The Sterling tumbled across the currency markets during Monday’s opening following the electrifying decision of the London Mayor, Boris Johnson, to join the Brexit campaign which amplified fears over the UK leaving the European Union. This unexpected move reversed the gains on Friday and almost quashed David Cameron’s efforts to secure a special EU reform deal ahead of the referendum which his Eurosceptics were already heavily criticizing. The Brexit topic is quite intricate and, although rating companies have branded it as negative for the UK economy, for every pro there is a con and this may be the theme which will rattle the markets in the coming months. With anxieties elevated ahead of the pending referendum on the 23rd of June and economic uncertainties of the possible implications of a Brexit weighing heavily on sentiment, the pound may be left vulnerable and open to further losses moving forward.

It will be interesting to hear Bank of England Mark Carney’s thoughts during the inflation report hearing on Tuesday towards the latest Brexit developments which have added to the UK’s woes and diminished any surviving expectations of UK rates being raised in 2016. Inflation is another jigsaw in the UK which has remained notoriously low and provided very little incentive for the BoE to take any action, while GDP growth currently faces headwinds from the global woes which have exposed the UK to downside risks. Carney may sound dovish and solemn today and this should encourage sellers to attack the Sterling against the Dollar once again.

Speaking of the GBPUSD, the pair suffered extreme losses during trading on Monday with prices plummeting to fresh 7 year lows at 1.4057 and may be set to decline further as concerns intensify over the impact of a Brexit to the UK economy. From a technical standpoint, this pair is heavily bearish as prices are trading below the daily 20 SMA while the MACD trades to the downside. Previous support at 1.4200 may become a dynamic resistance which should encourage a further decline towards 1.400 and potentially lower.

Stock markets driven by Oil

The global stock markets received an unexpected welcome boost during trading on Monday buoyed by the rebound in oil markets which had nothing to do with an improved sentiment towards oil or the global economy. Asian equities have started Tuesday noticeably flat showing signs of exhaustion with the Shanghai Composite Index trading -1.26% lower as investors shift their focus towards the state of the global economy. Although European and American equities may continue to enjoy short term gains, the factors which have left global stocks heavily depressed remain intact.

It must be remembered that fears over slowing global growth from various dimensions still linger in the background while these short-term rallies in oil prices only provide a foundation for sharper lower declines which consequently will pressure stocks. We are already in an age of negative interest rates which illustrates the bad health of the economic landscape and the Federal Reserve’s hesitance to respect its pledge to raise US rates should keep investors alert for what the future holds.

Eurozone under pressure

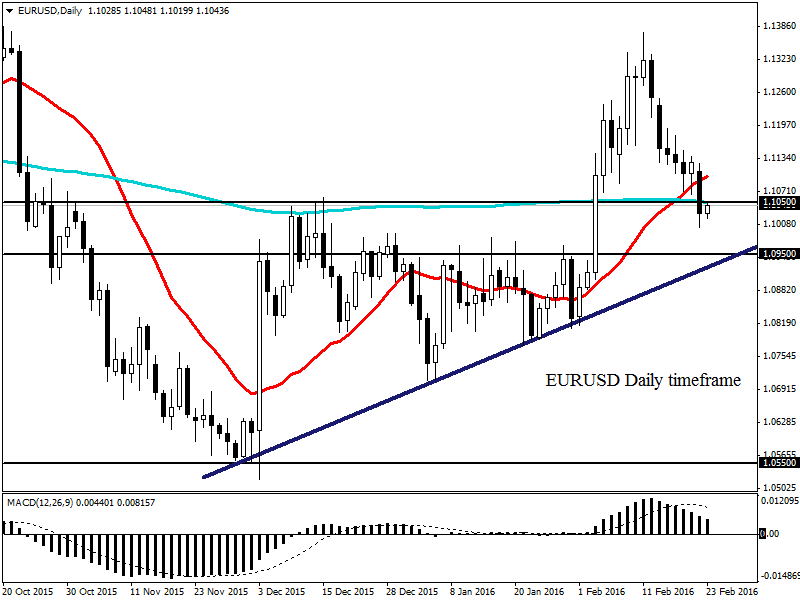

The growing speculation that a Brexit may spillover to the Eurozone and threaten the future of the European Union has already encouraged bearish investors to attack the Euro across the global currency markets. These speculations mount to the headwinds faced over faltering inflation levels which have been the product of falling oil prices while global woes continue to expose the Eurozone to downside risks. The German Ifo business climate report will be released on Tuesday and if this signals further weakness in Europe, expectations may rise towards further stimulus measures to be unleashed by the ECB in March.

The EURUSD breached below the psychological 1.105 support during trading on Monday which was also below the daily 20 SMA. Previous support at 1.105 may become a dynamic resistance which should encourage a further decline towards 1.095.

Commodity spotlight – WTI

WTI Oil experienced an exaggerated upsurge during trading on Monday with prices clipping $31.48 after the IEA predicted that the U.S shale oil production may shrink by 600,000 bpd in 2016. The prospects of less supply in the heavily saturated oil markets have provided a relief rally for bears to send prices crashing much lower when the reality of this complex situation hits investors. The prisoner’s dilemma that OPEC and Non-OPEC members continue to face combined with the visible conflict of interests from various parties should keep oil prices depressed for an extended period. From a technical standpoint, bears need to break back below $30 for a solid decline towards $25.

Disclaimer:This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 90% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.