Global Markets

The dovish FOMC meeting minutes dealt a sharp blow to the already vulnerable Dollar on Thursday. September’s meeting minutes continued to lack any real direction on when the US central bank will begin raising interest rates. While most members of the Federal Reserve are giving indications that the conditions for hiking US rates in 2015 are close to being achieved, the persistent concerns about low inflation, with this being weighed further down by depressed commodity prices, are acting as a barrier. An additional prerequisite for a hike remains further progress in the labour force but considering the widespread disappointment with the recent NFP report which was released before the FOMC meeting, traders are finding compelling reasons to suggest that a 2015 rate hike is fading into the distance.

The Sterling declined against most of its counterparts excluding the USD and JPY as a result of the BoE maintaining its bank rate at 0.5%. Even though the UK economy has been able to withstand some international pressures, persistent weakness in the UK inflation level has offered the BoE a solid reason to hold off raising UK interest rates until 2016. This can be seen in the GBPAUD which has sunk below the 2.1100 support; however any further GBP weakness will encourage a further decline to the next relevant support at 2.0900.

Although the GBP continues to be exposed to pressures, the FTSE100 has enjoyed the recent positive momentum and will conclude the week with further confidence following another WTI rally providing a bounce in oil stocks. Speaking of global equity markets, they concluded the day positively following the FOMC minutes. The rally in Wall Street may disorient some, especially considering that there is widespread confusion on when the Fed will finally begin raising US interest rates. For now though, investors are being tempted into the equity markets with the thought that if US rates are left unchanged for longer than expected and with the additional WTI rally, that this would also help sentiment. Any further fears on global economic health would be as this risk which may translate to a buildup of anxiety and more erratic moves in the global markets.

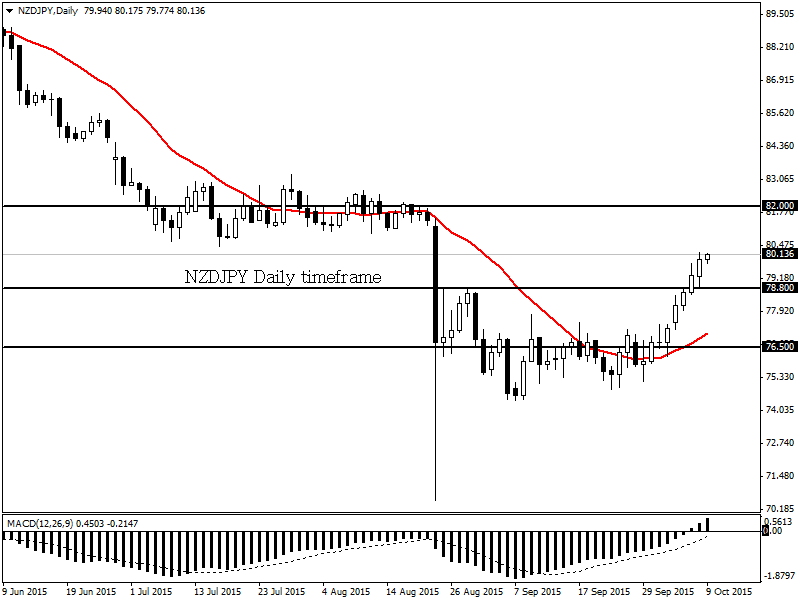

NZDJPY

The NZDJPY is technical bullish on the daily timeframe. Prices have breached the previous lower high of 78.80 and the MACD has crossed to the upside. With the candlesticks based above the daily 20 SMA, the next relevant resistance is based at 82.00.

EURCAD

The EURCAD remains technically bearish on the daily timeframe. Prices are trading below the daily 20 SMA and the MACD has crossed to the downside. A clear break below the 1.4650 support may open a path to the next relevant support at 1.4390.

EURNZD

After an extended period of consolidation the EURNZD has become technically bearish on the daily timeframe. A breach below the 1.7250 has opened a path to the next relevant support at 1.6700.

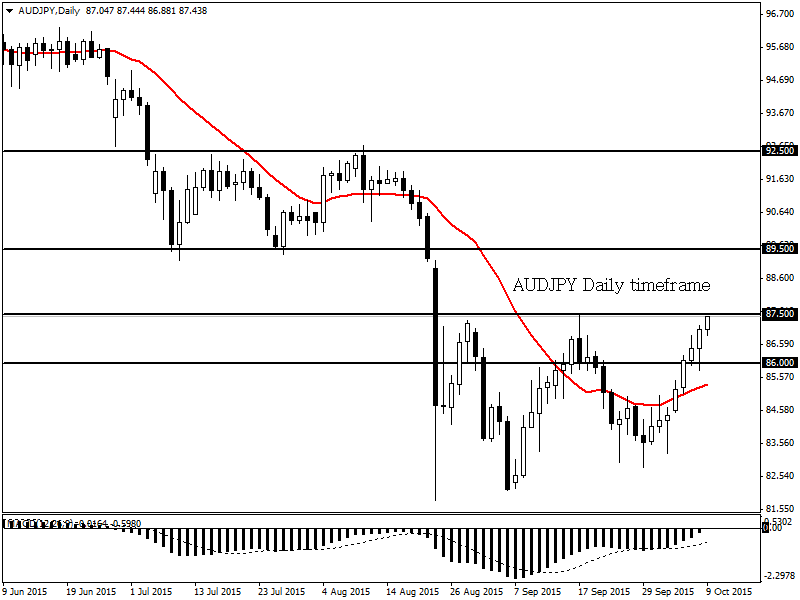

AUDJPY

The AUDJPY is in the process of turning technically bullish on the daily timeframe. A solid breach and daily close above the 87.50 resistance may open a path to the next relevant level based at 89.50. Prices must keep above the 86.00 support for this view to remain valid.

Disclaimer:This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 90% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.