Global Markets

WTI Oil plummeted over 6% during trading on Monday with prices edging closer to $31 as tepid manufacturing data from China, the world’s largest energy consumer, renewed fears that demand may be dwindling. These anxieties added to the rapidly fading expectations around OPEC cooperating with Russia to curb production, while ongoing concerns over the excessive oversupply of oil in the markets continued to haunt investor attraction. Although there was some initial optimism directed towards Russia’s willingness to slash production, Saudi Arabia remained defiant on the idea of any cuts, while Iran had already pledged to pump up to 1.5M barrels a day in a mission to reclaim its lost market share.

The visible clash of interests from various cartel members combined with an appreciating Dollar has added to oil’s woes consequently obstructing any opportunity for a recovery in prices. WTI remains firmly bearish and this horrible combination of record high productions, a heavily saturated oil markets and fears over sluggish demand should encourage sellers to attack oil prices towards $30.

From a technical standpoint, WTI Oil is bearish on the daily timeframe and prices have respected the daily bearish channel. Current candlesticks are in the process of crossing below the daily 20 SMA while the MACD points to the downside. A breach below $31 should invite and opportunity for a further decline towards $30.

Stock markets under pressure

The violent movements in the oil markets and renewed wave of risk aversion from the ongoing issues with China have soured risk appetite and this has consequently left the stock markets depressed. Although China stocks experienced a heavy selloff during trading on Monday as Asian equities declined, the losses in the Chinese stock markets were rapidly clawed back in the early sessions of this morning with the Shanghai Composite Index trading +2.17% as of writing. European and American equities also received punishment and closed negative as risk aversion encouraged investors to scatter away from riskier assets. Although some short term erratic movements may be observed in the stock markets as expectations grow around central banks expanding further stimulus measures, the lingering fears over slowing global growth and downside pressures from ongoing global concerns should encourage further selloffs in the future.

Currency spotlight – EURUSD

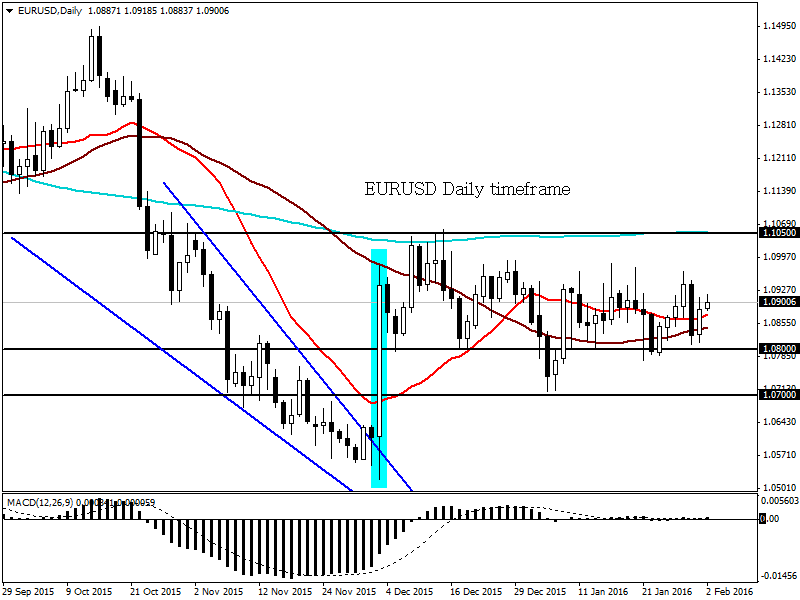

Euro bears failed to retrieve inspiration during trading on Monday despite Mario Draghi stating that Eurozone inflation was weaker than expected in the European Parliament in Strasbourg, France. This dovish statement should have reinforced the growing expectations of further stimulus measures in March, but investors rejected this rhetoric and the Euro appreciated against the Dollar. Inflation remains at worrying levels in the Eurozone while falling commodity prices have sabotaged the attempts for the ECB to jumpstart growth. Although the EURUSD bounced higher towards 1.090, the growing expectations around the possibility of further stimulus measures in March should keep prices pressured to the downside. While the pair currently trades in a wide range, a solid breakdown below 1.080 should encourage a further decline towards 1.070.

Disclaimer:This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 90% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.