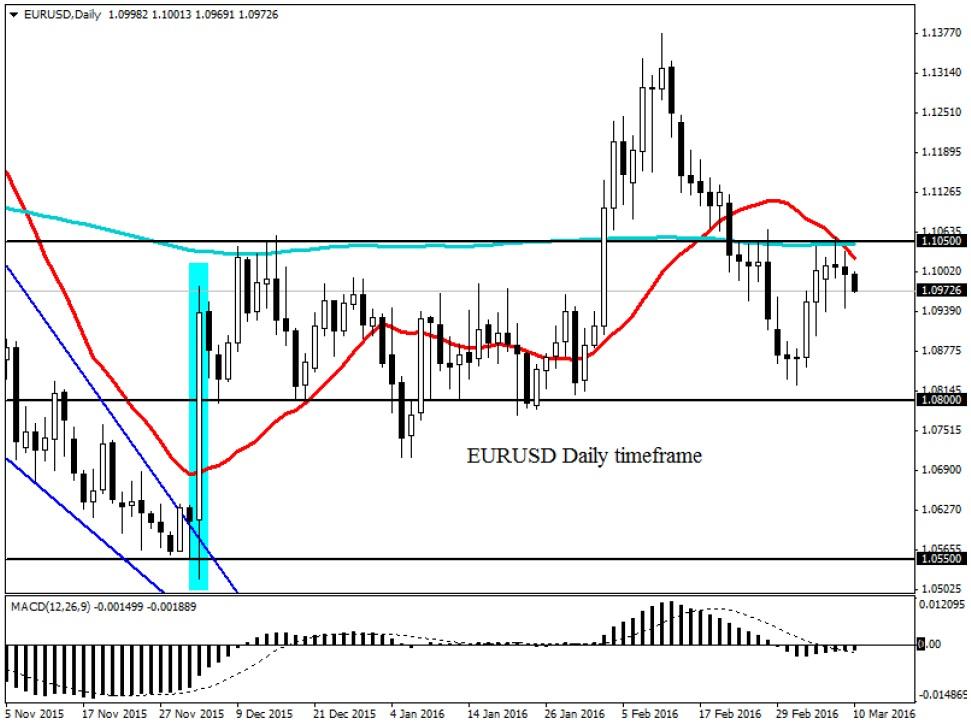

The uncertainties over the ECB’s pending decision can be seen in the EURUSD which has meandered in a wide range for an extended period with some resistance found at 1.1050. If the ECB fails to deliver today then bulls may receive encouragement to breach this level and send the pair higher. From a technical standpoint, prices are trading below both the 20 and 50 SMA while the MACD has crossed to the downside. This pair remains in standby ahead of the ECB press conference today.

Markets shrug positive China CPI

The global markets were almost unmoved in the early sessions of Thursday following the firm China consumer inflation of 2.3% in February which was the biggest rise in nearly two years and showed some positive signs for China’s economy. Although inflation may have shown signs of recovery, the tepid Manufacturing and dismal China trade data have elevated concerns over China’s economy growth while capital outflows continue to accelerate incessantly. Sentiment remains bearish for China and despite the rise in CPI for February; expectations are still live of further stimulus measures from Beijing in a bid to stimulate economic growth in China.

Disclaimer:This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 90% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.